Large-cap stocks have long been a staple in the portfolios of seasoned investors, offering a stable track record and often substantial dividends. While not as volatile as their smaller counterparts, the potential for growth remains present for select large-cap stocks, including Target, Cardinal Health, and Arista Networks.

Arista Networks: Riding the Wave of AI

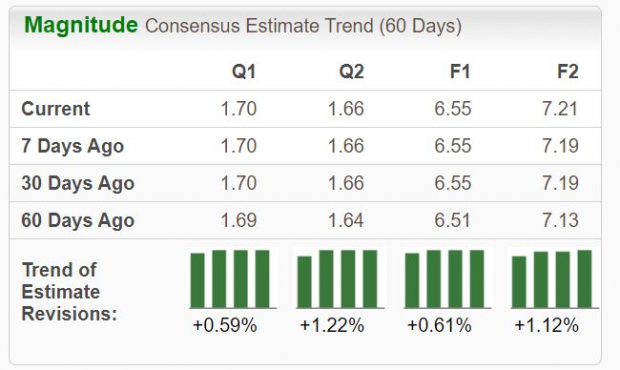

Arista Networks has surged alongside the artificial intelligence boom, providing critical network switches to major tech entities. A Zacks Rank #2 (Buy) stock, Arista Networks has seen upward earnings estimate trends across the board. Its impressive growth profile forecasts a substantial 43% earnings growth and a 33% rise in sales for the current fiscal year. The company’s momentum is expected to continue into FY24 with an additional 10% earnings boost and an 11% revenue climb.

Image Source: Zacks Investment Research

Target: Transforming into an Omni-Channel Powerhouse

Target has transcended traditional retail, evolving into an omni-channel force to be reckoned with. With a Zacks Rank #2 (Buy), Target’s earnings estimates have trended upwards, reflecting a projected 40% earnings growth for the current fiscal year. Additionally, the stock offers a robust dividend yield of 3.1% and has demonstrated a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Cardinal Health: Sustained Earnings Excellence

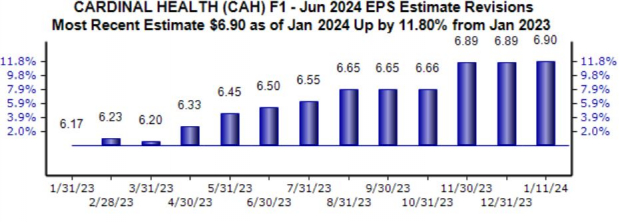

Cardinal Health, a prominent national drug distributor, and service provider to the healthcare industry, is another Zacks Rank #2 (Buy) stock. The company has witnessed a robust 12% increase in revisions trend for its current fiscal year, depicting a solid outlook for profitability. Forecasts indicate 20% earnings growth and a 10% rise in sales for the current year, with FY25 estimates pointing to an additional 12% earnings surge and an 8% revenue increase.

Image Source: Zacks Investment Research

Seeking Large-Cap Exposure

Large-cap stocks are the backbone of many investment portfolios, offering resilience and proven performance. For those eyeing large-cap opportunities, stocks like Target, Cardinal Health, and Arista Networks with their improved earnings outlooks, are worth a close watch.

The potential for substantial gains in the electric vehicle revolution market has become a modern-day gold rush. As the lithium battery demand is expected to soar, investors have the opportunity to capitalize on this growing trend. The prospect of significant gains from the surge in lithium batteries presents a compelling investment proposition.