Since early last year, Nvidia (NASDAQ: NVDA) has been ablaze, with its stock skyrocketing over 750%, fuelled by the transformative impact of generative artificial intelligence (AI). This innovative technology, capable of revolutionizing tasks and processes with its automation abilities, holds the promise of enhanced productivity, leading to a surge in profitability for businesses incorporating it.

Nvidia’s graphics processing units (GPUs), the industry gold standard, offer the computational muscle required for AI processing. This supremacy has triggered a substantial demand for the company’s top-tier processors, propelling its business and financial performance to new heights and culminating in the recent 10-for-1 stock split.

While some investors may speculate that the easy gains have already been made, others foresee a brighter future ahead. According to one analyst, Nvidia possesses a distinct edge, which is poised to keep it at the forefront of competition and pave the way for a lucrative windfall for shareholders.

Lets delve into the analyst’s assertions and unravel its implications for investors.

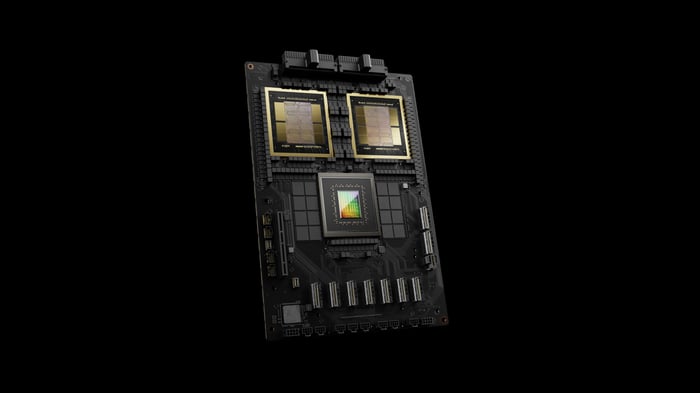

Nvidia’s GB200 Grace Blackwell Superchip. Image source: Nvidia.

An Illustrious History of Triumph

To grasp the origins of this ‘cash gusher,’ it is imperative to rewind and discern Nvidia’s trajectory leading to its present eminence.

Nvidia’s cutting-edge processors have long commanded the serious gamers’ realm, with an 88% stronghold on the discrete desktop GPU market in the first quarter, as per data by Jon Peddie Research.

Transcending its gaming-centric roots, Nvidia repurposed its technology for seamless data transmission, positioning itself as the go-to processor for data centers. Reports indicate that the company commands up to 92% of the data center GPU market, as corroborated by IoT Analytics. Moreover, Nvidia has clinched dominance in machine learning, a foundational AI domain, boasting a staggering 95% hold on that market, per insights from New Street Research.

Given that a significant portion of generative AI processing occurs in the cloud and data centers, Nvidia has entrenched itself as the industry leader. Anticipated to unveil its Blackwell processor family later this year, CEO Jensen Huang has posited that “The Blackwell Architecture platform will likely be the most successful product in our history.” If this prophecy materializes, and I wager it will, Nvidia might just be scratching the surface of its full potential.

Moreover, despite the prevalent narrative of impending competition, no formidable adversary has surfaced to challenge Nvidia’s dominance, even after years of opportunity.

The Currency Torrent

As envisioned by Melius Research analyst Ben Reitzes, Nvidia’s monumental advantage, possibly underestimated by some investors, is destined to perpetuate its technological spearhead status. Nvidia not only provides tailor-made AI chips but also offers integrated software that optimizes the performance of these AI-oriented processors to the fullest.

This ‘full stack’ strategy, entailing the fusion of hardware and software, furnishes Nvidia with an unparalleled edge, deemed challenging for competitors to replicate. This edge is particularly accentuated given the company’s entrenched history of technological leadership in the sector.

“They constructed a computational language and an ecosystem conducive to monetizing AI, and evidently, they are excelling,” Reitzes remarked.

The analyst further highlights that Nvidia’s accelerated pace of research and development (R&D) poses a formidable challenge for contenders. Recently intensifying its already breakneck pace of innovation, CEO Jensen Huang remarked that the company now functions on a “one-year rhythm,” rolling out new processors annually as opposed to the previous biennial cycle. “They are sprinting at 150 miles per hour while everyone else is cruising at 100. Catching up with these folks will be a Herculean task,” Reitzes affirmed.

Mired in the escalating adoption of AI and Nvidia’s predominant position, projections indicate that the company is poised to amass a staggering $270 billion in cash over the next three years. This potential inflow could unleash a cascade of returns to shareholders, manifesting in stock repurchases and augmented dividend payouts.

The analyst underscores that even amid heightened R&D expenditures, the anticipated cash influx is far in excess of prospective applications, hinting at a substantial portion being channeled back to stakeholders.

There are already discernible signs of this shift. Nvidia recently revealed a fresh $25 billion share repurchase initiative. In tandem with its stock split declaration in May, the company bolstered its dividend distribution by 150%. Nevertheless, Nvidia is currently utilizing less than 1% of its profits to sustain the dividend; even at the elevated rate, the yield is a modest 0.03%.

This scenario underscores the ample room for Nvidia to redistribute cash to shareholders, propelled by the ongoing tidal wave of AI adoption empowering the company with expanding resources for this very purpose. Moreover, given its killer advantage, it is improbable that a rival will wrest Nvidia’s crown, at least not in the near future.

Is Nvidia a Strategic Investment?

Before delving into Nvidia stock, it’s prudent to reflect on the following:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks to invest in now, with Nvidia conspicuously absent from the list. These selected stocks are poised to yield substantial returns in the forthcoming years.

Contemplate the scenario when Nvidia made it to this list on April 15, 2005 – if you had invested $1,000 at that juncture, you would now possess $757,001!*.

Stock Advisor not only furnishes investors with a lucid path to success, offering guidance on portfolio construction, consistent analyst updates, and bi-monthly stock picks but has also substantially outstripped the performance of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Danny Vena holds positions in Nvidia. The Motley Fool discloses positions in and recommends Nvidia. The Motley Fool adheres to a disclosure policy.