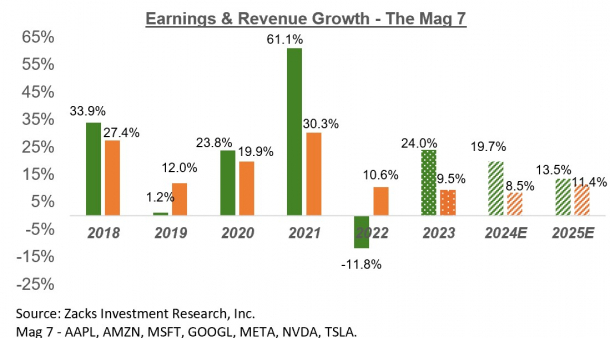

There’s been a lot of talk lately about the “Magnificent 7” stocks and their purported sole responsibility for the impressive market rally. These seven companies, namely Apple, Amazon, Meta Platforms, Alphabet, Microsoft, Nvidia, and Tesla, collectively represent almost 30% of the S&P 500’s total market capitalization.

It is argued that these seven stocks are upholding a generally weak market. Indeed, during this fourth-quarter earnings season, these stocks have, as a group, predominantly exceeded market expectations. With the exception of Tesla, the other five Magnificent 7 members have reported remarkable growth figures. Chip giant Nvidia is scheduled to announce its Q4 results later this month.

Their total fourth-quarter earnings are projected to increase by 48.7% on 14.5% higher revenues compared to the same period the previous year. These are extraordinary growth rates for companies of their size and understandably, the individual stocks continue to outperform the market. Looking ahead to the full year of 2024, earnings for this group are anticipated to rise by 19.7% on 8.5% higher revenues.

Image Source: Zacks Investment Research

But could it truly be just these seven stocks driving the market’s growth? The answer lies in understanding the current market conditions. Let’s dig deeper and see what we uncover.

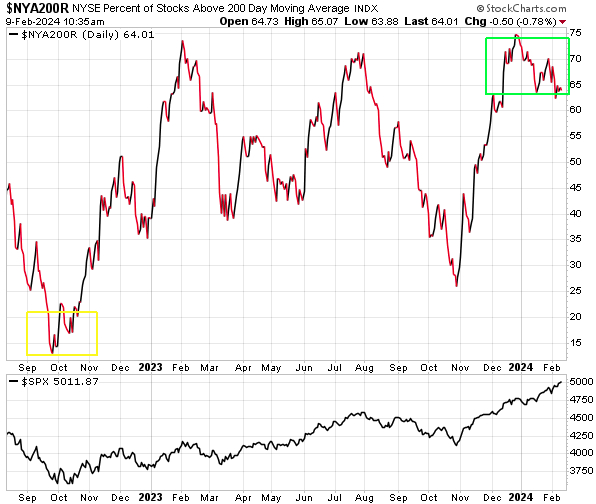

Market Breadth Indicates Positive Trend

Market breadth, as measured by the percentage of stocks trading above their 200-day moving average on the NYSE, has significantly improved from the bear market lows. It surged from low teens to approximately 75%, marking a multi-year high and signaling an expansion in market breadth.

Image Source: StockCharts

This broadening participation is a positive sign from a longer-term perspective, as it enhances the likelihood of a sustainable bull market. The major U.S. indexes continue to reach new highs, indicating the emergence of a new bull market.

Conversely, an extreme level of market breadth suggests an impending reversal. With the recent moderate decline in breadth compared to the beginning of the year, the likelihood of a short-term pullback in the near future appears plausible, especially given the impressive surge over the past few months. However, the increased breadth suggests positive prospects in the long run.

Normally, in the initial stages of a bull market, it is the technology sector that leads, driven by a bullish artificial intelligence theme. These stocks are usually the hardest hit during times of volatility. As bull markets expand, interest rekindles in other segments of the market.

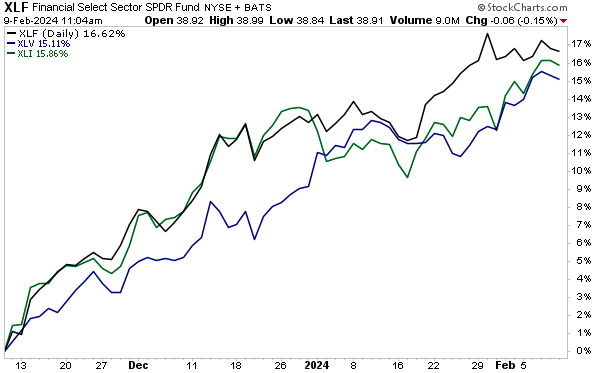

Emergence of Strength in Other Sectors

Besides tech, several sectors are either at or near their 52-week highs. Financials, industrials, and health care have all made notable comebacks:

Image Source: StockCharts

These sectors started showing strength late last year, with each experiencing at least a 15% rally over the past few months. So when it’s claimed that only big tech is driving this rally, it’s important to take such assertions with a grain of salt.

While it’s true that tech stocks have been responsible for much of the gains in the major indices, it’s also worth noting that there are numerous individual stocks within the health care, industrial, and financial sectors that are making new 52-week highs.

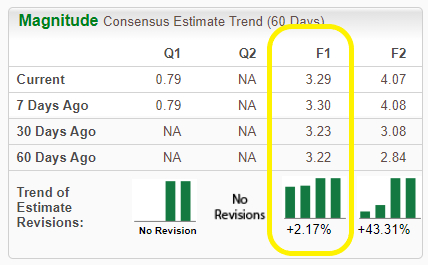

For instance, pharmaceutical giant Novo Nordisk has seen its stock soar to new all-time highs, propelled by its extensive portfolio of diabetes and obesity drugs. Earnings estimates for the current year have increased by 2.17% in the past 60 days. An expected full-year earnings of $3.29 per share would represent a 21.9% improvement over the previous year:

Image Source: Zacks Investment Research

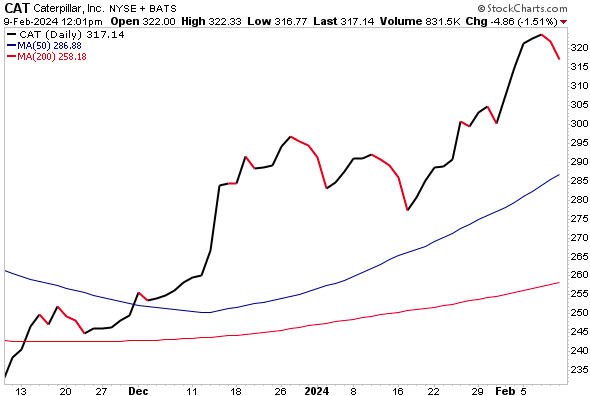

Similarly, within the industrial sector, the construction and mining equipment manufacturer Caterpillar’s stock has also surged to all-time highs, reflecting its status as a barometer of the global economy, with its shares surging by over 36% in the last 3 months:

Image Source: StockCharts

Final Observations

The market signals positive outlooks ahead, with companies from various sectors actively participating in this upward trend. While technology stocks have spearheaded the progress in the early stages of this new bull market, other sectors have exhibited renewed strength as they join the rally.

With many technology stocks now overextended, it’s an opportune time to explore other avenues and diversify portfolio holdings. It is essential to leverage all the resources available as we move further into the New Year.