When considering purchasing, selling, or persisting with a stock, investors frequently turn to analyst suggestions. Media buzz about rating variations by these finance-firm-based (or sell-side) analysts can influence a stock’s value, but is this information truly significant?

Prior to delving into the dependability of brokerage recommendations and leveraging them to your benefit, let’s explore what these heavyweights on Wall Street think about Superior Group (SGC).

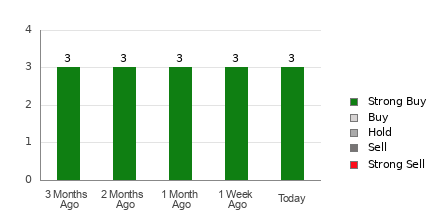

Superior Group currently boasts an average brokerage recommendation (ABR) of 1.00, on a scale of 1 to 5 (Strong Buy to Strong Sell), gauged from the real recommendations (Buy, Hold, Sell, etc.) made by three brokerage firms. With an ABR of 1.00, the stock is deemed a Strong Buy.

Out of the three recommendations contributing to the current ABR, all three are Strong Buy, encompassing 100% of all recommendations.

Understanding Brokerage Recommendation Trends for SGC

The ABR proposes acquiring Superior Group, but relying solely on this data might not be prudent. Numerous studies have indicated that brokerage recommendations have minimal success in directing investors towards stocks with significant potential for price appreciation.

Curious as to why? The vested interest brokerage firms have in a stock often results in a notably positive bias among their analysts when rating it. Our findings reveal that for every “Strong Sell” recommendation, brokerage firms bestow five “Strong Buy” recommendations.

Consequently, the aims of these institutions don’t always align with those of retail investors, offering scarce foresight into the trajectory of a stock’s future price movements. Hence, it’s advisable to utilize this information to corroborate your own analysis or a tool proven effective in forecasting stock price shifts.

Zacks Rank, our exclusive stock rating tool with a commendable externally verified track record, segregates stocks into five categories, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), acting as a reliable indicator of a stock’s near-future price performance. Consequently, validating the ABR through the Zacks Rank might guide you towards a profitable investment resolution.

Clarifying Zacks Rank vs. ABR

Despite both Zacks Rank and ABR scaling from 1 to 5, they serve distinct purposes.

Brokerage recommendations solely underpin the ABR calculation, frequently exhibited in decimals (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model designed to leverage earnings estimate revisions, depicted as whole numbers from 1 to 5.

Historically, analysts at brokerage firms have persisted in an overly optimistic stance with their recommendations. Because these ratings tend to be more favorable than warranted by their research due to their employers’ vested interests, they mislead investors more often than guiding them.

Conversely, earnings estimate revisions form the basis of the Zacks Rank, with empirical evidence showcasing a robust correlation between trends in such revisions and short-term stock price movements.

Another notable distinction between ABR and Zacks Rank is timeliness. The ABR might not be up-to-date, whereas Zacks Rank swiftly reflects changes as analysts adjust their earnings estimates to reflect a company’s evolving business landscape, rendering it consistently timely in predicting future price movements.

Contemplating Investment in SGC

Considering the earnings estimate revisions for Superior Group, the Zacks Consensus Estimate for the ongoing year has declined by 1.3% in the past month to $0.74.

An evident increase in analysts’ pessimism regarding the company’s earnings potential, exemplified by significant consensus in downward revisions of EPS estimates, could warrant a potential decline in the stock’s value in the near future.

The recent consensus estimate shift, coupled with three additional factors tied to earnings estimates, culminated in a Zacks Rank #4 (Sell) for Superior Group.

Evaluating all factors, it might be judicious to approach Superior Group with caution, especially given the equivocal signals from the Buy-equivalent ABR.

7 Best Stocks for the Next 30 Days

Just unveiled: Specialists distill 7 premier stocks from the current roster of 220 Zacks Rank #1 Strong Buys. These tickers are designated as “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market by over 2 times, averaging an annual gain of +23.7%. Hence, prioritize these 7 hand-picked stocks for immediate consideration.

Want fresh insights from Zacks Investment Research? Download the latest report highlighting 5 Stocks Set to Double.

Superior Group of Companies, Inc. (SGC) : Free Stock Analysis Report