Dueling Giants

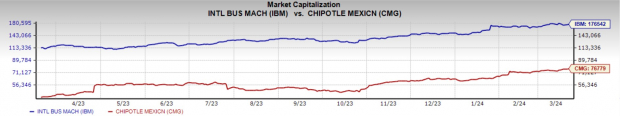

Two top-notch stocks setting the financial world abuzz are Chipotle Mexican Grill (CMG) and IBM (IBM), both on the brink of scaling new heights.

IBM’s shares recently hit a 52-week peak of $199.18 thanks to a substantial uptick in sales growth. In contrast, Chipotle’s expansion drive has been accentuated by its upcoming 50 to 1 stock split, propelling its shares to over $3,000 each.

Market Dominance

IBM boasts a market capitalization of $177.65 billion, while Chipotle stands at $76.77 billion, firmly establishing their dominance in the computer-integrated systems and retail restaurant sectors.

Image Source: Zacks Investment Research

IBM’s Revamp

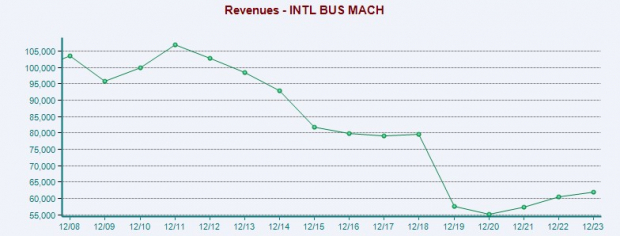

Formerly renowned for its computer hardware offerings, IBM’s strategic shift towards software applications like hybrid cloud and AI has reinvigorated its revenue growth, surging by 5% to $60.53 billion last year, the most significant jump since 2011.

Image Source: Zacks Investment Research

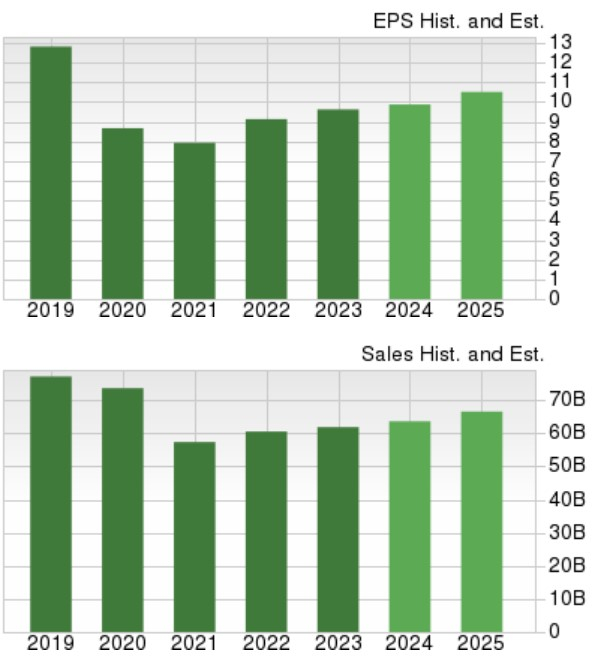

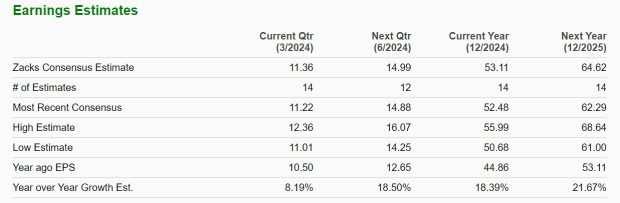

IBM’s projected sales are set to increase by 3% in fiscal 2024 and another 4% the following year, reaching $66.59 billion. Anticipated annual earnings for FY24 are up 4%, with a further 5% boost expected in FY25 to $10.58 per share. Notably, this would represent a 33% surge over the past five years, edging closer to the pre-pandemic levels of $12.81 per share in 2019.

Image Source: Zacks Investment Research

Chipotle’s Game-Changer

Chipotle’s remarkable growth trajectory hits a new milestone with its awaited stock split, making its shares more accessible to retail investors. The 50-1 split announcement paves the way for one of the largest stock splits on the NYSE, effective June 26.

Image Source: Zacks Investment Research

Performance & Prospects

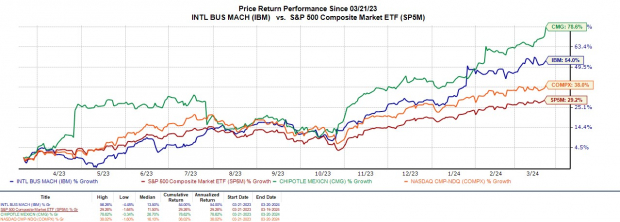

Chipotle’s stock has surged by +27% this year, while IBM has seen a +19% climb, outperforming the S&P 500 and Nasdaq. Over the past year, Chipotle has soared by +78%, with IBM up +54%, surpassing broader market indexes.

Image Source: Zacks Investment Research

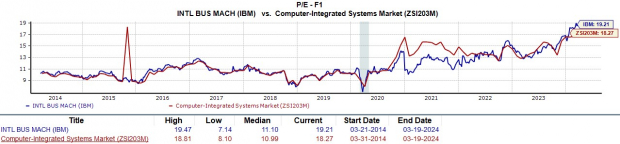

Trading at a reasonable 19.2X forward earnings multiple, IBM sits below the S&P 500 but slightly above the industry average.

Image Source: Zacks Investment Research

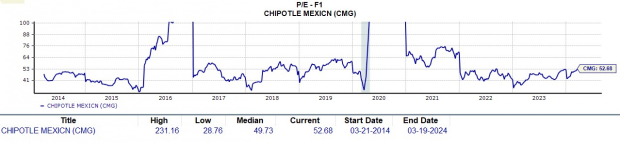

Chipotle, historically commanding a premium due to its growth margins and premium fast-casual status, currently trades at 52.6X forward earnings, lower than the historical high of 231.1X but nearing the median of 49.7X. Post-split, Chipotle’s P/E ratio may rise due to EPS dilution.

Image Source: Zacks Investment Research

Verdict

Both Chipotle and IBM currently hold a Zacks Rank #3 (Hold). While long-term investors may enjoy gains, caution is advised due to the strong rallies witnessed this year.

Want the latest insights from Zacks Investment Research without the fluff? Click below to access the details.