Intel shareholders were joyous as the semiconductor giant, INTC, witnessed a significant uptick in its stock price by over 5% during Tuesday’s afternoon trading session. The elation was sparked by the revelation of Intel’s upcoming desktop processor, Nova Lake, marking a notable departure from the initial plan of utilizing Panther Lake for desktops, reserving the latter for mobile devices. The anticipated release of these processors is slated for 2025, with potential changes looming as murmurs indicate a revamped version of Arrow Lake. Nova Lake is speculated to lean toward an artificial intelligence (AI) orientation for PCs.

The Rise of Competition

Intel’s strides in the turf of processor technology are imperative given the escalating competition in the market. A prime contender to watch is AMD, a perennial player that is now amassing a larger slice of the semiconductor market pie. Recently, AMD solidified its standing by securing the highest share ever in the server market, posing a formidable challenge to Intel’s dominance.

Although Intel is fortifying its position in the client PC sector, AMD is not lagging behind. With a substantial 3.8% year-over-year growth in the laptop market and a commendable 24.1% stake in the server market, AMD is gradually eroding Intel’s domain, capturing 5.6% of Intel’s server market share—a vivid testament to its ascendant threat.

The Analyst’s Verdict: Buy, Hold, or Sell?

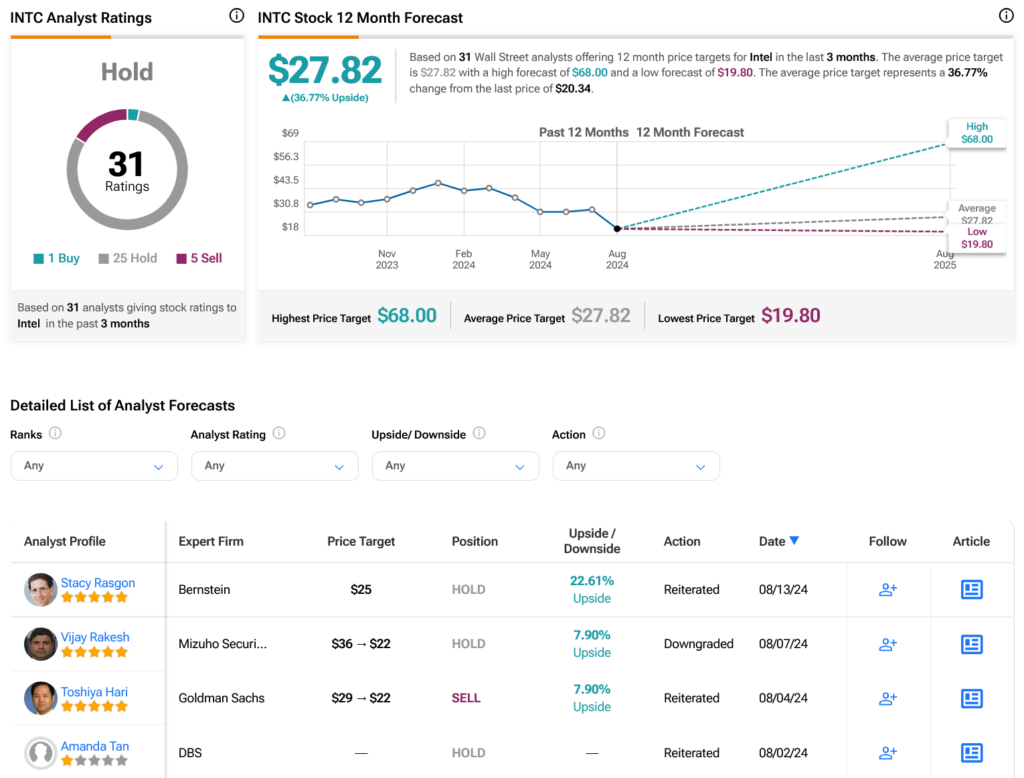

Analysts on Wall Street have arrived at a consensus Hold rating for INTC stock, reflective of one Buy, 25 Holds, and five Sells over the past quarter. Despite enduring a harsh 41.86% share price downturn in the last year, the average INTC price target stands at a promising $27.82 per share, signaling a potential upside of 36.77%.