Investors, scouring the tumultuous landscape of the health care sector, have unearthed a hidden trove of opportunity, a glimmering mirage of undervalued prowess.

As the RSI, a momentum gauge revered by traders, dips below 30, a peculiar alchemy of fortune and foresight brews. Benzinga Pro outlines the parameters for oversold assets, guiding the astute investor through these uncharted waters.

Below, a mosaic of disavowed equities beckon, their RSI whispering tales of resilience and resurgence.

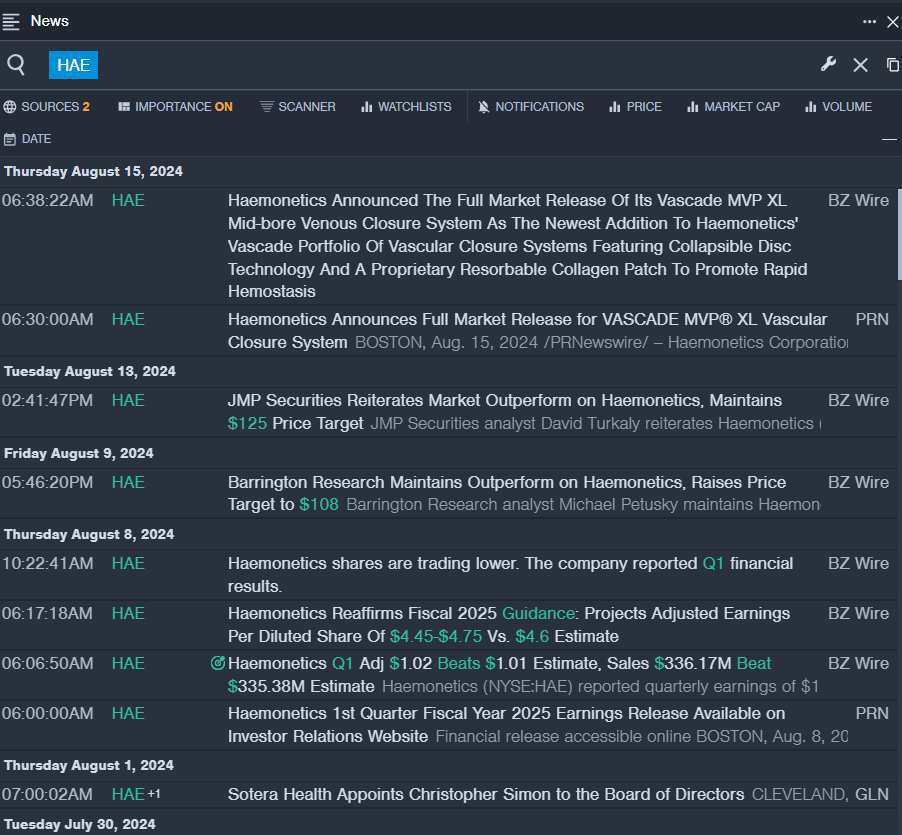

Reviving Haemonetics Corporation HAE

- On Aug. 8, Haemonetics unveiled earnings that surpassed expectations, yet the market inflicted a 19% gash on its share price in the past lunar cycle, grappling with a 52-week nadir of $70.74.

- RSI Value: 25.47

- HAE Price Action: Shares roused by 1.1%, settling at $73.99 at the bell on Thursday.

Resilient ImmunityBio Inc IBRX

- With a stunning revelation on Aug. 6, ImmunityBio unfurled the ANKTIVA study in tandem with the AdHER2DC cancer vaccine, a formidable remedy poised to challenge endometrial cancer. Despite a 38% skirmish in its valuation over the bygone month, the stock clings to a $1.25 shadow of its 52-week zenith.

- RSI Value: 29.87

- IBRX Price Action: Shares orchestrated a 2.6% ascension, closing at $3.98 as Thursday’s curtain fell.

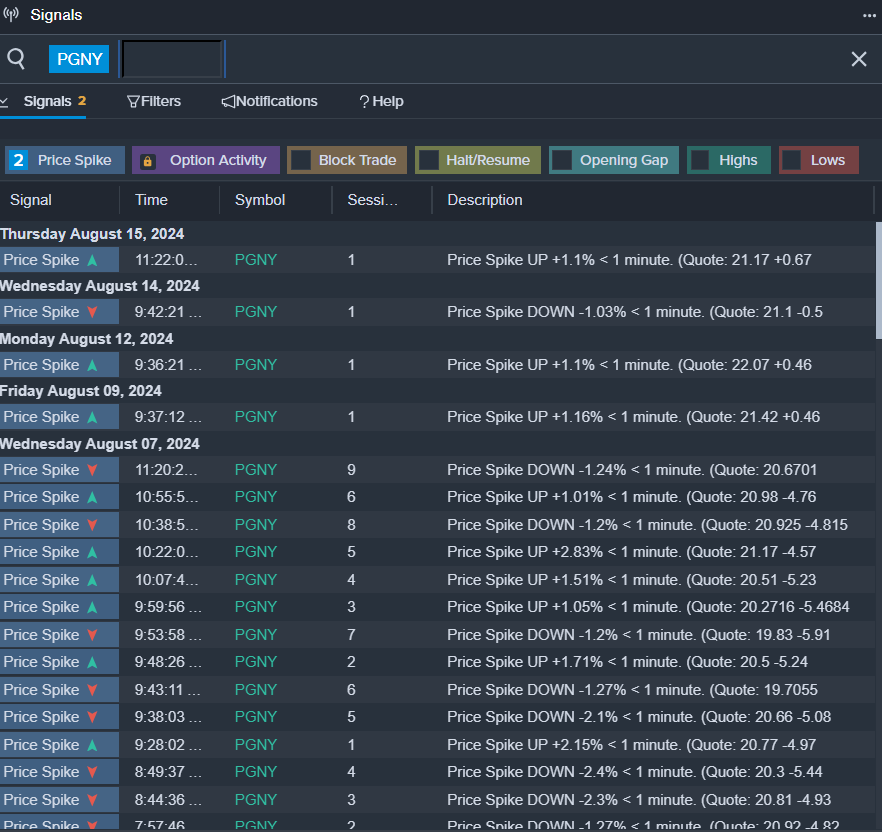

Resurgence of Progyny Inc PGNY

- Painting a Dickensian narrative on Aug. 6, Progyny lamented subpar second-quarter figures, even as Pete Anevski, the company’s helmsman, reassured investors about the resilience of their patterns. The market castigated its shares by 31% in the lunar cycle, contemplating a 52-week low of $19.60.

- RSI Value: 29.06

- PGNY Price Action: Shares staged a 1.7% reclamation, closing at $20.85 as Thursday’s anecdotes drew to a close.

Read Next: