For many investors, the guidance of Wall Street analysts plays a crucial role in their investment decisions. The fluctuating ratings provided by these sell-side analysts can significantly impact a stock’s valuation. But are these recommendations truly reliable?

Before delving into the credibility of brokerage recommendations and how investors can leverage them to their advantage, let’s explore the sentiments of Wall Street experts towards Netflix (NFLX).

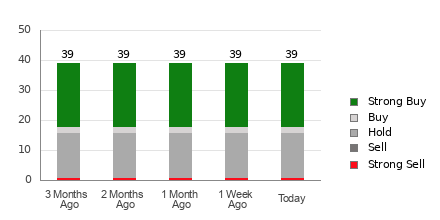

As per current data, Netflix boasts an Average Brokerage Recommendation (ABR) of 1.91 on a scale ranging from 1 to 5 (Strong Buy to Strong Sell), determined by the cumulative suggestions (Buy, Hold, Sell, etc.) of 39 brokerage firms. An ABR of 1.91 positions between Strong Buy and Buy.

Among the 39 recommendations contributing to the prevailing ABR, 21 reflect Strong Buy, while two indicate a Buy rating. Together, Strong Buy and Buy constitute 53.9% and 5.1% of all recommendations, respectively.

Shifting Brokerage Perspective on NFLX

While the ABR advises a bullish stance on Netflix, it might be imprudent to base investment decisions solely on this metric. Numerous studies have demonstrated the limited efficacy of brokerage recommendations in guiding investors towards stocks with the most promising price appreciation potential.

Have you pondered why? The inherent bias of brokerage firms towards stocks they cover tends to skew the analysts’ ratings positively. Research suggests that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” ratings.

Hence, their motives may not always align with those of retail investors, offering scant insights into a stock’s potential trajectory. Consequently, it is advisable to either corroborate this information with your own research or rely on a more reliable indicator for predicting stock price movements.

Our proprietary stock assessment tool, Zacks Rank, grades stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This mechanism, backed by external audits, serves as a robust gauge of a stock’s probable price performance in the near future. Consequently, employing the ABR to verify the Zacks Rank may prove advantageous in making informed investment choices.

Distinguishing Zacks Rank from ABR

Although both Zacks Rank and ABR are depicted on a 1-5 scale, each holds distinct significance.

ABR solely relies on brokerage recommendations and typically includes decimal values (e.g., 1.28). In contrast, Zacks Rank operates as a quantitative model, empowering investors to harness earnings estimate revisions and is denoted in whole numbers: from 1 to 5.

Brokerage analysts have traditionally exhibited a heightened optimism in their recommendations. This unwarranted positivity, stemming from their firms’ vested interests, often misleads rather than guides investors.

Conversely, Zacks Rank hinges on earnings estimate revisions. Empirical findings suggest a strong correlation between short-term stock price movements and trends in earnings estimate adjustments.

Moreover, the Zacks Rank distributes its various grades proportionately across all stocks subject to earnings estimates by brokerage analysts for the ongoing year, ensuring equitable representation. This symmetry is a quintessential feature of the tool.

Another pivotal disparity between ABR and Zacks Rank lies in their timeliness. While ABR may lack real-time updates, the Zacks Rank swiftly responds to earnings forecast modifications, offering investors a current perspective on future price shifts.

Assessing Netflix’s Investment Prospects

In terms of earnings estimate revisions for Netflix, the Zacks Consensus Estimate for the current fiscal year has surged by 4.2% in the past month, reaching $19.08.

An escalating optimism among analysts regarding the company’s earnings outlook, evidenced by unanimous upward revisions in EPS estimates, could propel the stock to greater heights in the imminent future.

Given the substantial consensus estimate alteration and other relevant earnings-related factors, Netflix secures a Zacks Rank #2 (Buy). For a detailed list of today’s Zacks Rank #1 (Strong Buy) stocks, please click here.

Hence, the Buy-equivalent ABR for Netflix could offer valuable guidance to investors.

Research Chief Names “Single Best Pick to Double”

Out of myriad stocks, five Zacks specialists have each designated a top contender to skyrocket by over 100% in the forthcoming months. Director of Research Sheraz Mian selects the most promising among them.

This enterprise caters to millennial and Gen Z cohorts, raking in almost $1 billion in revenue last quarter alone. Given the recent pullback, now might be an opportune moment to hop on board. While not all elite picks prevail, this particular selection could surpass previous Zacks’ Stocks Set to Double like Nano-X Imaging, which surged by +129.6% in slightly over nine months.