All aboard the investment ship – two consumer discretionary stocks that are setting sail toward success on the Zacks Rank #1 (Strong Buy) list are cruise line operators Norwegian Cruise Line NCLH and Royal Caribbean Cruises RCL.

As the spring and summer emerge as peak travel season, these two stocks have begun to sparkle with potential, appearing undervalued at their current price points.

Voyaging through Post-Pandemic Recovery & Future Growth Trajectories

Looking back more than three years after the tumult of the COVID-19 pandemic, the cruise industry is navigating a course towards recovery.

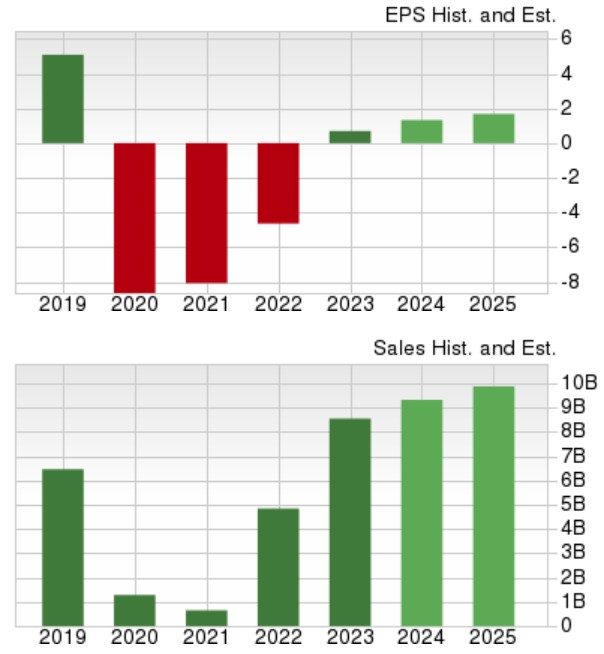

Noteworthy projections indicate that Norwegian’s total sales might rise by 9% in fiscal 2024 and another 6% in FY25, reaching $9.93 billion. Earnings for Norwegian are forecasted to surge by a whopping 94% this year to $1.36 per share, compared to $0.70 per share in 2023. Looking ahead, FY25 EPS is expected to climb by an additional 27% to $1.73 per share.

While Norwegian’s earnings still have some ground to cover to reach pre-pandemic levels of $5.09 per share in 2019, the company has already surpassed pre-COVID sales of $6.46 billion from that year.

Image Source: Zacks Investment Research

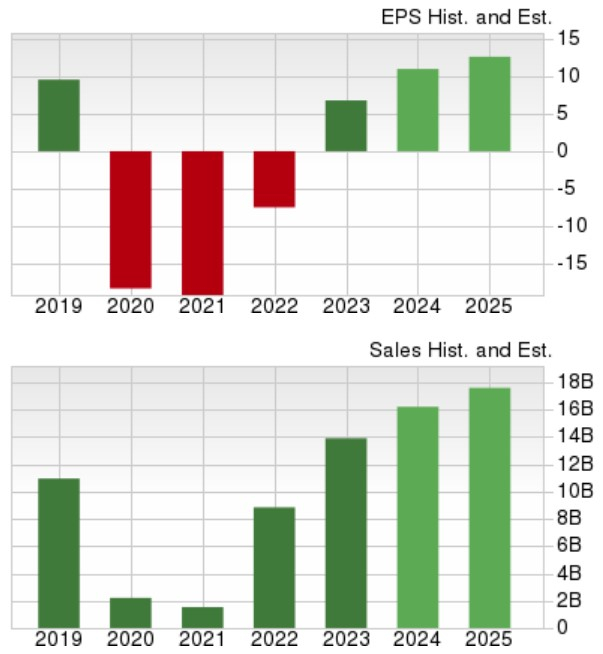

Moving to Royal Caribbean, its revenue is set to grow by 16% in FY24 and a further 9% in FY25, reaching $17.63 billion. The company’s annual earnings are anticipated to soar by 62% in FY24 to $10.96 per share, in contrast to $6.77 per share last year. Moreover, a 15% increase in EPS is anticipated for FY25. Impressively, Royal Caribbean is on track to surpass pre-pandemic earnings of $9.54 per share in 2019 and has already exceeded pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

Irresistible P/E Valuations

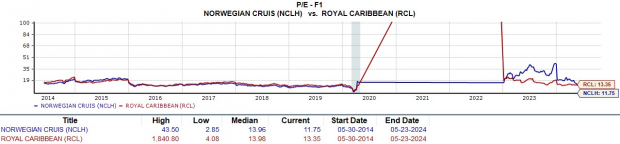

Accentuating the recovery of Norwegian and Royal Caribbean stocks post-pandemic are their attractive P/E valuations. Norwegian’s stock is trading at 11.7X forward earnings, while Royal Caribbean stands at 13.3X – both at a substantial markdown compared to the Zacks Leisure and Recreation Services Industry average of 18.7X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Cruising Towards Success

In addition to their recovery trend and appealing P/E ratios, the continuous upward revision of earnings estimates for Norwegian Cruise Line and Royal Caribbean in FY24 and FY25 augur well for further growth. This underlines the potential for appreciation in the stocks of Norwegian and Royal Caribbean from their current levels.

Departing on the Investment Voyage…

What Awaits in the Horizon?

Discovering the future of these two stocks may offer unexpected revelations.

Despite historical market performance post-midterm years, presidential election years since 1950 have consistently experienced positive trends. With an engaged electorate, the market has displayed relentless bullishness regardless of the winning party!

Now is the perfect time to access Zacks’ insightful Special Report containing 5 stocks promising substantial returns, irrespective of political affiliations…

1. A pioneering medical manufacturer has witnessed remarkable growth of +11,000% in the past 15 years.

2. A standout rental company is dominating its sector effortlessly.

3. An energy powerhouse is planning to boost its already substantial dividend by 25%.

4. An aerospace and defense frontrunner has recently secured a potentially massive $80 billion contract.

5. A colossal chipmaker is establishing extensive facilities in the U.S.