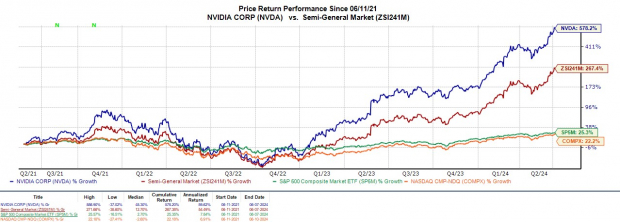

Amidst the echoes of market volatility, Nvidia’s NVDA has undergone a transformative 10-1 stock split, offering shares at around $120. The split arrives on the back of Nvidia’s stock price tripling in 2023 and doubling yet again this year.

While the essence of a stock split doesn’t alter a company’s total market value, the reduced share price certainly ignites the discourse on whether now is the opportune moment to venture into NVDA, which formerly traded at lofty all-time highs exceeding $1,000.

Image Source: Zacks Investment Research

Market Valuation

Nvidia’s supremacy as the frontrunner in semiconductor chips fueling artificial intelligence propelled its market capitalization beyond Apple AAPL, reaching a staggering over $3 trillion, securing the position as the second-highest valued company in the United States, trumped only by Microsoft MSFT.

This grandeur underlines Nvidia’s might, overshadowing other notable chip titans like AMD AMD and Intel INTC, with market capitalizations at $271 billion and $130 billion, respectively.

Image Source: Zacks Investment Research

Growth Trajectory Post-Split

Undoubtedly, Nvidia’s market standing and industry dominance advocate for potential investments in its shares. It’s crucial to note that stock splits do not impact a company’s underlying fundamentals or earnings, although earnings per share (EPS) get diluted to adjust for the increased share count.

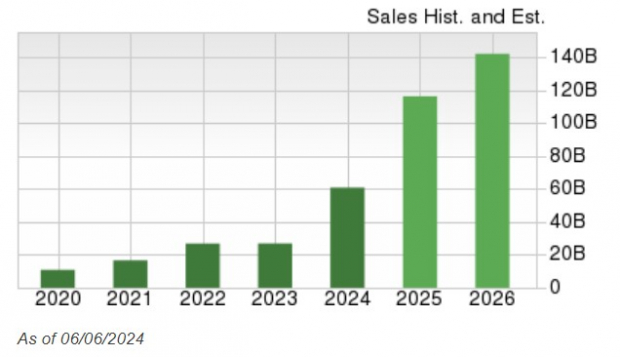

In this context, Nvidia’s annual earnings are now estimated at $2.65 per share ($26.54 per share/10) for the ongoing fiscal 2025, with a projected 22% expansion in FY26 EPS to $3.25. Importantly, sales remain unaffected by a stock split, with Nvidia’s revenue anticipated to surge by 91% in FY25 to $116.4 billion compared to $60.92 billion in FY24. Furthermore, FY26 sales are forecasted to rise by an additional 22% to $142.29 billion.

Image Source: Zacks Investment Research

Key Insights

With a glimmer of hope, Nvidia’s stock split unveils a window to partake in the expansive growth of the tech giant at a more affordable price, especially as NVDA proudly sports a Zacks Rank #1 (Strong Buy).

The forward stock split aligns aptly with Nvidia’s plans to launch its Blackwell series of GPUs, expected to hit the market officially later this year. These GPUs are anticipated to outshine the competition as the most potent AI chips in the market, surpassing both Nvidia’s current H200 series and AMD’s MI300 series.