Steeping into the industrials sector at a time when stocks are oversold presents a rare chance to hitch a ride on the undervalued bandwagon.

One key indicator to spot such opportunities is the Relative Strength Index (RSI), a momentum gauge that juxtaposes a stock’s strength during price hikes against its strength during descents. This metric, when coupled with price action, unfolds a hint of the potential short-term trajectory of a stock. Typically, the RSI signals an oversold condition when it dives below 30, as per market insights.

Let’s delve into the domain of oversold stocks in the industrials arena, harboring an RSI hovering around or below the 30 mark.

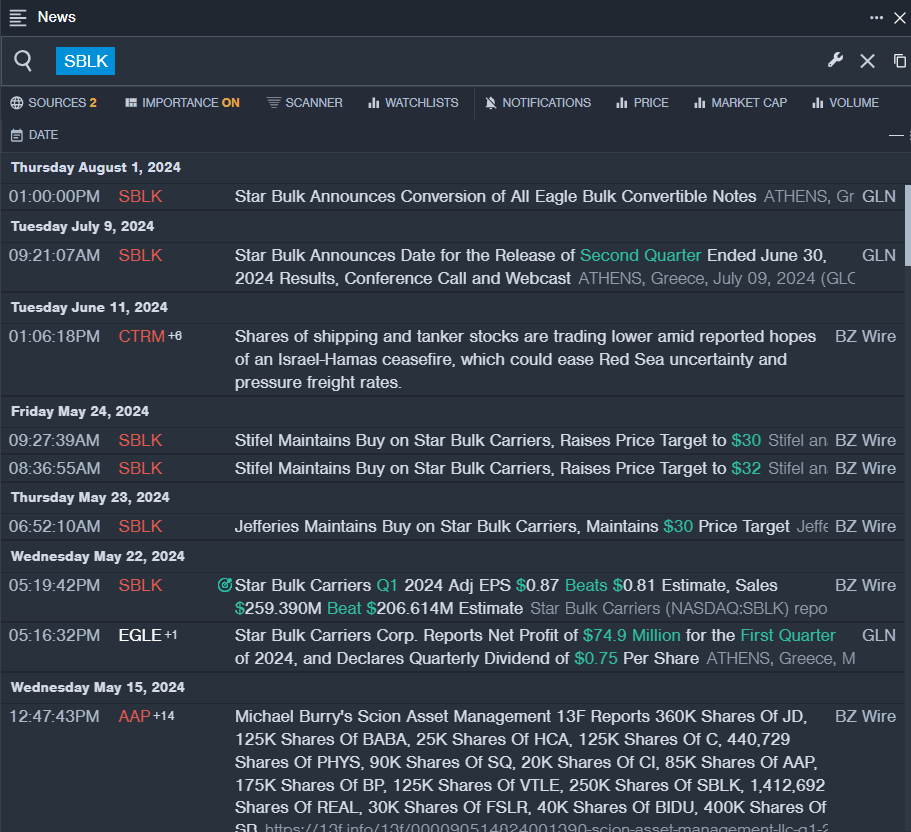

Star Bulk Carriers Corp SBLK

- Star Bulk Carriers is poised to unveil its second-quarter results post the closing bell on Wednesday, Aug. 7. The company’s stock witnessed a dip of approximately 12% over the preceding month, with its 52-week low pegged at $16.86.

- RSI Value: 27.28

- SBLK Price Action: The curtain fell with Star Bulk Carriers’ shares declining by 3.6% to settle at $21.74 on Thursday.

- Insights from Benzinga Pro’s real-time newsfeed sparked a buzz around the latest developments in the SBLK realm.

Symbotic Inc SYM

- Symbotic recently made headlines with a disappointing third-quarter earnings report and fourth-quarter revenue guidance falling short of estimates. In the words of Rick Cohen, chairman and CEO of Symbotic, “Our teams are laser-focused on executing the 39 systems currently in deployment, a drive that reflects in our record revenue for the quarter. However, the silver lining was blurry as our system gross margin slipped below expectations, courtesy of elongated construction schedules and implementation expenses.” This stumble caused Symbotic’s stock to plummet by around 37% in the last five days, hitting its 52-week low at $24.21.

- RSI Value: 26.59

- SYM Price Action: Symbotic’s shares saw an 8.2% dip to conclude at $24.61 on Thursday.

- Triggers from Benzinga Pro’s charting tool helped to decode the trend underpinning the SYM stock narrative.

