Investors treaded cautiously through the week’s opening days, only to witness a surprising shift on Friday afternoon triggered by an optimistic stance put forth by US Federal Reserve Chair Jerome Powell.

In a momentous speech delivered in Jackson Hole, Powell hinted at the readiness of the Fed to commence interest rate cuts.

The crypto markets mirrored this optimism, breaking free from a stagnant pricing gridlock that had persisted for several weeks. In parallel, Waymo unveiled a new iteration of its self-driving technology, adding yet another feather to its cap in a series of recent victories.

Stay abreast of the latest industry happenings with the Investing News Network’s tech round-up.

1. Market Resurgence in Anticipation of Rate Cuts

The week kicked off on a shaky note for the stock markets, witnessing the S&P 500 (INDEXSP:.INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC) opening lower on Monday (August 19) relative to the previous week’s close. However, market dynamics swiftly turned, leading to the eighth consecutive day of wins for these indices, alongside the S&P/TSX Composite Index (INDEXTSI:OSPTX).

On the same day, the Russell 2000 Index (INDEXRUSSELL:RUT) posted gains of 1.1 percent, marking a notable upward trajectory.

Tuesday (August 20) saw a tentative start for major indexes as investors awaited fresh inflation data. By Wednesday (August 21), the release of US non-farm payroll benchmark revisions and minutes from July’s Fed meeting took center stage. Insights from the Bureau of Labor Statistics indicated a revision in job growth figures between March 2023 and March 2024, pointing to a slightly lower performance than anticipated.

The divulgence of the Fed meeting minutes outlined policymakers’ contemplation of a quarter percentage point rate cut in response to dwindling inflation and escalating unemployment rates. This revelation bolstered expectations of an impending rate cut in September, fueling market optimism. The Russell 2000 spearheaded this upward momentum, gaining over 1 percentage point to culminate at 2,170.32.

Thursday’s (August 22) dawn continued the trend, witnessing all major indexes, except the S&P/TSX Composite index, opening above the preceding day’s close. Economic indicators suggested a weakening US manufacturing PMI, plummeting to 48 in August from 49.6 in July, falling short of initial projections. Concurrently, initial jobless claims experienced a marginal uptick in the week ended August 17 compared to the previous week, rising by 4,000 to 232,000.

2. Nvidia’s Performance Insights

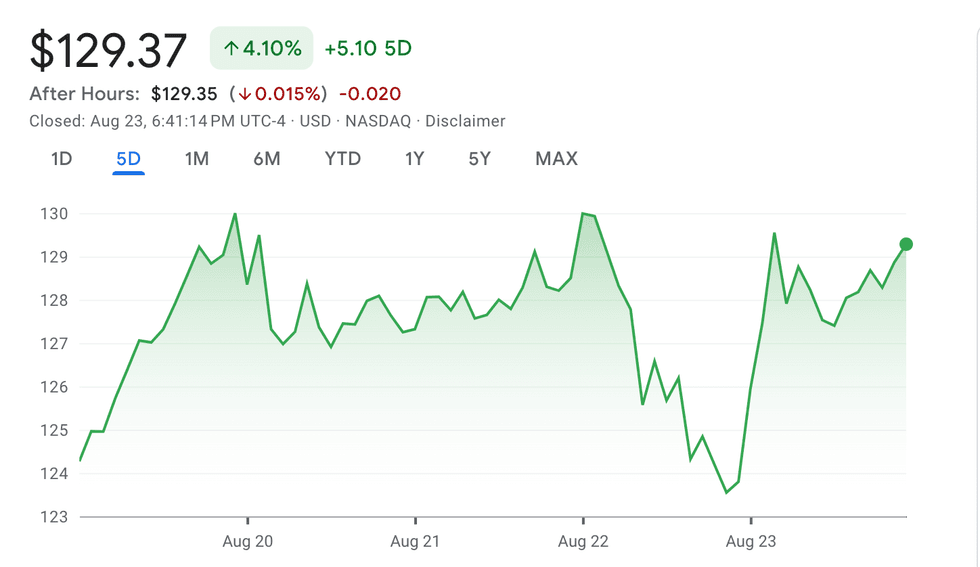

Chart courtesy of Google Finance.

Insights into NVIDIA’s performance from August 19 to August 23, 2024.

The market experienced a midday retreat on Thursday, spearheaded by the