The tide may be turning for Chinese equities after years of struggle and decline. While U.S. equities face choppy waters, opportunities across the Pacific are starting to shine again. As the saying goes, “There’s always a bull market somewhere.”

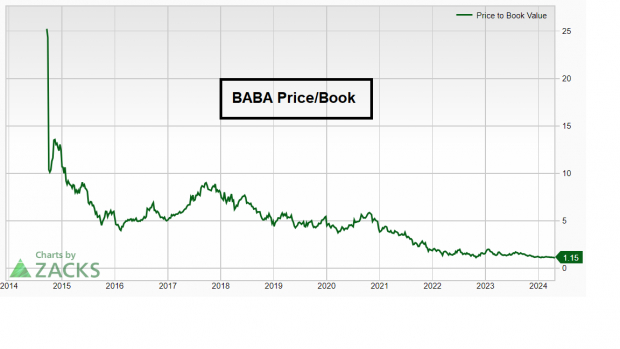

For too long, Chinese stocks have languished, haunted by restrictive policies, pandemic woes, and a looming real estate crisis, reflecting a drawn-out bear market. The FXI ETF, a popular Chinese equity proxy, has plummeted over 40% in the past three years, overshadowed by the allure of American and other international markets.

Image Source: Zacks Investment Research

Yet, five compelling signals indicate a potential turnaround for Chinese equities, including:

Market Restructuring

Traditional Chinese policies have hindered market growth for years. However, recent optimism from UBS and GS signals a shift in the wind. The government’s pro-business reforms aim to attract foreign investors back to China, potentially revitalizing the $10 trillion equity market.

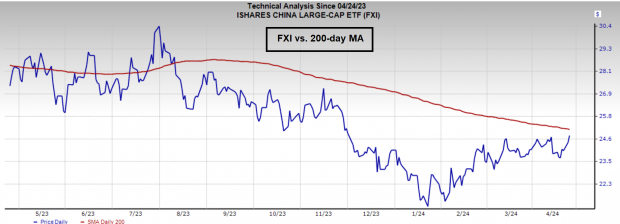

Compelling Valuations

Once deemed “value traps,” Chinese stocks like BABA now boast historically low price-to-book ratios, like Alibaba’s 1.15 ratio. These attractive valuations could spark renewed interest in the market.

Image Source: Zacks Investment Research

Turning the Tide

The Chinese real estate crisis, exemplified by Evergrande’s collapse, had cast a shadow over the market. Yet, as often happens, markets rebound when the forecast seems bleakest. Chinese equities might find solid ground sooner than expected.

Buybacks Bolster Confidence

Major Chinese firms, including Alibaba, TCEHY, and JD, are actively repurchasing shares, signaling their confidence and potentially reducing market dilution. These moves could lift the sentiment around Chinese tech stocks.

Positive Price Action

Recent price movements suggest a shift in momentum favoring Chinese stocks. Outperforming their U.S. counterparts, Chinese equities are on the verge of clearing critical resistance levels, a promising sign for investors.

Image Source: Zacks Investment Research

Final Thoughts

With governmental shifts and other promising indicators aligning, the outlook for Chinese equities appears brighter than it has in years.

Unmatched Returns for Investors

Reflecting on the history of Bitcoin’s meteoric rise, it’s evident that decentralized currencies can offer unparalleled returns. In recent presidential election years, Bitcoin has surged impressively, showcasing its potential for another significant rally in the near future.