Beta measures a stock’s volatility in comparison to the overall market. The market, such as the S&P 500 Index, has a beta of 1.0, and any value above 1.0 indicates higher volatility, while below 1.0 suggests the opposite. Low-beta stocks, like Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED, offer a stable investment option a calm lake amidst turbulent waters.

These low-beta stocks can fortify portfolios, especially when paired with high-beta stocks, creating a harmonious symphony of risk-balanced investments.

Let’s delve into the details of each of these graceful low-beta swans:

Low Beta Stock Spotlight: Elevance Health Surpasses Expectations

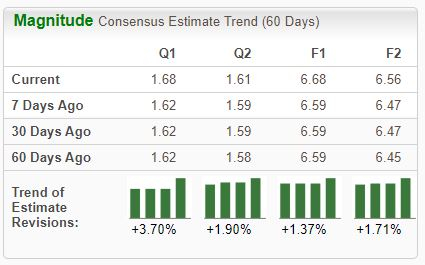

Elevance Health, a Zacks Rank #2 (Buy) company, focuses on providing health benefits for consumers, families, and communities along their wellness journey. Earnings projections are on the rise, with a recent 1% outperformance against Zacks Consensus EPS estimates and slightly lower sales figures.

Earnings increased by 12.5% year-over-year, with sales climbing by 1%. Witness below the quarterly revenue figures illustrated for the stock.

Image Source: Zacks Investment Research

Interactive Brokers: Setting the Market Ablaze

Interactive Brokers Group operates as a global electronic market maker and broker, outpacing the S&P 500 with an impressive 125% value surge over the past two years (almost tripling the S&P 500’s 50% gain) through enhanced trading activity.

Image Source: Zacks Investment Research

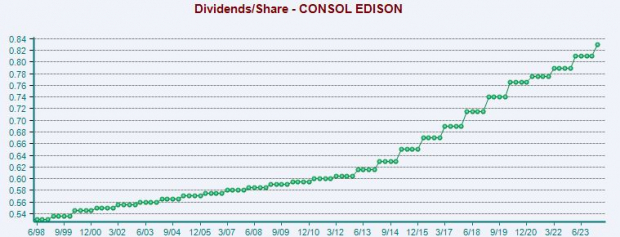

Consolidated Edison, another Zacks Rank #2 (Buy) utility holding company, has consistently surpassed Zacks Consensus EPS estimates by 6% over the last four releases. ED shares offer a 3.8% annual yield, appealing to income-seeking investors, with modest dividend growth apparent at a 2% rate over five years.

Witness the company’s shareholder-centric approach in the visual below:

Image Source: Zacks Investment Research

Wrapping It Up

Seeking a serene investment journey in the choppy waters of the market? Low-beta stocks are the life jacket you need. Whether to shield against high waves or add balance to your portfolio, stocks like Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED are stars to guide your ship by.

Moreover, with promising Zacks Ranks, these stocks paint a picture of hope and growth in a sometimes tempestuous market.