Some things in life are underrated: Mint chocolate chip ice cream, for example. Sure, regular old chocolate is great, but give me the choice and I’ll take the light green ice cream every time.

Stocks are no different. Nvidia, Microsoft, and Tesla garner plenty of attention, but there are other stocks out there — stocks that often outperform the biggest names.

Today I want to give one of those stocks its due: Visa (NYSE: V). Let’s have a look at what makes this stock so underrated.

Image source: Getty Images.

Understanding the Ingenious Visa Business Model

One potential reason why Visa’s stock is underrated is that some people simply don’t understand the company’s business model. While Visa is best known for the credit and debit cards that bear the Visa logo, the company doesn’t actually issue these cards. Rather, banks and other financial institutions issue the cards. That means Visa bears no credit risk (the risk of a borrower being unable to pay back the cost of a purchase).

Visa generates most of its revenue by operating a massive payment network that connects card issuers to various merchants around the world. With Visa acting as an intermediary, an American can walk into a pub in Liverpool and pay with a credit card with no questions asked. In exchange for facilitating the transaction, Visa collects various fees.

Who pays these fees? In a way, everyone does. At the most basic level, merchants pay swipe fees to Visa; however, they can pass those fees along to customers, either directly or indirectly. Similarly, Visa also charges financial institutions reimbursement fees to recoup the costs of expanding and maintaining its network.

At any rate, thanks to the immense scale of Visa’s network, those fees really add up. Consider these financial highlights from its most recent quarter (for the three months ending on March 31, 2023):

- $8.8 billion in revenue, up 10% year-over-year

- $4.7 billion in net income, up 10% year-over-year

- $4.3 billion in free cash flow

- $3.8 billion returned to shareholders via dividend payments and share repurchases

If you’re an investor, that is the type of quarter you want to see. The company is growing its revenue and profits, generating plenty of free cash flow and then returning billions of dollars to shareholders via dividends and share buybacks.

The Magnificence of Visa’s Performance

Clearly, Visa’s business model works. Moreover, its business model has been working for a long time. That explains why the stock has performed so well over the last decade.

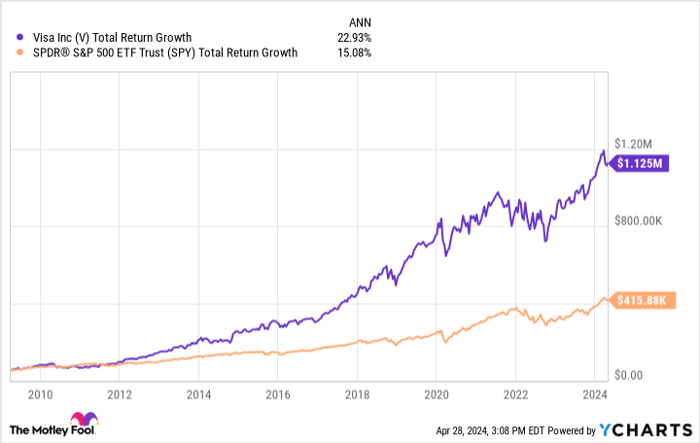

Consider this: If you had invested $50,000 in Visa in early 2009 — and never sold it — you’d have over $1 million today. That’s an annual return of 22.9% — far outpacing the S&P 500‘s 15.1% return over the same period.

V Total Return Level data by YCharts

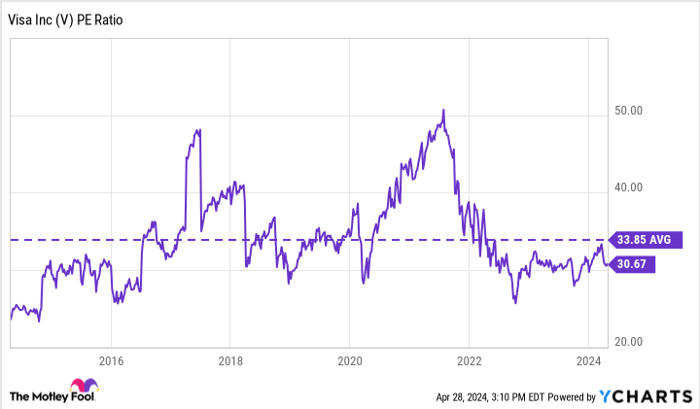

But what is even better news for investors is that Visa’s current valuation looks attractive. The company’s price-to-earnings (P/E) ratio is 30.7x, which is below the 10-year average of 33.9x.

V PE Ratio data by YCharts