The Disappointing Double-digit Declines

Lauded as part of the “Magnificent Seven,” which catapulted the S&P 500 into the realms of the bull market, stocks like Apple and Tesla are facing a sobering reality. In a sharp contrast to their peers’ stratospheric rise this year, Apple has stumbled by 11%, while Tesla felt the weight of a 32% drop since the year began.

Contributing significantly to the S&P 500’s first-quarter woes, these two industry giants collectively shaved off 1.3 percentage points from the index’s returns, as per Statista. Visualizations portray Apple’s -7.1% and Tesla’s -5% contributions to the S&P 500’s Q1 journey, marking them as the primary detractors.

Investor sentiment toward Apple and Tesla shifted amidst the first quarter. Apple, a perennial favorite with an illustrious product lineup, seemed to lack that spark of innovation that investors crave. Despite its recent foray into spatial computing with the Apple Vision Pro, which received mixed reviews, the company’s AI roadmap trails behind its peers. This lag could prompt investors eyeing high-growth prospects to seek clearer paths elsewhere.

Tesla’s Trials and Tribulations

Tesla, on the other hand, implemented strategic moves like price adjustments to boost sales volume and trim production costs. While these strides are commendable, current initiatives are eroding earnings, compounded by challenges such as burgeoning competition and unfavorable currency dynamics.

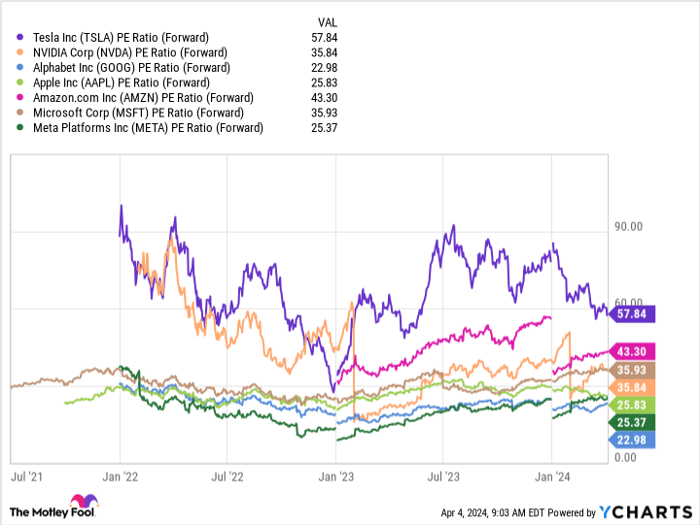

Notably, Tesla boasts a lofty 57x forward earnings estimate valuation, making it the priciest amongst the Magnificent Seven. Such steep pricing might dissuade potential investors, nudging them toward more affordable alternatives within the elite group.

Explore more on the TSLA PE Ratio (Forward) on YCharts

Meanwhile, Nvidia’s meteoric rise, fueled by triple-digit revenue and net income growth, crowns it as the star performer within the cohort. The impending release of the revolutionary Blackwell architecture and potent chips further bolsters investor optimism. Coupled with commanding presence in the AI chip realm, where the AI market’s value is poised to surpass $1 trillion by the decade’s end, Nvidia remains a stalwart beacon in the tech space.

Microsoft, Amazon, and Meta Platforms, other pivotal contributors to the S&P 500’s Q1 surge, are also deep in the AI investment fray. The allure of AI winners appears to be a significant draw for early 2024 investors.

Looking Beyond the Lull for Apple and Tesla

Are Apple and Tesla’s glory days a thing of the past? Not quite. Despite their current woes, both companies stand poised for enduring success.

Apple’s robust moat built on brand supremacy guarantees a stronghold in its markets. The services business emerges as a prospective growth engine propelling its trajectory. Meanwhile, Tesla’s preeminent position in the U.S. EV realm, coupled with ongoing technological advancements, bodes well for its enduring legacy.

Hence, though Apple and Tesla are under the microscope for less-than-ideal reasons today, their future, intertwined with that of their stakeholders, holds promise for substantial victories.

Contemplating an Apple Investment Amidst the Storm?

Intrigued by a potential Apple investment? Before delving in, ponder this:

The Motley Fool Stock Advisor team has pinpointed what they deem as the perfect♀♀