Value investing, like hunting for bargains, entails seizing opportunities where stocks are undervalued to reap substantial returns when the market recognizes their true worth.

We all relish a good deal, don’t we?

Adding the Zacks Rank into the mix can amplify the gains, helping to pinpoint stocks that analysts are increasingly optimistic about.

JD.com

JD.com functions as an online direct sales company in China. It proudly holds the prestigious Zacks Rank #1 (Strong Buy), with earnings projections climbing across various timeframes.

Currently priced at a modest 7.8X forward 12-month earnings multiple, significantly below the 39.0X five-year median and the historic apex of 84.9X. The forward 12-month price/earnings ratio stands at 0.3X, comfortably lower than the 0.5X five-year median.

Of note is the company’s consistent quarterly performance, surpassing the Zacks Consensus EPS estimate in each of its last ten releases.

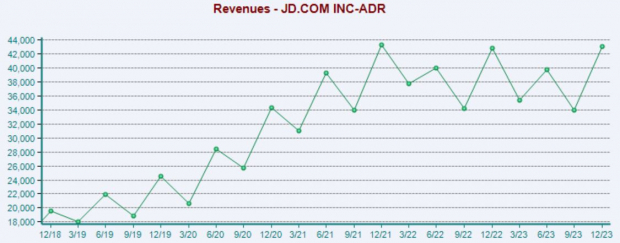

Take a look at the chart below showing the company’s quarterly revenue:

Image Source: Zacks Investment Research

KB Home

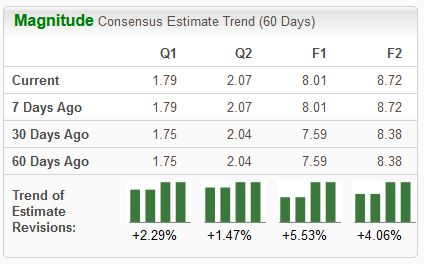

As a prominent homebuilder in the United States, KB Home has garnered bullish sentiments from analysts, who are elevating their earnings forecasts and propelling the stock to a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

At present, shares are valued at a reasonable 7.3X forward 12-month earnings multiple, slightly below the five-year median and peak of 12.5X in 2020. The forward 12-month price-to-sales ratio is currently at 0.6X, also beneath the five-year highs of 0.8X.

AllianceBernstein

AllianceBernstein, currently holding a Zacks Rank #2 (Buy), offers diversified investment management services primarily to pension funds, endowments, foreign financial institutions, and individual investors.

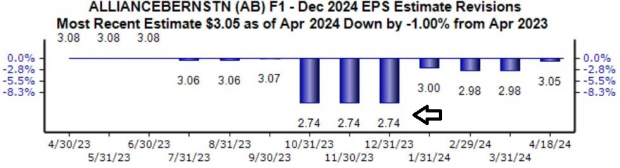

Notably, projections for the current fiscal year have seen a significant positive shift since the beginning of 2024, with a Zacks Consensus EPS estimate of $3.05 indicating a 14% year-over-year growth.

Image Source: Zacks Investment Research

Currently trading at a reasonable 10.2X forward 12-month earnings multiple, comfortably below the 11.5X five-year median and the peak of 16.3X in 2022. The forward 12-month price-to-sales ratio is at 1.0X, aligning with the five-year median and below the highs of 1.5X in 2021.

Final Thoughts

Value investors are perpetually in pursuit of bargains, banking on the market eventually catching on to the undervalued opportunities and translating into substantial profits.

When this approach is coupled with the Zacks Rank, which centers on earnings estimate adjustments, uncovering mispriced stocks with promising short-term potential becomes more straightforward.

All three stocks mentioned – JD.com, KB Home, and AllianceBernstein – may captivate value-focused investors, supported by their impressive Style Scores of ‘A’ and ‘B’ for Value.