Fission Uranium FCUUF has concluded its proceedings before the Supreme Court of British Columbia regarding the endorsement of the final order for its acquisition by Paladin Energy Limited. The hearings, commencing on Sept. 13, 2024, and wrapping up on Sept. 26, now await the anticipated ruling from the Court in the imminent weeks.

Despite Fission’s affirmation of the acquisition by Paladin Energy, opposing currents run strong, as CGN Mining Company Limited (“CGN”) holds an 11.26% position in Fission, casting a shadow of dissent. CGN operates under the aegis of China General Nuclear Power Corp.

The affirmative vote from Fission’s stockholders during the special session on Sept. 9, 2024, is at odds with the acquisition pending the reception of the final order, clearance under the Investment Canada Act, and fulfillment of other customary prerequisites.

Fission Uranium-Paladin Energy Merger Unveiled

Fission Uranium sealed the deal with Australian counterpart Paladin Energy in June 2024. In this agreement, Paladin Energy is set to procure FCUUF’s outstanding equities, equating to a calculated total equity valuation of C$1.14 billion ($0.846 billion).

The successful merger heralds the genesis of a new entity with a pro forma market capitalization of $3.5 billion, positioning it among the realm of prominent global uranium entities boasting a combined mineral resource of 544 million pounds of uranium and ore reserves of 157 million. Furthermore, the amalgamated company will house a robust compilation of exploration, development, and production assets along with an expansive international capital markets exposure.

Upon completion, existing shareholders of Paladin Energy and Fission Uranium will inherit approximately 76% and 24%, respectively, of the coalesced entity. Paladin Energy has duly filed for the listing of its shares on the Toronto Stock Exchange in unison with the closing of the transaction, ensuring Fission Uranium shareholders a bountiful allocation of TSX-listed Paladin Energy shares.

FCUUF Acquisition: Enhancing Paladin Energy’s Uranium Poise

Paladin Energy emerges as a standalone uranium producer with a substantial 75% stake in the prestigious Langer Heinrich Mine, a long-term, world-renowned asset set in Namibia. Complementing this jewel, Paladin Energy further occupies a substantial collection of uranium exploration and development assets spanning across Canadian and Australian domains, thereby proficiently distributing uranium to major global nuclear utilities via its Langer Heinrich Mine with an estimated 17-year mining tenure and a nominal annual capacity rate of 6 million pounds of uranium.

The acquisition pact with Fission Uranium will empower Paladin Energy to flourish as the sole proprietor of the Patterson Lake South uranium property, touted as a forthcoming high-grade uranium mine and mill nestled within Canada’s Athabasca Basin region. Various financial estimates offer a depiction of a 10-year mine cycle geared to produce 9.1 million pounds of uranium annually.

This strategic maneuver stands as a testament to Paladin Energy’s foresight in seizing the burgeoning demand for uranium, catalyzed by several factors such as heightened electricity requisites and the global impetus towards greening the electrical grids, among others.

In recent epochs, the global uranium milieu has transitioned from being inventory-dominated to increase production-oriented. The dearth in investments towards uranium mining over the past decade has steered a structural imbalance between global production and uranium necessities. The forthcoming years 2024 and 2025 portend a vacuum exceeding 66 million pounds of uranium between production and demand. Extrapolating this trend, the gulf is envisioned to burgeon to over 400 million pounds by 2034. Consequently, uranium valuations shall remain lifted owing to robust demand and constrained supplies.

Fission Uranium’s Stock Performance Benchmark

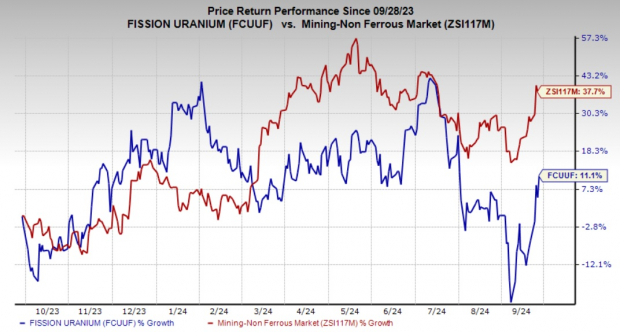

Fission Uranium’s shares have soared by 11.1% over the last year, juxtaposed against the industry’s uptick of 37.7%.

Image Source: Zacks Investment Research

FCCUF’s Zacks Rank & Select Stocks Advice

Presently, Fission Uranium is standing at a Zacks Rank #3 (Hold).

Embarking on a different path, here are a few noteworthy gems from the basic materials sector – Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO, and IAMGOLD Corporation IAG. Each of these entities flaunt a Zacks Rank #1 (Strong Buy) at the moment.

The consensus perusal for Carpenter Technology’s fiscal 2025 earnings hovers around $6.06 per share. The earnings forecast has undergone a northward shift of 17% within the last 60 days, while the firm boasts an average trailing four-quarter earnings revelation of 15.9%. CRS’ market performance reflects an astounding 129% appreciation over a year.

For Eldorado Gold’s 2024 earnings, the consensus stands at $1.32 per share. Earnings estimates have inclined by 16% in the past 60 days, harmonizing with an impressive average trailing four-quarter earnings return of 430%. EGO’s stocks have soared by 106% in a year’s timespan.

Delving into IAMGOLD’s fiscal prospects for 2024, the forecast aligns at 39 cents per share. Recent estimations indicate a 44% surge in earnings prediction over the preceding 60 days, coupling with an admirable average trailing four-quarter earnings leap of 200%. IAG’s shares have experined a bullish spike of 160% over the course of a year.

Refined insights and market trends on stock analysis available here.