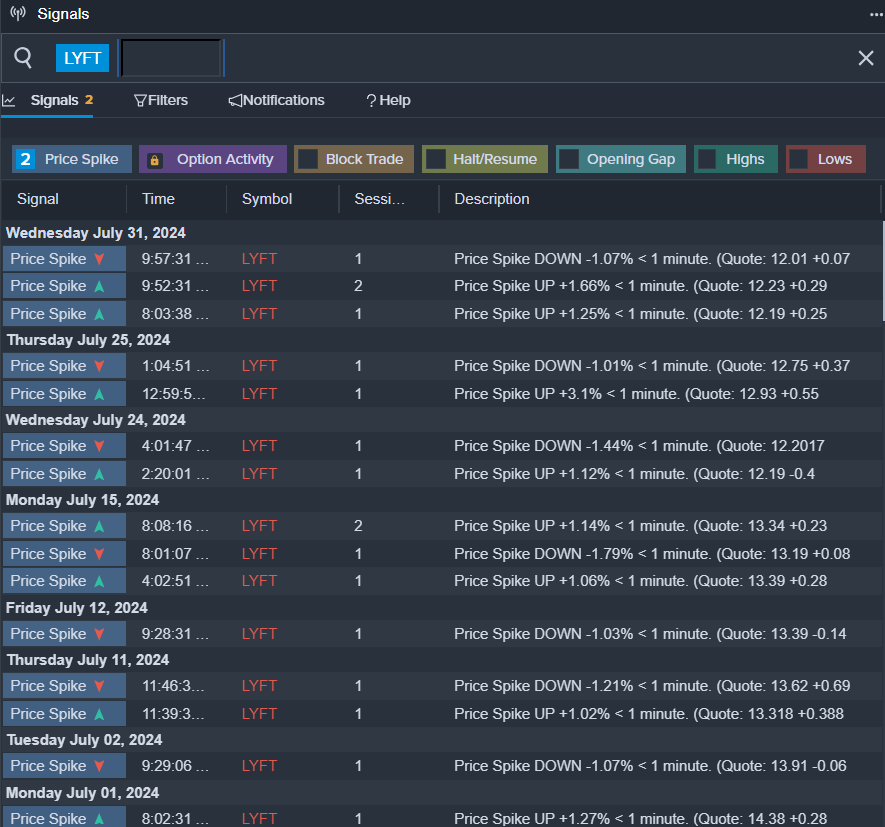

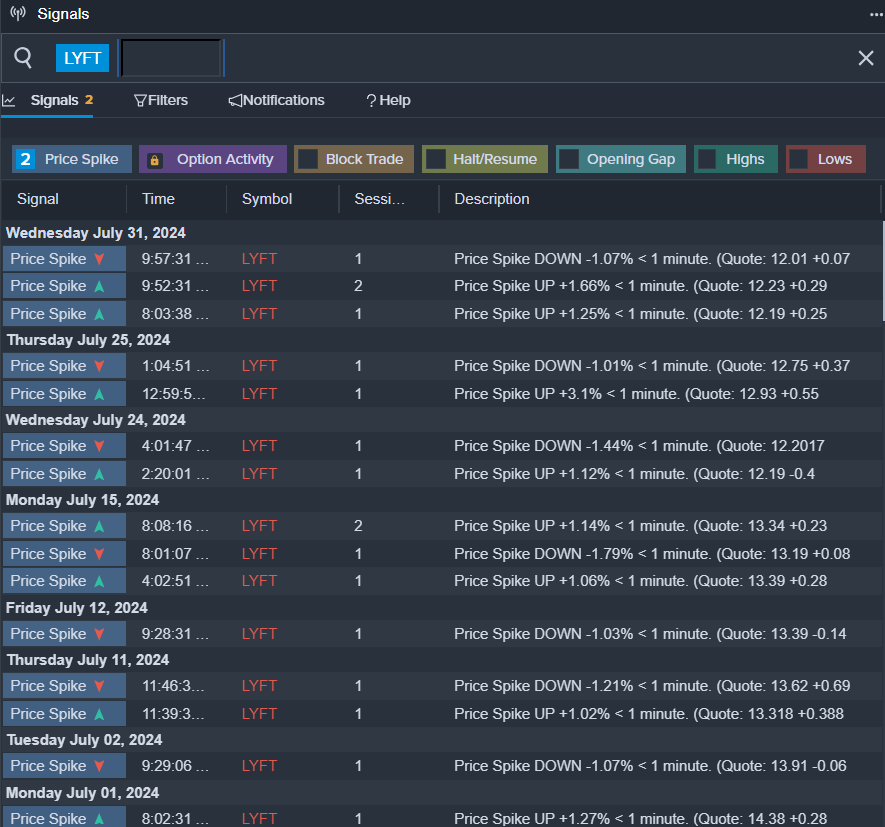

LYFT Inc LYFT

- In a recent twist, Lyft announced the forthcoming departure of President Kristin Sverchek effective Aug. 20. This revelation was accompanied by Lyft’s shares taking a tumble of around 15% over the previous month, marking its 52-week low at $8.85.

- RSI Value: 25.99

- LYFT Price Action: Lyft’s stock witnessed a 5.2% downturn, settling at $11.42 as the closing bell chimed on Thursday.

- Whispers from Benzinga Pro’s signals feature hinted at a possible breakthrough in the LYFT stock saga.