Nvidia Corp Faces Hurdles with Taiwan Semiconductor

Amidst the collaborative efforts between Nvidia Corp and its key supplier, Taiwan Semiconductor Manufacturing Co, the journey towards the next generation of Nvidia’s advanced artificial intelligence chips has hit a roadblock. Issues arising from production challenges have cast a shadow over the planned shipments for the current year.

Complications with New Manufacturing Process

The latest designs by Nvidia, relying on a novel manufacturing process from Taiwan Semiconductor, have encountered specific hurdles within the upcoming Blackwell family of data center chips. Sources familiar with the matter, as cited by the Financial Times, suggest that complications have emerged, potentially leading to delays in the rollout.

Market Sentiments and Financial Forecast

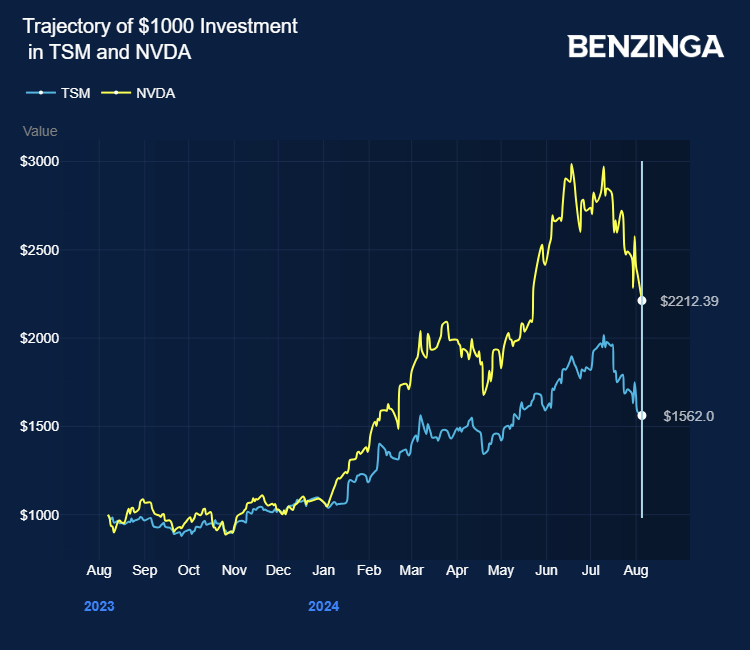

Analysts foresee a staggering $1 trillion expenditure on data centers for artificial intelligence in the upcoming five years. However, Wall Street’s concern regarding the sustainability of the AI surge has been escalating. As a significant benefactor of the AI wave, Nvidia’s market capitalization has dwindled by approximately $750 billion since mid-June.

Industry Concerns and Investor Reactions

Hedge fund Elliott Management has raised apprehensions in a recent communication with investors, as reported by the Financial Times. Moreover, the broader semiconductor sector appears jittery, especially with the United States ramping up advanced semiconductor restrictions against China.

Analytical Insights and Recommendations

Despite the tumultuous market conditions, Morgan Stanley has labeled Taiwan Semiconductor as a “top pick” following a significant selloff on Monday. The analysts highlighted the quality, defensive attributes, and appealing valuations of Taiwan Semiconductor, as highlighted by Bloomberg.

Taiwan Semiconductor’s stock has witnessed a remarkable 54% surge over the past year. Investors looking to capitalize on Taiwan Semiconductor’s potential can explore avenues through iShares Semiconductor ETF (SOXX) and First Trust NASDAQ Technology Dividend Index Fund (TDIV).

When last checked, TSM shares surged by 2.01% to $150.91 in premarket trading on Tuesday.

Disclaimer: This content was partially generated with the help of AI tools and has been reviewed and published by Benzinga editors.

Photo by Ivan Marc via Shutterstock