Unlocking Trading Potential with the Golden Cross

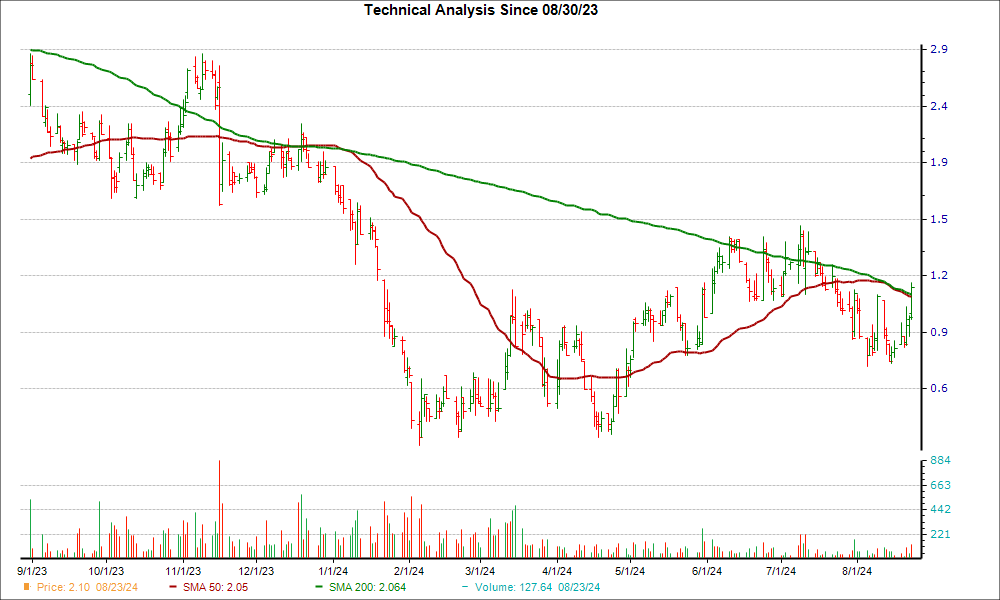

When it comes to technical analysis, the recent developments at Vnet Group Inc. (NASDAQ:VNET) have caught the eye of market watchers. The company has just hit a crucial support level. A golden cross was achieved as VNET’s 50-day simple moving average surged above the 200-day simple moving average, a significant event in the realm of trading.

Decoding the Golden Cross

Considered a signal for a potential bull market, a golden cross is a chart pattern that emerges when a stock’s short-term moving average surpasses its long-term moving average. The most prevalent crossover involves the 50-day and 200-day moving averages, as lengthier periods typically indicate stronger breakouts.

Signs of a Golden Cross

The emergence of a golden cross typically unfolds in three stages. Initially, the stock’s price hits a low point after a decline. Subsequently, the shorter moving average crosses above the longer moving average, marking a reversal towards positive trends. The final stage is when the stock sustains its upward trajectory, indicating potential bullish momentum.

Encouraging Trends for VNET

VNET appears poised for a breakthrough following a 25.3% increase in the last month. Moreover, it currently holds a #2 (Buy) rating on the Zacks Rank.

Earnings Outlook and Investor Sentiment

Delving into VNET’s earnings forecast reinforces the optimistic uptrend. In the current quarter, there have been 1 upward revisions compared to none downward over the past 60 days, aligning with an increase in the Zacks Consensus Estimate.

Potential Gains Ahead

With the surge in earnings estimates and the favorable technical indicators, investors are advised to closely monitor VNET for prospective gains in the coming days.