The artificial intelligence (AI) revolution is being supercharged by the “Magnificent Seven” stocks of Microsoft, Amazon, Alphabet, Apple, Tesla, Meta Platforms, and Nvidia (NASDAQ: NVDA).

With the exception of Apple and Tesla, each of these AI stocks has handily beaten the S&P 500 over the last year. Nvidia stands out in a league of its own, however.

The stock is up nearly 260% in the last year, and the company has added a trillion dollars of market cap in less than 12 months. With such a meteoric rise, investors may be thinking that they’ve missed the boat.

Let’s dig into the current state of Nvidia’s business and, more importantly, take a look at what catalysts could be in store for future growth. Now could be as good a time as ever to begin building a position in this monster AI stock.

Nvidia crafts graphics processing units (GPU) that are essential in various generative AI applications, including accelerated computing and machine learning. The demand for the company’s A100 and H100 chips remains robust and shows no signs of slowing down.

Nvidia recently unveiled financial results for its fourth quarter and fiscal 2024, which ended Jan. 28. In the full year, the company reported $60.9 billion in revenue — up a staggering 126% year over year. Particularly encouraging is the company’s margin expansion and profitability surge.

Despite this outstanding performance, the question remains – will the music ever stop? I wouldn’t bet on that just yet.

Image source: Getty Images.

Just Scratching the Surface: Nvidia’s Potential Growth

Despite Nvidia’s explosive growth last year, analysts on Wall Street believe that the party might just be getting started.

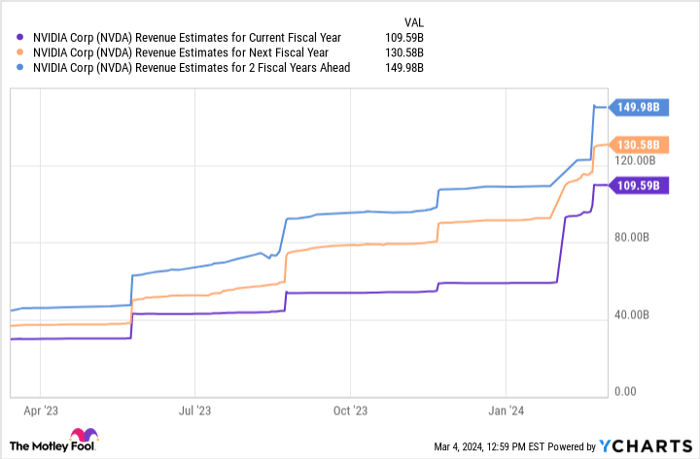

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Nvidia is projected to grow its revenue by around 78% this year, followed by steady growth in the subsequent years. Forecasting beyond a year is more of an art than a science. As an investor, I’m cautious about estimates past fiscal 2025.

New catalysts have emerged, indicating that Nvidia’s growth estimates may be conservative. The recent revelation of Nvidia’s investment in voice-recognition software company SoundHound AI signals new areas of growth.

Additionally, Nvidia disclosed during the earnings call its entry into the enterprise software domain. While still in its early stages, this move signifies the company’s expansion beyond semiconductor chips, potentially offering higher-margin opportunities.

Despite potential competition in semiconductor manufacture, Nvidia’s foray into software could mitigate potential margin pressures.

Timing the Nvidia Investment

During the fourth-quarter earnings release, Nvidia CEO Jensen Huang heralded a tipping point in accelerated computing and generative AI. Far from suggesting Nvidia’s cresting, Huang envisioned a doubling of the installed base for data center infrastructure within the next five years. These projections, combined with Nvidia’s prevailing market dominance and the outlined catalysts, offer investors compelling reasons to anticipate significant growth in Nvidia stock.