Amazon(NASDAQ: AMZN) has joined the elite $2 trillion valuation club, a mark of distinction shared with only five other corporate titans. While each member of this exclusive group is a global powerhouse in its own right, Amazon’s investment appeal stands out among its peers. Here are three compelling reasons why now is the time to consider adding Amazon stock to your portfolio.

Unleashing the Power of AWS

If artificial intelligence (AI) is the modern-day gold rush, then Amazon Web Services (AWS) is the pickaxe-wielding prospector. As the premier provider of cloud computing services, AWS plays a pivotal role in supporting AI applications for businesses worldwide. Although facing stiff competition in the AI frenzy, AWS made a significant comeback in the first quarter with a remarkable 17% year-over-year revenue surge. This robust growth trajectory has reinvigorated Amazon’s profit landscape, with AWS accounting for a staggering 62% of the company’s total profits despite contributing only 18% to its revenue. With AWS poised as a key driver of Amazon’s future prosperity, investors have every reason to be optimistic about the company’s bottom line.

A Surge in Companywide Profitability

While AWS reigns supreme as the profit powerhouse within Amazon’s ecosystem, the company’s e-commerce divisions are not lagging behind. Fueled by CEO Andy Jassy’s relentless pursuit of profitability, both the North American and international segments have shown remarkable improvement in their operating margins.

| Division | Q1 2023 Operating Margin | Q1 2024 Operating Margin |

|---|---|---|

| North America | 1.2% | 5.8% |

| International | (4.3%) | 2.8% |

Data source: Amazon.

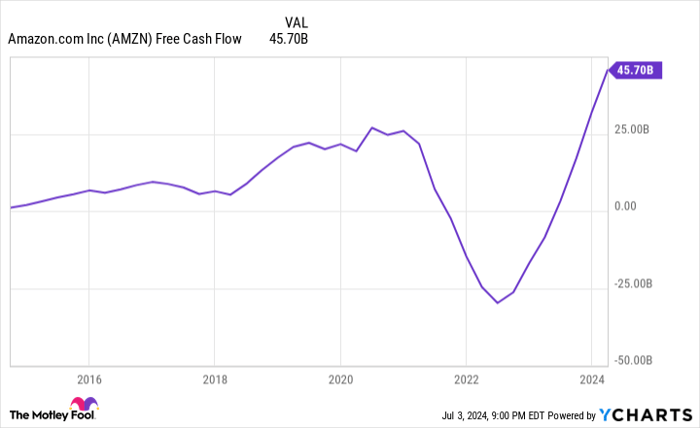

Despite operating in fiercely competitive sectors with narrower margins compared to AWS’ stellar 38% margin, these divisions are making significant strides in bolstering Amazon’s overall financial health, resulting in record cash flows for the company.

AMZN Free Cash Flow data by YCharts

As Amazon’s profit margins continue to expand and its revenue growth persists, the company is positioned to outshine its competitors in the market.

The Advertising Advantage

Amazon’s track record of successful ventures is exemplified by the resounding success of its advertising division. While AWS occupies the top spot, advertising is emerging as a potent contender in Amazon’s revenue stream.

In the first quarter, advertising revenue surged to $11.8 billion, marking a robust 24% year-over-year growth and cementing its position as Amazon’s fastest-growing division. Despite being dwarfed in size by AWS, the advertising segment’s rapid expansion is a key indicator of Amazon’s diversified revenue streams and its ability to capitalize on emerging market trends.