When we think of automotive innovation, the illustrious name of Tesla swiftly comes to mind. With cutting-edge advancements in self-driving technology and other features, Tesla has solidified its position in the industry. While some reports may suggest Tesla’s cameras possess almost supernatural capabilities, debates have downplayed such claims. Yet, recent signals indicate Tesla is encountering technological setbacks in China, a circumstance that surprisingly benefits its shares, soaring over 2% in Monday’s afternoon trading session.

According to The Wall Street Journal, Tesla boasts several advanced features, but in China, most of them remain inactive, at least for now. Tesla aims to activate Full Self-Driving in China, enabling a Tesla vehicle to navigate from one point to another autonomously, with minimal human intervention.

Unfortunately, Chinese regulators have refrained from endorsing this feature within their jurisdiction, citing apprehensions related to accidents and data security. Furthermore, Tesla awaits approval to transmit data generated in China back to the United States for refining artificial intelligence models essential for self-driving. Consequently, this inability to harness its technology to its full potential is inadvertently causing Tesla to lag behind its competitors.

The Unusual Affinity of Chechen Republic for Tesla

In a rather eccentric turn of events, a recent report divulged a peculiar admiration for Tesla and its CEO Elon Musk in the Chechen Republic. The President of the republic, Ramzan Kadyrov, garnered attention after featuring in a video where he was seen driving a Cybertruck equipped with a mounted machine gun on its roof.

Kadyrov extended an invitation to Musk to visit the region as his most esteemed guest, lauding Musk as “the strongest genius of our time,” and a remarkable specialist. Expressing his gratitude, Kadyrov declared intentions to donate the gun-fitted Cybertruck to the Russian military for their operation in the Russia-Ukraine conflict.

Investor Sentiment on Tesla’s Market Position

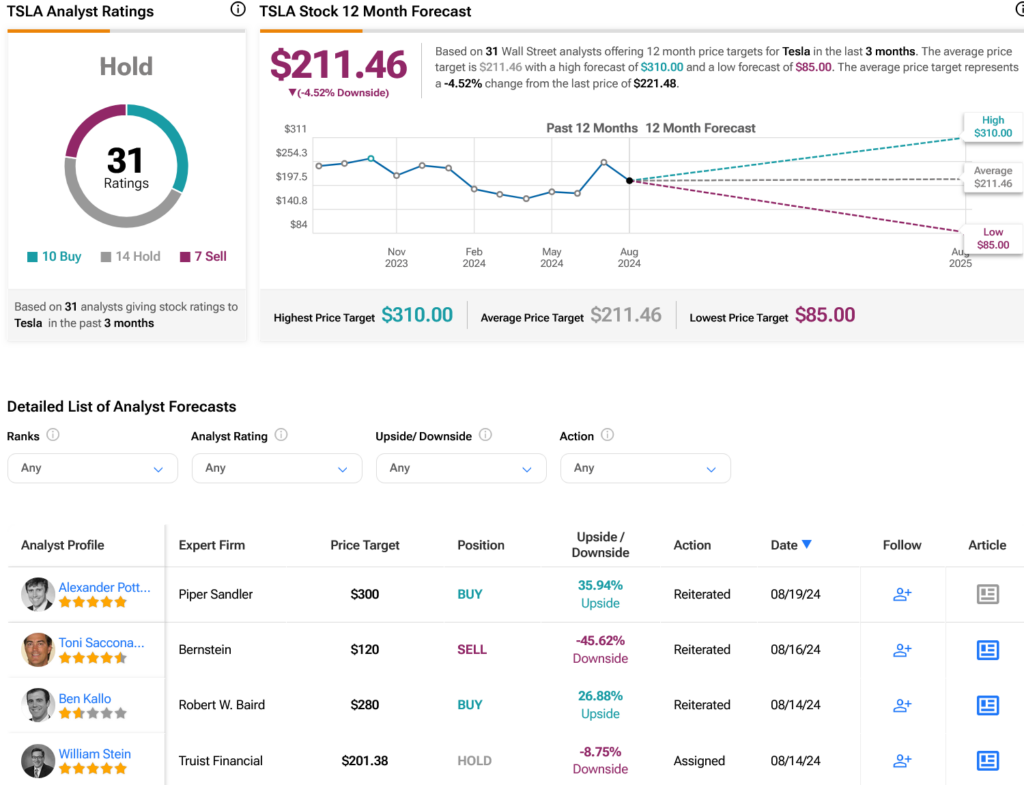

As per Wall Street analysts, a Hold consensus rating is currently assigned to TSLA stock, with 10 Buys, 14 Holds, and seven Sells recorded over the past three months. Despite a 4.58% decline in its share price over the previous year, the average TSLA price target of $211.46 per share indicates a potential 4.52% downside risk.