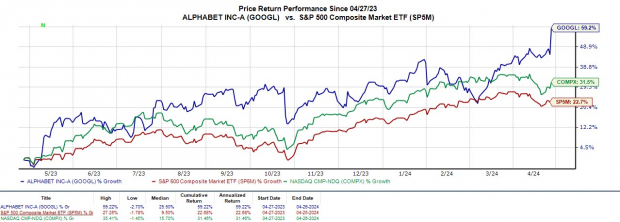

Alphabet GOOGL made headlines in Friday’s trading session after surpassing its first quarter earnings expectations yesterday evening and aiding the overall market in finishing on a strong note.

With a remarkable surge of over +10% today, Alphabet shares soared due to the announcement of the tech behemoth initiating its inaugural dividend in conjunction with the board of directors sanctioning $70 billion in stock buybacks.

Let’s delve into Alphabet’s riveting Q1 report and assess if now presents an opportune moment to join the robust post-earnings upswing with GOOGL already up by more than +20% year to date.

Image Source: Zacks Investment Research

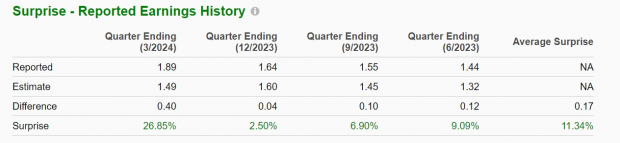

Reviewing Q1 Performance

Alphabet’s Q1 earnings surged by 61% to $1.89 per share compared to $1.17 in the same quarter last year, surpassing the Zacks Consensus forecast of $1.49 per share by 27%. On the revenue front, Q1 sales of $67.59 billion marked a 16% increase from $58.06 billion a year earlier, exceeding estimates by 2%.

Image Source: Zacks Investment Research

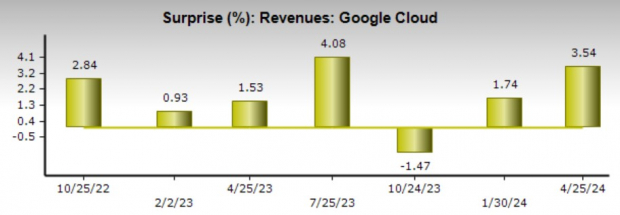

The robust performance was attributed to Google Search, Cloud services, and a robust uptick in advertising revenue on YouTube. Alphabet also underlined its strong position for the upcoming age of artificial intelligence with its Gemini platform, a generative AI model adept in audio, video, and text comprehension.

Significantly, Google Cloud revenue surpassed expectations by 3%, escalating by 28% year-over-year to $9.57 billion, with Alphabet maintaining its third-place standing in the U.S. cloud computing market, trailing behind Amazon’s AMZN AWS and Microsoft’s MSFT Azure.

Image Source: Zacks Investment Research

Market Capitalization and Dividend Initiatives

Alphabet’s newly introduced quarterly dividend stands at $0.20 per share, with the initial disbursement scheduled for June 17 to shareholders on record as of June 10. With the dividend declaration and stock repurchase announcement triggering today’s upsurge, Alphabet briefly touched a $2 trillion market cap for the first time since 2021, standing only below Apple AAPL and Microsoft in terms of market capitalization.

Image Source: Zacks Investment Research

Final Thoughts

Alphabet’s Q1 results have reinstated the expectations of double-digit growth in revenue and earnings for fiscal 2024. At present, GOOGL boasts a Zacks Rank #3 (Hold). Nevertheless, a potential upgrade to a ‘buy’ rating might not be far off, considering the anticipated upward trend in earnings estimates over the next few weeks.