JPMorgan Chase (NYSE: JPM), the behemoth of American banking with its colossal assets, recently tantalized investors with a delightful 9% increase in its third-quarter payout – a dividend bonanza worth $1.25. Known for their robust dividend yields, banks like JPMorgan Chase are a seasoned favorite among dividend-seeking investors, thanks to their consistent payouts and financial prowess. Over the past decade, JPMorgan Chase has not only held its ground but surged, growing its dividend exponentially.

Is JPMorgan Chase a treasure trove of a dividend stock? Let’s delve into the depths and explore.

A Blossoming Dividend

JPMorgan’s quarterly $1.25 dividend translates to a sumptuous annual feast of $5. At the time of declaration, with share prices soaring near their zenith on Sept. 23, the dividend yield stood at a respectable 2.37%.

Although a 2.37% yield is decent, the ideal scenario for dividend aficionados typically involves a 3% yield or higher. Yet, given JPMorgan’s robust profitability and its consistent dividend growth, there’s a promising glimmer on the horizon – a possible ascent to that coveted 3% threshold in the foreseeable future.

Since its inception in 2000, JPMorgan Chase has unfailingly doled out dividends every year, weathering the storm of the 2009 and 2010 slashes that plagued the banking industry post-Great Recession. Emerging from the ashes of a mere $0.20 in 2010, JPMorgan’s dividend now stands proudly projected at $5 annually.

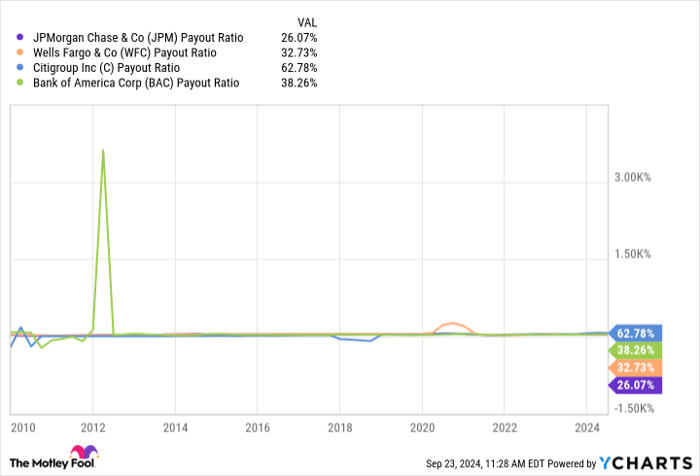

The payout ratio serves as a compass when charting a bank’s dividend growth prospects. JPMorgan shines with the lowest payout ratio among its peers at a modest 26%, a favorable range for banks, typically falling within the 30% to 40% spectrum.

Source: JPM payout ratio; data by YCharts.

When assessing a dividend’s allure, a peek into a bank’s earnings and surplus capital for distribution is insightful. Based on projections from Visible Alpha, a financial analysis platform, operating earnings per diluted share display a decrease of 8 cents in the upcoming year, poised for a robust rebound in 2026 and 2027.

With a common equity tier 1 (CET1) capital ratio of 15.3%, JPMorgan flaunts a sturdy financial foundation. The CET1 metric gauges a bank’s core capital against risk-weighted assets like loans, with this surplus capital serving as a buffer for loans, dividends, and share buybacks.

Regulators mandate annual CET1 requirements for major U.S. banks, setting JPMorgan’s 2025 threshold at 12.3%. With a surplus exceeding $53 billion in risk-weighted assets, JPMorgan waltzes comfortably in the realm of excess capital.

Nurturing the Dividend Gem

Forecasting JPMorgan Chase’s trajectory, it seems destined to burgeon its dividend, perchance surpassing the coveted 3% yield threshold. Blessed with bountiful excess capital and robust earnings, the bank stands poised for a rewarding journey ahead. However, as the stock basks in its current richness, pricy valuations may dim the allure of share repurchases.

JPMorgan Chase’s prudent aim would be to align its payout ratio within the 30% to 40% corridor, blending harmoniously with its peers. In my view, this financial giant shines brightly as a beacon of a dividend stock. While not the pinnacle of yield, JPMorgan guarantees a steady dividend flow with ample room for prosperity.

Insights on Investing: JPMorgan Chase Edition

Prior to diving into JPMorgan Chase’s stock pool, reflect on this:

The Motley Fool Stock Advisor‘s keen analysts unearthed what they project as the 10 best stocks for aspiring investors, a realm where JPMorgan Chase did not take center stage. The chosen 10 stocks are poised to sculpt monumental returns in the coming years.

Imagine a tale akin to Nvidia’s ascension back on April 15, 2005… If you sowed $1,000 in the soil of our recommendation, behold a cornucopia of $756,882!

Stock Advisor crafts a roadmap for investors, offering a blueprint for success through portfolio construction, analyst insights, and two fresh stock picks each month. This service has outshone the S&P 500 by a staggering fourfold since its inception in 2002*.

*Stock Advisor returns as of September 23, 2024