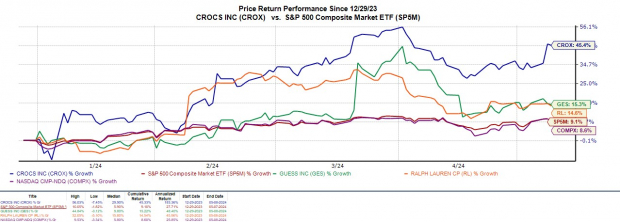

A standout in this week’s earnings parade, Crocs CROX stock leaped into the limelight after surpassing Q1 earnings forecasts with gusto on Tuesday. The renowned footwear and apparel titan has seen its shares skyrocket by over +40% this year, effortlessly outshining broader market benchmarks and notable competitors like Guess GES and Ralph Lauren RL.

Given this, let’s delve into whether it’s wise to hold or acquire Crocs stock in the wake of the company’s stellar Q1 performance.

Image Source: Zacks Investment Research

Impressive Q1 Performance

Crocs boasted compelling brand growth as Q1 revenues surged by 6% year over year to $938.63 million, surpassing estimates of $883.85 million by 6%. Even more noteworthy, the company exhibited enhanced profitability with earnings of $3.02 per share, a 16% increase from the previous year quarter, surpassing EPS estimates of $2.25 by 34%.

Further enhancing its allure, Crocs has now exceeded both top and bottom-line expectations for 16 consecutive quarters, delivering an average earnings surprise of 17% in its last four quarterly reports.

Image Source: Zacks Investment Research

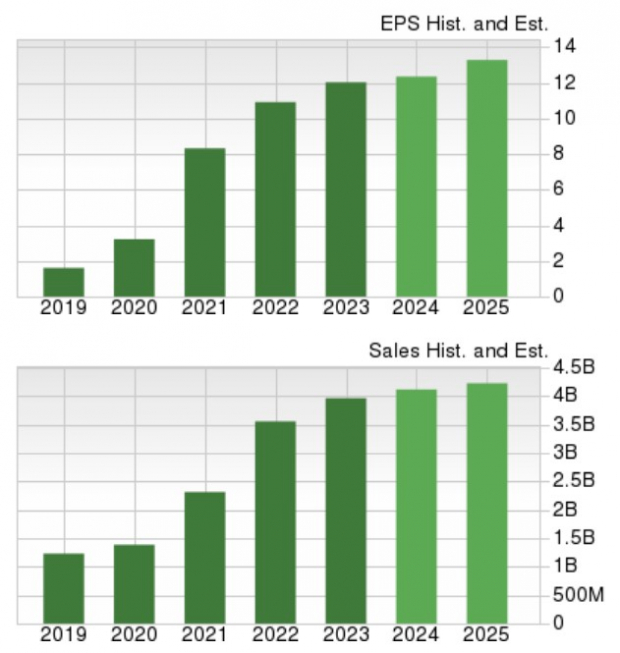

Growth Trajectory & Future Prospects

As per Zacks projections, Crocs’ annual earnings are anticipated to rise by 3% in fiscal 2024, with a further estimated expansion of 9% in FY25 to $13.56 per share. Total sales are predicted to grow by 4% this year and are forecasted to climb another 6% in FY25 to $4.37 billion.

Image Source: Zacks Investment Research

Appealing P/E Valuation

Despite the remarkable rally in Crocs stock year-to-date, CROX continues to be valued at just 10.9X forward earnings. This represents a slight discount to the Zacks Textile-Apparel Industry average of 12.5X and Ralph Lauren’s 14.8X while maintaining a position slightly above Guess’s P/E valuation of 9.1X.

Image Source: Zacks Investment Research

Final Thoughts

Presently, Crocs stock holds a Zacks Rank #3 (Hold). With its promising growth trajectory and attractive valuation, retaining CROX could prove lucrative. However, amid such a scorching start to the year, it might be prudent to await potential better entry points.

Disclaimer: This article offers insights and should not be taken as financial advice. Always conduct thorough research before making investment decisions.