Amidst the tumult of the health care market, opportunities arise to seize undervalued stocks.

Examining the Relative Strength Index (RSI) unveils a stock’s momentum, aiding in predicting short-term performance. When the RSI dips below 30, a stock is deemed oversold, as per market experts.

Here’s a rundown of notable, oversold contenders in the health care sector:

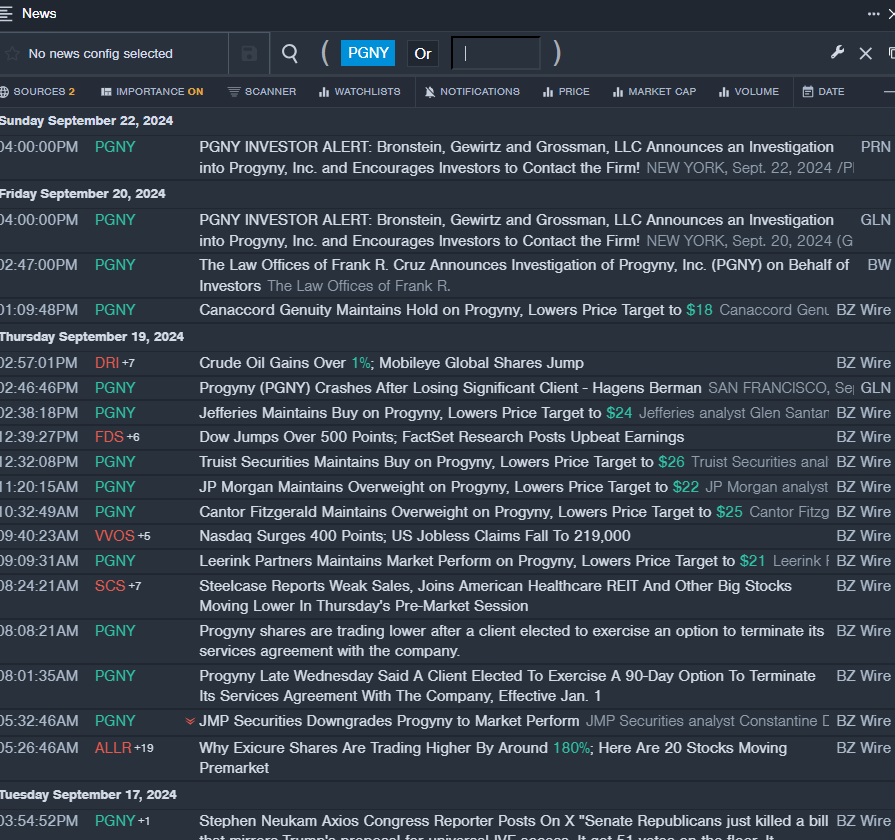

Progyny Inc

- Reports on Sept. 19 detailed a client opting to sever ties with Progyny. This news precipitated a 32% decline in the company’s stock over five days, hitting a 52-week low of $13.93.

- RSI Value: 26.50

- PGNY Price Action: Progyny’s shares inched up by 1% to close at $16.62 on Friday.

Indivior PLC

- On Sept. 4, Indivior unveiled updates on Aelis Farma’s Phase 2B study related to cannabis use disorder. The stock hit a 52-week low of $9.14.

- RSI Value: 25.92

- INDV Price Action: Indivior shares slipped by 2.1% to settle at $9.48 on Friday.

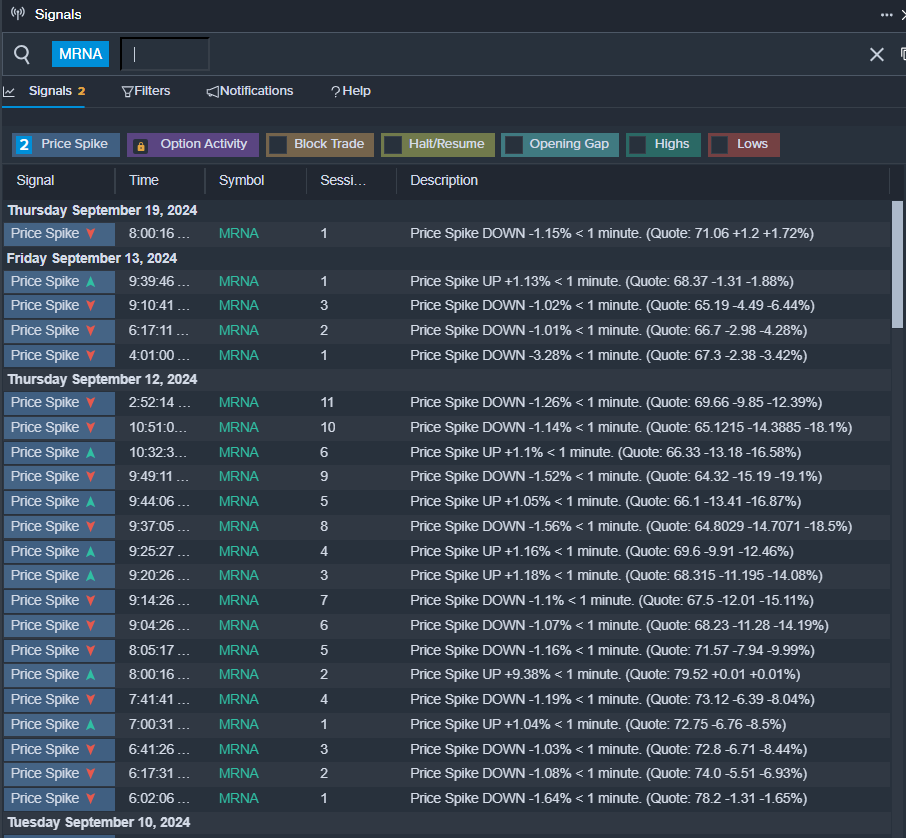

Moderna Inc

- Moderna made waves on Sept. 17, as Health Canada greenlit its SPIKEVAX vaccine against COVID-19, primarily targeting the KP.2 variant. The company plans to distribute the vaccine promptly. Dr. Shehzad Iqbal, Moderna Canada’s country medical director, emphasized the importance of vaccination amidst escalating COVID-19 cases. Throughout the last month, Moderna’s shares decreased by 20%, reaching a 52-week low of $62.55.

- RSI Value: 28.17

- MRNA Price Action: Moderna shares dipped by 3.4% to close at $65.69 on Friday.

Will these health care stocks bounce back from their recent lows, or is there more turbulence ahead? Only time will tell in the unpredictable world of stock markets.

Market News and Data brought to you by Benzinga APIs