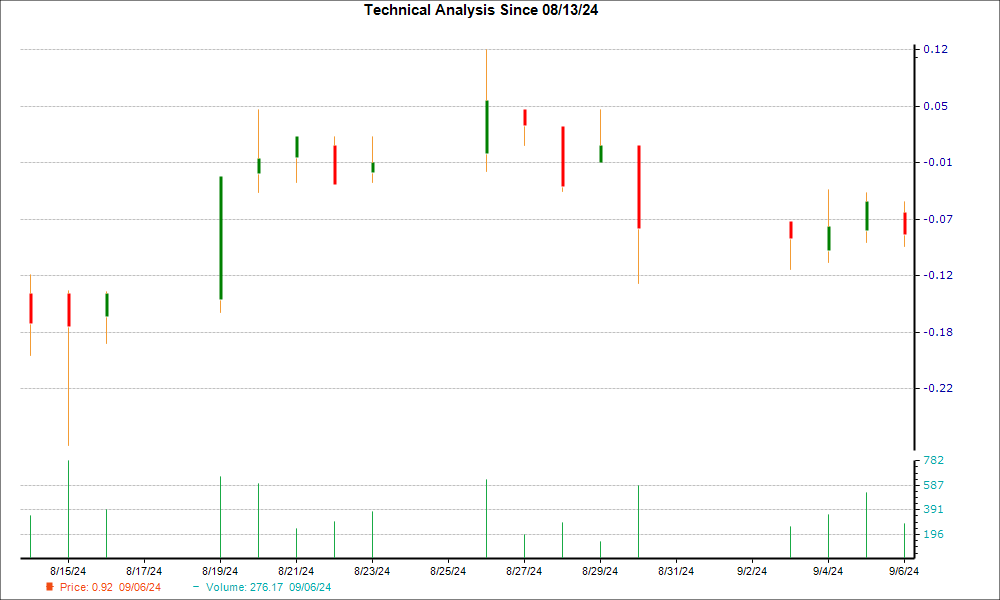

Recently, Canaan’s stock price trajectory has depicted a bearish trend, witnessing an 8.1% decline over the past fortnight. Nevertheless, the emergence of a hammer chart pattern during its latest trading session suggests a possible impending trend reversal. The presence of this pattern implies that the stock may soon find a bottom, indicating a shift in control towards the bulls who are poised to provide support.

While the hammer pattern hints at approaching stabilization amidst waning selling pressure, a growing optimism among analysts on Wall Street regarding the future earnings of this cryptocurrency-mining computer manufacturer serves as a robust fundamental factor augmenting the likelihood of a reversal in the stock’s trend.

Understanding the Hammer Chart Pattern and Its Trading Implications

One of the key price patterns in candlestick charting, the hammer pattern is characterized by a minor disparity between the opening and closing prices, resulting in a small candle body. Additionally, a notable variation between the daily low and the opening or closing price manifests as a long lower wick (or vertical line). With the length of the lower wick typically exceeding twice the real body’s length, the candle displays a resemblance to a ‘hammer.’

Essentially, amid a downtrend dominated by bears, a stock typically opens lower than the prior day’s close and concludes at a lower point as well. However, on the day the hammer pattern materializes, continuing the downtrend, the stock plunges to a new low. Subsequently, encountering support at the daily low, a surge in buying interest emerges, propelling the stock up to conclude the session near or slightly above its opening price.

Concurrently, the occurrence of this pattern at the downtrend’s base signals a potential erosion of bearish control over the price. The successful intervention by bulls to avert further price decline hints at a probable reversal in the prevailing trend. Hammer candles can manifest across various timeframes, including one-minute, daily, and weekly charts, appealing to both short-term traders and long-term investors.

Despite its utility as a technical indicator, the hammer chart pattern exhibits limitations. Notably, the effectiveness of a hammer hinges on its positioning on the chart, necessitating its utilization alongside other bullish indicators for informed decision-making.

Factors Amplifying the Potential for CAN’s Trend Reversal

Significantly, a recent uptrend in earnings estimate revisions for CAN serves as a bullish fundamental indicator. Positive alterations in earnings estimates typically pave the way for near-term price appreciation.

Within the last 30 days, the consensus EPS estimate for the ongoing year has surged by 33.3%. Essentially, this upswing denotes a consensus among sell-side analysts tracking CAN, foreseeing improved earnings compared to their previous projections.

Moreover, CAN presently holds a Zacks Rank #2 (Buy), positioning it among the top 20% of over 4,000 stocks evaluated based on trends in earnings estimate revisions and EPS surpasses. Notably, stocks with Zacks Rank #1 or 2 tend to outperform the broader market.

Furthermore, the Zacks Rank has demonstrated its efficacy as a potent timing indicator, aiding investors in pinpointing moments when a company’s prospects start turning favorable. Consequently, for Canaan’s shares, a Zacks Rank of 2 signifies a robust fundamental cue indicative of a potential turnaround.