Toyota Motor’s Market Edge

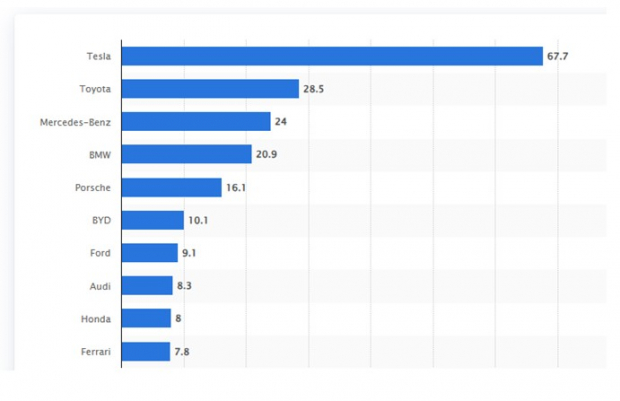

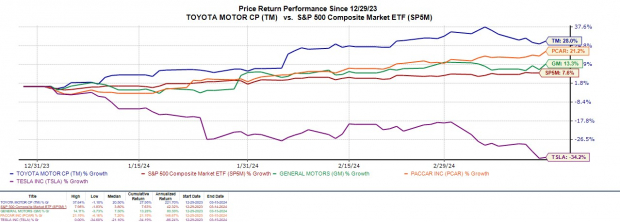

Even with Tesla’s slowing sales growth, a few auto stocks have been outperforming the market. Toyota Motor’s monstrous growth in part due to its lineup of hybrid electric vehicles has separated it from Tesla. The company’s loyalty base and brand reputation have made it a formidable competitor.

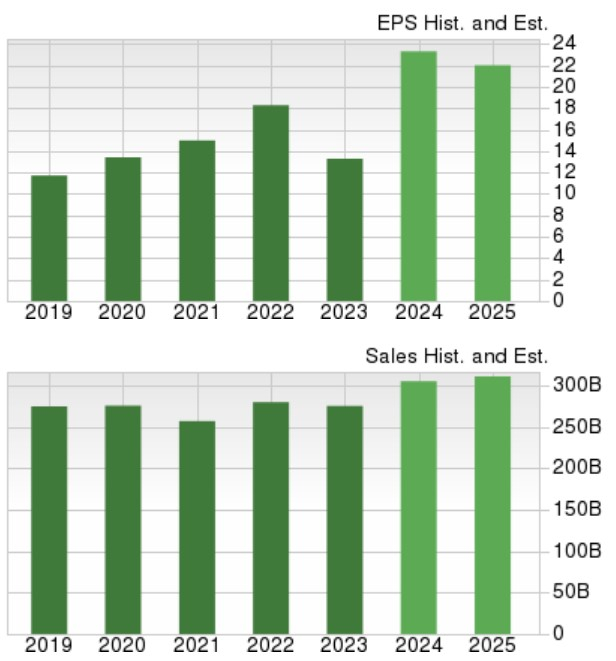

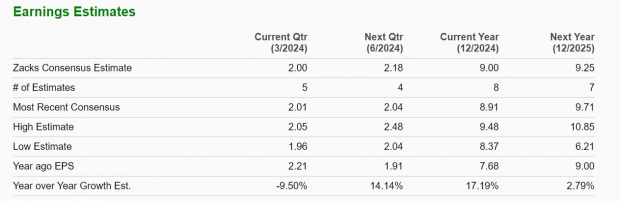

Having been early adopters of electrification, Toyota has the largest number of electrified vehicle options in the market. With electrified vehicles now accounting for 30% of their sales, Toyota’s stock looks promising with an expected EPS increase to $23.06 per share, a staggering rise of 73% projected in fiscal 2024.

General Motors Increased Profitability

General Motors has seen a surge in profitability, making its stock a compelling choice trading at just 4.3X forward earnings. With expectations of annual earnings growth in both the current year and the next, buoyed by being the top-selling automaker in the United States and delivering a significant number of all-electric vehicles, General Motors’ stock outlook is on the upswing.

PACCAR’s More Attractive Valuation

PACCAR, a leader in the truck manufacturing sector, with its focus on adapting to hybrid and all-electric models for big rigs, has pushed its shares up by 96% in the last three years. Trading at a reasonable 14.1X forward earnings multiple, well below its historical high, makes PACCAR an appealing option for investors. Their current market dominance has translated into a stock price increase of +21% year to date.

Blazing YTD Performances

With Toyota Motor, PACCAR, and General Motors posting impressive year-to-date stock performance, outpacing the market leader Tesla, investors are taking notice. Toyota’s stock has surged +28%, while PACCAR and General Motors have seen increases of +21% and +13% respectively, highlighting their strong market position and investor confidence.

Bottom Line

Toyota Motor, General Motors, and PACCAR are currently experiencing positive earnings revisions, coupled with attractive P/E valuations. With all three auto stocks carrying a Zacks Rank #1 (Strong Buy) and an “A” Zacks Style Scores grade for Value, now presents an opportune moment for investors looking to enter the auto market.