Rivalry Impacting Stock Performance

Lyft, Inc. stock faces a downturn as Uber Technologies, Inc. extends its collaboration with Waymo, transitioning from Alphabet Inc.‘s Google Self-Driving Car Project.

Uber and Waymo plan to introduce autonomous ride-hailing services in Austin and Atlanta using Jaguar I-PACE vehicles by 2025, accessible through the Uber app.

Uber’s expansion beyond traditional ride-hailing to include food delivery, freight, and same-day delivery services has redefined its market presence.

Financial Performance Comparison

In the second quarter of 2024, Uber reported a 16% increase in revenue, totaling $10.70 billion, surpassing analyst predictions. Notably, Mobility revenue surged by 25% to $6.13 billion, with Delivery at $3.29 billion and Freight at $1.27 billion.

Uber observed a 21% rise in trips, reaching 2.8 billion, indicating a positive trend in ride demand following pandemic recovery.

Conversely, Lyft announced a 1% workforce reduction and plans to divest assets related to bike and scooter operations to optimize operational expenses.

Operational Adjustments and Growth Metrics

As of December 31, 2023, Lyft employed 2,945 individuals, down from 1072 employees laid off in April 2023. Second-quarter sales for Lyft rose by 41% to $1.44 billion, exceeding analyst expectations, with a 15% year-over-year increase in rides to 205 million.

Market Performance and Future Prospects

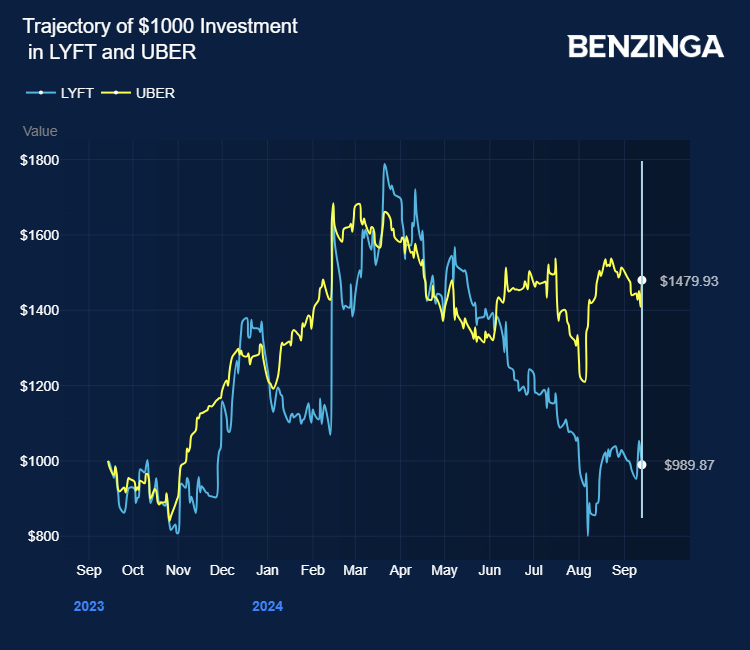

Uber stock has surged by 49% within the past year, contrasting Lyft’s 0.18% decline. Investors seeking exposure to both companies can explore options like the Vanguard Total Stock Market ETF (VTI) and the iShares Russell 1000 Growth ETF (IWF).

Price Action: LYFT stock is currently trading down by 4.68% at $11.08 as of the latest check on Friday.

Photo Courtesy Lyft