Last week, the stock market faced a significant downturn, marked by the VIX index skyrocketing above 60 and a steep decline of over 10% in a matter of weeks. Despite this turmoil, the market’s swift rebound has taken many by surprise, resembling a phoenix rising from the ashes.

Upon reflection, the drastic selling witnessed last Monday appears to have been a singular event, triggered by the unwinding of the Japanese carry trade that led to a mass capitulation among highly leveraged traders. While stocks have swiftly recovered from last week’s lows, many gems still remain undervalued – particularly among the elite “Magnificent 7,” a group encompassing some of the largest and most outstanding performers in the market.

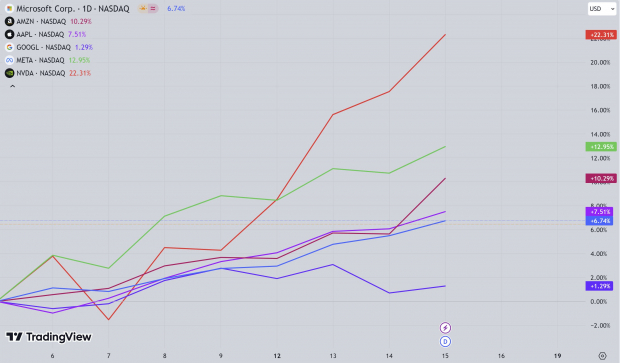

Among these, the notable trio of Nvidia (NVDA), Meta Platforms (META), and Amazon (AMZN) have exhibited remarkable gains since the market trough, suggesting they might spearhead the Mag 7 and overall market recovery.

Image Source: TradingView

The Trajectory of Stock Rally

Investing in stocks at their peak can be daunting, yet history assures us that strength often paves the way for more robust growth. However, the market’s trajectory is never linear. If you find it challenging to invest during peaks, it’s prudent to await a minor setback. Yet, when the pullback inevitably arrives, seizing the opportunity requires fortitude and decisive action.

How can investors feel assured in buying during market pullbacks? Amidst the broader economic landscape, conducive conditions are expected to persist, fostering investor confidence. The economy is exceeding expectations, exhibiting resilience through the Federal Reserve’s rate hikes, with earnings on a steady upward trajectory and anticipated lower interest rates on the horizon. These favorable conditions are forecast to bolster economic expansion, fueling corporate profitability and potentially enhancing stock valuations.

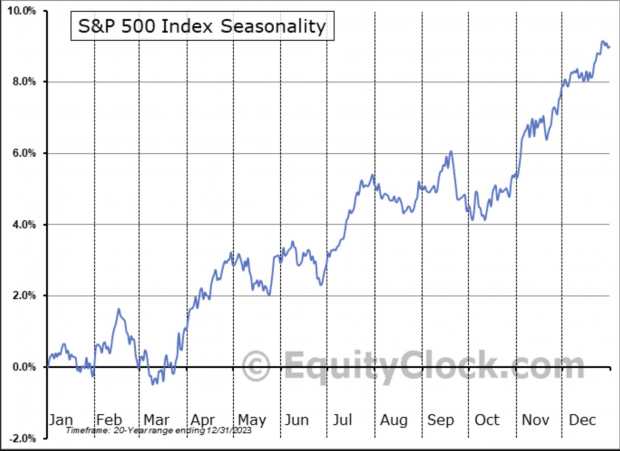

An examination of the seasonality chart hints at possible stock weakness in late September and October. Additionally, the looming US presidential election may inject added volatility, contributing to temporary market dips.

Hence, if no significant pullbacks materialize in the next couple of weeks, investors can bide their time, as future buying prospects are likely before the year concludes.

Image Source: EquityClcck

Unveiling the Robust Earnings Growth of META, AMZN, and NVDA

While the overarching market outlook remains optimistic, what places Nvidia, Amazon, and Meta Platforms in a league of their own? These global players are witnessing exponential profit growth rates, a remarkable feat given their substantial market presence.

Despite carrying a Zacks Rank #3 (Hold) designation, indicative of stagnant earnings revisions, the stellar earnings growth projections make them compelling investment candidates. Nvidia is poised for 37.6% annual EPS growth, Amazon for 27.4%, and Meta Platforms for 19% over the next three to five years. While not a direct correlation, stocks often appreciate in sync with earnings growth, hinting at significant price upticks for these industry leaders.

These companies occupy prominent positions in pivotal secular business and technology trends, driving their exceptional growth. From Artificial Intelligence to cloud computing, e-commerce, and digital communities, they spearhead high-margin, high-growth sectors.

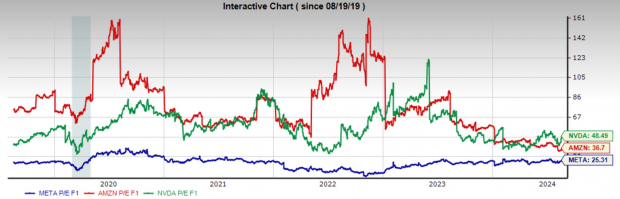

Moreover, their valuations are currently reasonable, particularly in historical context. Meta Platforms trades at 25.3x, aligned with its 10-year median, Amazon at 36.7x (well below its 10-year median of 93.6x), and Nvidia at 48.5x, slightly exceeding its 10-year median of 42.7x.

Image Source: Zacks Investment Research

Final Considerations

Despite the market’s remarkable resurgence, it remains essential to acknowledge its inherent unpredictability. While Nvidia, Amazon, and Meta Platforms continue to exhibit favorable economic and earnings growth metrics, market dynamics are non-linear. Potential pullbacks, especially influenced by seasonal patterns and impending elections, should be viewed as strategic opportunities for prudent investors to enter or increase holdings in top-tier stocks. Emphasize risk management and ensure your investments align with long-term goals, as market forces operate independently of expectations.