Although many investors have been burned trying to buy Chinese Technology stocks over the better part of the last three years, current valuations along with other bullish catalysts make them more compelling than ever. The long China tech thesis is further bolstered by the fact that so many investors have been hurt trying to buy these stocks for so long, that the narrative now suggests many investors are holding large short positions.

Admittedly, I understand why investors may be hesitant to consider investing in China because of the weak economy and geopolitical risk. However, the fact that so many have now sworn off the area makes it even more appealing, because the best fishing is in uncrowded waters.

Additionally, while the growth story in China is a worthy concern, banking authorities have begun increasing liquidity in the economy, which should soon be a tailwind.

Furthermore, the valuations in these stocks are so attractive that the downside is somewhat capped, because they are likely trading below intrinsic value. All this while analysts have been raising earnings estimates.

Finally, now that the China Internet ETF KWEB is -75% off its all-time high, we are beginning to see technical signs of a bottom. This bullish wedge is a useful pattern for investors to keep an eye on. If the KWEB ETF can breakout above the $27.25 level, I think the next bull run has begun. Alternatively, if it can’t hold above the $24.50 level, it may not be ready.

Image Source: TradingView

Tencent Holdings

Tencent Holdings Limited TCEHY is a multinational conglomerate based in China and one of the world’s largest technology companies. Renowned for its diverse portfolio, Tencent is a major player in social media, gaming, entertainment, and various internet-related services. The company is the force behind popular platforms like WeChat, a widely used messaging app, and has a significant presence in the global gaming industry through its ownership of Riot Games, Supercell, and a stake in Epic Games.

Management at Tencent Holdings seems to be most convinced of its undervalued status, as the company has been buying back shares at a rabid pace. In December the company bought back $1.3 billion of shares and was increasing buyback all of 2023. In Q2 2023 they bought $1.3 billion worth, Q3 $1.9 billion, and Q4 $2.2 billion.

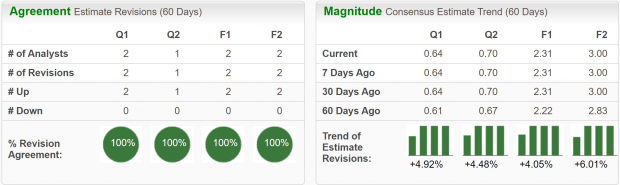

Analysts have also been raising earnings estimates at the technology conglomerate giving TCEHY a Zacks Rank #1 (Strong Buy) rating. FY23 EPS are expected to grow 31.25% YoY to $2.31 per share and FY24 is forecast to climb 29.7% YoY to $3.00 per share.

Image Source: Zacks Investment Research

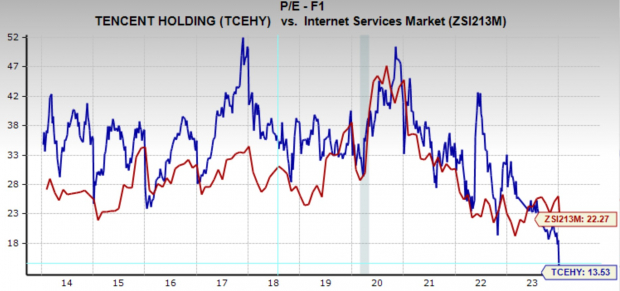

Tencent Holdings is now trading at its 10-year low earnings earnings multiple at just 13.5x. This is considerably below its 10-year median of 35.1x and below the industry average of 22.3x.

Image Source: Zacks Investment Research

PDD Holdings Group

PDD Holdings Group PDD, also known as Pinduoduo is the hot new e-commerce thing in China and abroad, even threatening incumbent e-commerce giant Alibaba. PDD Holdings is expected to grow its annual sales by 75% this year and 38.6% demonstrating a blistering pace of growth.

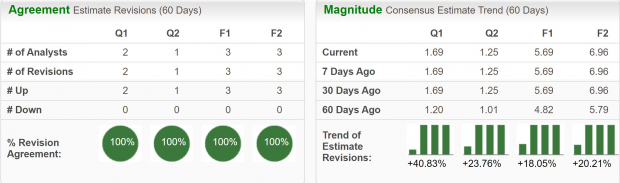

Reflecting PDD’s growth campaign, analysts have been steadily raising earnings estimates, also giving the stock a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have increased by 41% over the last two months and are projected to grow 39.7% YoY to $1.69 per share. FY23 earnings estimates have been revised higher by 18% and are forecast to grow 43% YoY to $5.69 per share.

PDD Holdings isn’t quite the bargain as the other stocks shared here, but at 24x forward earnings it certainly isn’t too expensive, especially considering those high growth rates.

Image Source: Zacks Investment Research

NetEase

NetEase NTES is a Chinese technology company with a prominent presence in the online gaming, e-commerce, and internet services sectors. Known for its diverse portfolio, NetEase has developed and published popular online games, including World of Warcraft and Overwatch. The company also operates e-commerce platforms, offering a range of products to consumers. Additionally, NetEase has a music streaming app and even owns some pig farms.

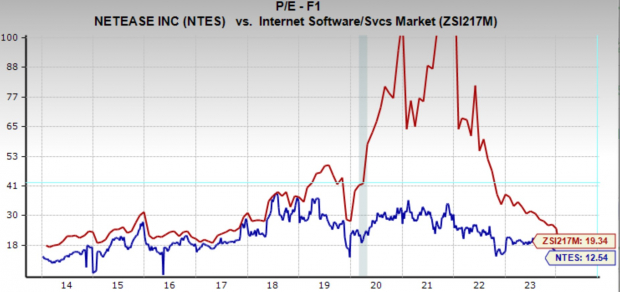

NetEase enjoys a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions and is projecting next year’s sales growth at 11% YoY to $16.2 billion. Additionally, FY23 earnings estimates have been revised higher by 4.3% in the last two months and are expected to grow 45% YoY to $7.26 per share.

Over the next 3-5 years, EPS are forecast to grow 16% annually and with a forward earnings multiple of 12.5x, NTES has a PEG Ratio of 0.71x, indicating that it is undervalued based on growth. It is also below its 10-year median valuation of 21x, and below the industry average of 19.3x.

Image Source: Zacks Investment Research

Alibaba

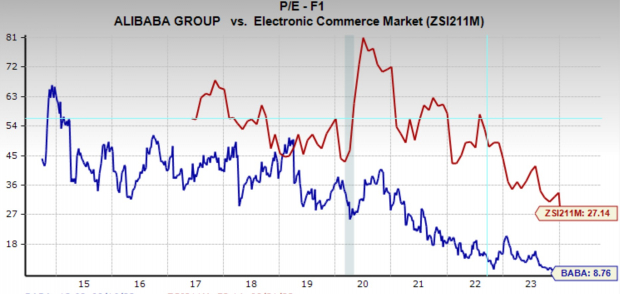

Well known as one of China’s leading technology companies Alibaba’s BABA businesses include retail, e-commerce, financial services, digital entertainment and cloud computing. The stock has been trending lower for nearly three years now and is -78% from its all-time high. However, over that time annual sales have doubled, reflecting a clear disconnect. Although BABA currently has a Zacks Rank #3 (Hold) rating, its valuation is the most appealing of the stocks shared here.

Like Tencent, Alibaba management has demonstrated an extreme commitment to returning cash to shareholders having bought back an incredible $9.5 billion of shares in 2023. Additionally, FY24 earnings are forecast to grow 15% YoY while sales are expected to climb 5.2% over the same period.

Alibaba is trading at a one year forward earnings multiple of 8.8x, just a fraction of its 10-year median multiple of 36.1x, and well below the industry average of 27.1x. The company also pays a dividend yield of 1.4%.

Image Source: Zacks Investment Research

Bottom Line

Although there is additional risk that comes with investing in Chinese equities, it is hard to deny the compelling proposition some of these stocks offer. For investors looking to add exposure to Chinese technology stocks, the stocks shared here are a great starting point.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

NetEase, Inc. (NTES) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

KraneShares CSI China Internet ETF (KWEB): ETF Research Reports

PDD Holdings Inc. (PDD) : Free Stock Analysis Report