Smart investing requires playing the long game. It’s not enough to simply identify a winning stock. To generate significant returns, investors must use time to their advantage.

That’s why the buy-and-hold strategy works. By identifying well-run companies and then staying invested in their stocks for many years, anyone can generate impressive returns.

With that in mind, let’s examine two tech stocks that long-term investors should consider.

Image source: Getty Images.

ServiceNow

The first is ServiceNow (NYSE: NOW).

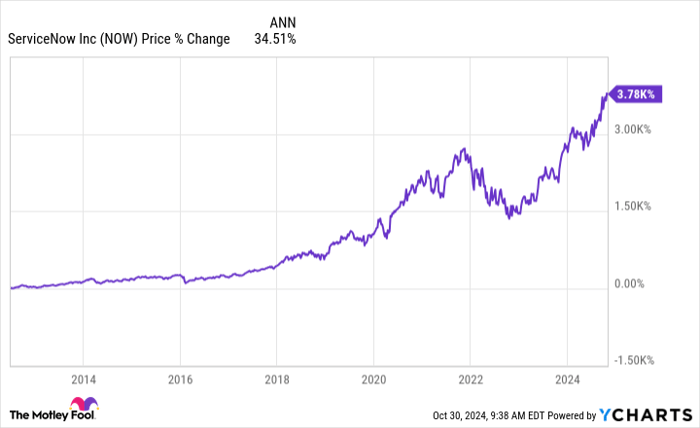

When it comes to tech stocks worth holding for a decade (or more), I want a company with a proven track record. ServiceNow is an industry leader in the field of Information Technology Service Management (ITSM). Since going public in 2012, the company’s stock soared by more than 3,770%. That works out to a compound annual growth rate (CAGR) of 34.5%.

The company’s key offering is its Now Platform, which is cloud-based and provides a single application that helps companies manage their workflows. Service Now reports that over 85% of Fortune 500 companies use its platform. Overall, the company boasts over 8,100 total customers.

Financially, ServiceNow continues to show strong growth. As of its most recent quarter (the three months ending on Sept. 30, 2024), the company reported revenue of $2.8 billion, with over $2.7 billion, or 96%, coming from subscriptions. Revenue increased by 22% from a year ago.

ServiceNow has captured a key market and grown its business to the point that the vast majority of large American companies use its signature product. Moreover, it is continuing to grow its revenue a substantial rate.

Investors looking for an under-the-radar tech stock to buy and hold should remember ServiceNow.

Netflix

Next, there’s Netflix (NASDAQ: NFLX). The reason why Netflix makes the cut is simple: The company is in the process of winning the streaming wars.

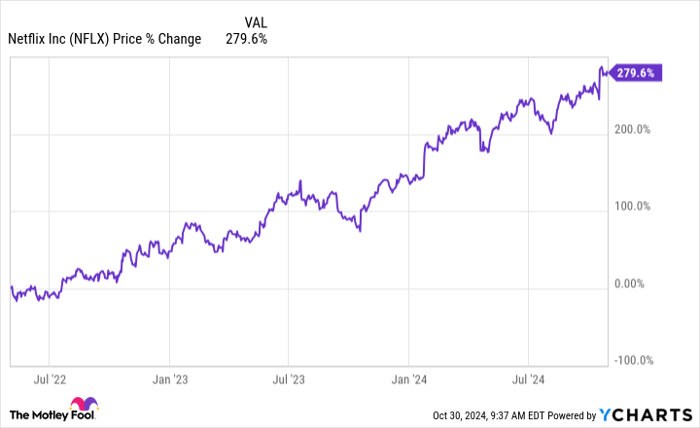

Two years ago, Netflix looked like it was losing its competitive moat. Deep-pocketed tech rivals like Apple and Amazon were eager to spend big on costly projects that threatened to eat away at Netflix’s video streaming market share.

However, as recent viewership data proves, Netflix more than holds its own. On top of that, the company’s decisions to crack down on password sharing and launch an ad tier have proven to be winners.

As a result, Netflix’s share price is up 279% in less than three years.

Moreover, the company once again has the wind at its back, as its key metrics are rising fast.

In its most recent quarter (the three months ended on Sept. 30, 2024), the company grew revenue 15% year over year to $9.8 billion. Paid subscribers rose 14% to 283 million.

Yet, what’s truly astonishing is the company’s profitability. Netflix’s trailing 12-month operating margin skyrocketed to 25.7%, which is the highest in the company’s history. That’s nearly double the company’s margin of 12.9% from five years ago.

In short, Netflix pulled off an impressive feat. It supercharged its growth (in both subscribers and overall revenue), while also boosting its profitability by raising prices and cutting costs.

That’s a recipe for success at just about any company. That is why Netflix remains a buy-and-hold candidate in my book.

Should you invest $1,000 in ServiceNow right now?

Before you buy stock in ServiceNow, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ServiceNow wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $853,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, and ServiceNow. The Motley Fool has a disclosure policy.