U.S. stock markets continue to show momentum in January after some initial hiccups following an astonishing 2023. Month to date, the Dow, the S&P 500, and the Nasdaq Composite are up 1.1%, 2.5%, and 3%, respectively. Before last week, the S&P 500 and the Nasdaq Composite had completed a six-day winning streak. The Dow and the S&P 500 are currently trading at their historic high levels.

Robust Economic Data for Q4 2023

The Department of Commerce reported that the U.S. economy grew at 3.3% in the fourth quarter of 2023, well above the consensus estimate of 2%. The U.S. GDP rose 2.5% in 2023 compared with 1.9% in 2022. At the beginning of 2023, the consensus estimate for full-year GDP was 2%.

The headline personal consumption expenditure (PCE) price index rose 2.7% year over year in the third quarter of 2023 compared with 5.1% a year ago. The core PCE price Index (excluding volatile food and energy items) increased 3.2% annually in the same period compared with 5.9% a year ago. The metric is the Fed’s most favored inflation gauge. In the last quarter, personal consumption expenditures increased 2.8%. The chain-weighted price index rose 1.5% in the third quarter, down from 3.3% in the previous period and below the consensus estimate of 2.5%.

Solid Economic Data for December

The Department of Commerce reported that the headline PCE price Index for December rose 0.2% month over month and 2.6% annually. The core PCE inflation in December increased 0.2% month over month and 2.9% annually. The annual rate of increase in December was the slowest since March 2021. The consensus estimate was 0.2% and 3%, respectively. In November, core PCE inflation increased 3.2% year over year.

Personal spending in December increased 0.7% month over month, beating the consensus estimate of 0.5%. November’s data was revised upward to 0.4% from 0.2% reported earlier. Personal income increased 0.3% in December compared with 0.4% in November. The personal savings rate fell to 3.7% for the month from 4.1% in November.

An Ideal Situation

A strong U.S. economy along with a steadily dwindling inflation rate, put an end to the fear of a near-term recession and restored hope among market participants that the Fed is likely to achieve the much-hyped soft landing of the economy.

Since July 2023, the central bank has stopped hiking interest rate hike, which is currently in the range of 5.25-5.5%. In its December FOMC meeting, the Fed indicated possible rate cuts of 25 basis points for three times in 2024.

The CME FedWatch tool currently shows a 47.7% probability that the central bank will initiate the first rate cut. The interest rate future tool is also showing the possibility of five rate cuts of 25 basis points in 2024.

At this stage, it should be prudent to invest in U.S. corporate behemoths (market capital > $40 billion) with a favorable Zacks Rank. These companies have a robust business model, a solid financial position, and globally acclaimed brand value.

Our Top Picks

We have narrowed our search to five such stocks that have strong potential for 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

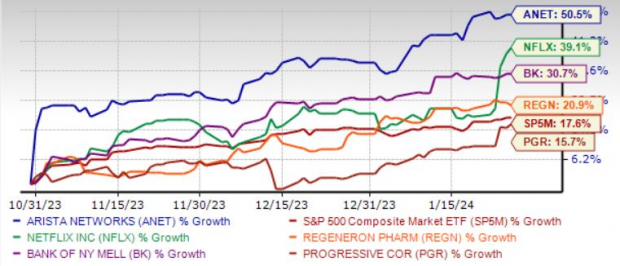

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Netflix Inc. NFLX added 13.12 million paid subscribers globally in the fourth quarter of 2023, with a rise of 1% in average revenue per subscription. NFLX attributed the robust top-line growth to its paid subscription-sharing offering (part of its password-sharing crackdown), recent price changes, and the strength of its business in general. NFLX is expected to continue dominating the streaming space, courtesy of its diversified content portfolio, which is attributable to heavy investments in the production and distribution of localized and foreign-language content.

Netflix has an expected revenue and earnings growth rate of 14.3% and 40.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.9% over the last seven days.

Arista Networks Inc. ANET develops markets and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. ANET benefits from the expanding cloud networking market, driven by strong demand for scalable infrastructure. The company recently joined the Microsoft Intelligent Security Association. Arista Networks continues to gain from solid momentum and diversification across its top verticals and product lines. It is well-poised for growth in the data-driven cloud-networking business, with proactive platforms and predictive operations. ANET introduced an enterprise-grade Software-as-a-Service offering for its flagship CloudVision platform. Arista Networks has an expected revenue and earnings growth rate of 11.5% and 10.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Regeneron Pharmaceuticals Inc. REGN discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. REGN’s products include EYLEA injection to treat neovascular age-related macular degeneration and diabetic macular edema, myopic choroidal neovascularization, diabetic retinopathy, neovascular glaucoma, and retinopathy of prematurity. REGN also provides Dupixent injection to treat atopic dermatitis and asthma in adults and pediatrics, Libtayo injection to treat metastatic or locally advanced cutaneous squamous cell carcinoma, Praluent injection for heterozygous familial hypercholesterolemia or clinical atherosclerotic cardiovascular disease in adults, REGEN-COV for COVID-19, and Kevzara solution for treating rheumatoid arthritis in adults. Regeneron Pharmaceuticals has an expected revenue and earnings growth rate of 5.9% and 4.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last 30 days.

The Progressive Corp. PGR continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for