- Energy giants Exxon Mobil and Chevron report earnings tomorrow.

- Exxon boasts a strong financial position, potentially mitigating risks from rising interest rates.

- Analysts are cautious on Chevron, but a positive surprise could unlock significant upside.

With the earnings season in full swing, all eyes are on the energy sector as the titans, Exxon Mobil and Chevron, are set to unveil their quarterly results tomorrow before the market opens.

Recent months have seen the industry soaring high on the back of escalating tensions in the Middle East, targeting merchant ships in the Red Sea basin, and orchestrated production cuts by the OPEC+ coalition.

This has translated into positive year-to-date returns for both companies: ExxonMobil up by 21.7%, with Chevron following closely at 9.66%, demonstrating an upward trajectory.

Oil Prices: Trends Uphold

Oil prices, a pivotal benchmark for energy giants like ExxonMobil and Chevron, continue an upward trend, fueled by rising tensions and production cuts, as both Brent and WTI crude prices catch the tailwinds.

A significant factor to watch is the simmering Israel-Iran conflict, with recent escalations hinting at a potential impact on oil prices. An underlying stability is expected, supported by high prices and fundamental factors.

Hence, unless a sudden escalation disrupts, oil prices are poised to maintain their stability, lending support to the stock values of ExxonMobil and Chevron.

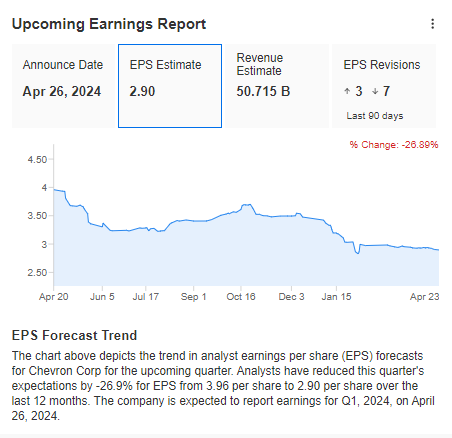

Chevron Earnings Watch: Balancing Skepticism and Upside Potential

Analysts prepare for Chevron’s earnings cautiously, with downward revisions dominating their expectations, painting a somewhat pessimistic outlook.

Source: InvestingPro

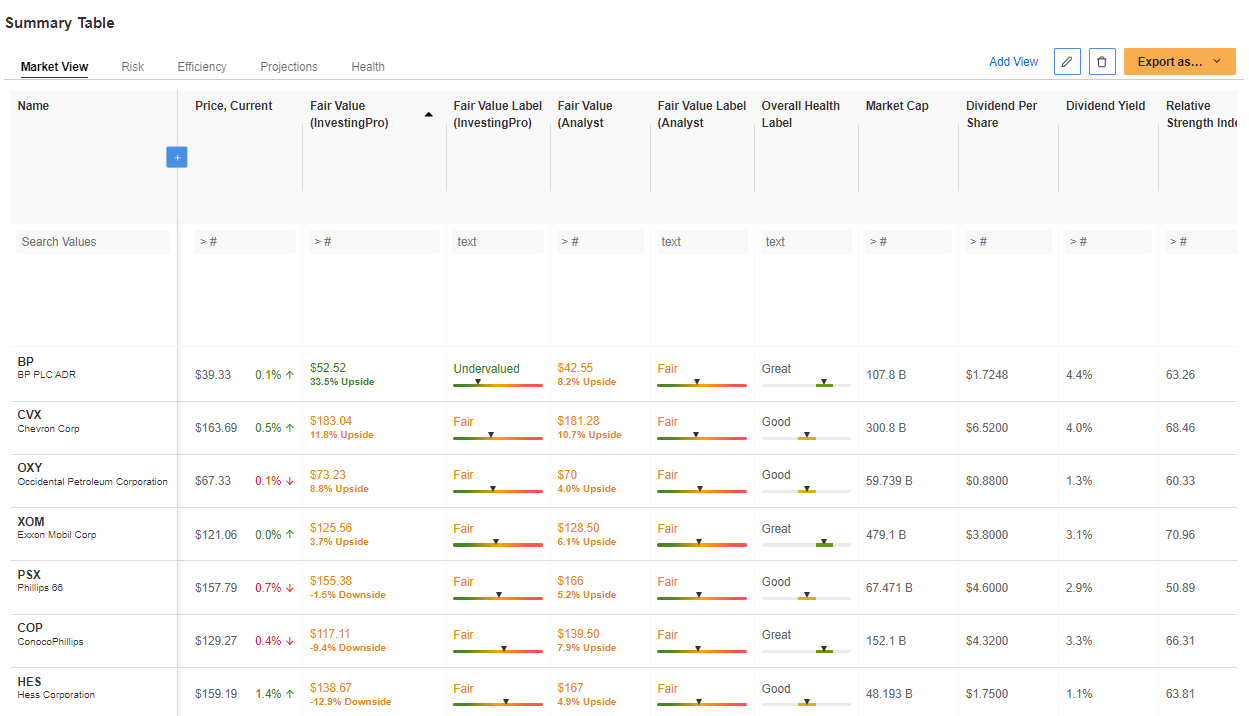

However, a strong showing by Chevron could ignite a wave of optimism, with potential for over 11% growth, positioning it favorably among peers.

Source: InvestingPro

Technically, a breakthrough above $168 per share could trigger a bullish signal, potentially driving prices towards the previous highs near $190.

ExxonMobil: Financial Strength Bolsters Stock Growth

ExxonMobil’s stock has reached historical peaks, pushing its market cap to a mammoth half a trillion dollars, largely due to its robust finances.

Over recent years, diligent debt reduction has slashed interest costs, propelling the company’s financial health to new heights.

With solid ground amid rising interest rates, ExxonMobil’s outlook remains positive, reinforced by high oil prices and a fortified balance sheet.

Source: InvestingPro

Tomorrow’s earnings report could temper the current uptrend if investor expectations are significantly missed. Yet, absent major surprises, the trajectory for ExxonMobil’s stock appears to be one of continued growth.