The retail sector is like a dynamic ecosystem of companies, from traditional brick-and-mortar stores to powerhouses of e-commerce. An optimistic horizon looms for this sector, buoyed by the anticipation of an upsurge in consumer spending in the wake of abating inflationary pressures and the possibility of near-term interest rate cuts. To unearth the cream of the crop in retail stocks, we have pored over the TipRanks Stock Screener tool.

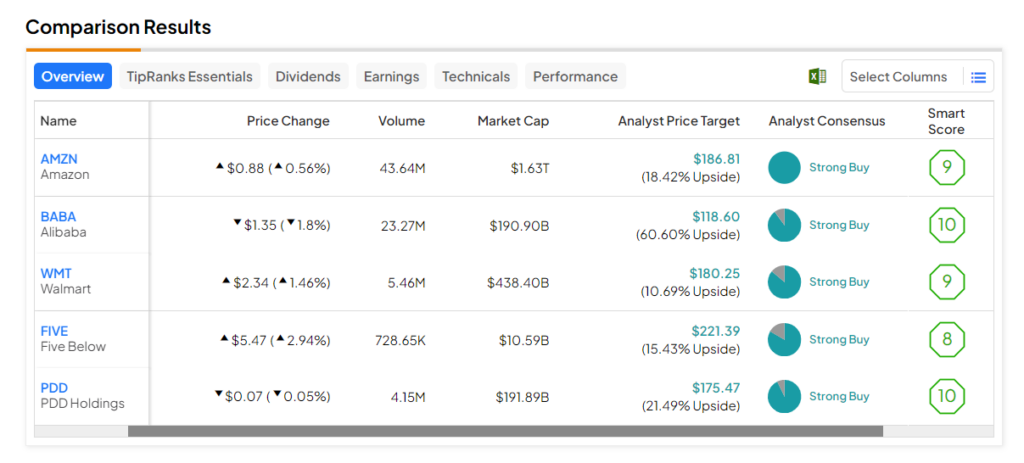

Brace yourself for stocks that have garnered a Strong Buy rating from analysts and flaunt an Outperform Smart Score (8, 9, or 10) on TipRanks, hinting at their potential to outperform the broader market. Moreover, the price targets set by analysts signal a substantial potential upside of more than 10%.

These are the five remarkable stocks we’ve uncovered for investors to mull over.

- Five Below (NASDAQ:FIVE) – This specialty discount retailer lures customers with various high-quality products, mostly priced under $5, catering to teenagers and pre-teens. FIVE stock’s average price target suggests an upside potential of 15.4%. Notably, its Smart Score of eight is beguiling.

- PDD Holdings (NASDAQ:PDD) – This Chinese e-commerce platform serves as a liaison between consumers and manufacturers as well as agricultural producers. PDD stock’s price forecast of $175.47 indicates a handsome upside potential of 21.5%. Additionally, it boasts an outperforming Smart Score of “Perfect 10.”

- Alibaba (NYSE:BABA) – A Chinese multinational conglomerate specializing in e-commerce, retail, internet, and technology. The stock’s average price target suggests an impressive upside potential of 57.7%. Moreover, it has a Smart Score of “Perfect 10.”

- Walmart (NYSE:WMT) – A mammoth multinational retail corporation renowned for its extensive network of hypermarkets, discount department stores, and grocery stores. WMT stock has an average price target of $180.25, indicating a 10.7% upside potential from current levels. It flaunts a Smart Score of nine.

- Amazon (NASDAQ:AMZN) – A multi-talented multinational technology and e-commerce behemoth celebrated for its online retail platform, cloud computing services, digital streaming, artificial intelligence, and consumer electronics. AMZN stock has an analyst consensus of 18.4% upside potential and a Smart Score of nine. As it hurtles towards its Q4 results due on February 1, eight analysts have bestowed a Buy rating upon the stock.

Happy exploring!