Netflix, the mighty streaming giant known for dominating the entertainment landscape, recently encountered turbulent waters. Co-founder Reed Hastings’ public endorsement of Kamala Harris for the presidency resulted in an unforeseen backlash – a surge in subscription cancellations.

The shockwaves were so intense that media outlets dubbed it the “single worst day for cancellations this year.” This blow hit Netflix hard, especially coming on the heels of a summer plagued by dwindling subscriptions after its decision to retire the basic service tier.

To add salt to the wound, Hastings made another politically charged move by pledging $7 million to The Republican Accountability PAC, a donation that irked many subscribers. The fallout was instantaneous; disgruntled viewers swiftly took to social media platforms to express their discontent with Hastings’ political stance.

A Legal Labyrinth: Netflix’s Battle Over “Baby Reindeer”

As if the political storm wasn’t enough, Netflix found itself embroiled in a legal entanglement linked to one of its hit shows, “Baby Reindeer.” A judge ruled against Netflix in a case involving potential defamation of Fiona Harvey, the real-world persona behind a character depicted in the series.

The court highlighted Netflix’s misleading use of the phrase “based on a true story” in “Baby Reindeer,” ultimately condemning the company for its reckless disregard of the truth. The ruling added to Netflix’s mounting challenges.

The Investor Conundrum: Should You Buy Netflix Stock?

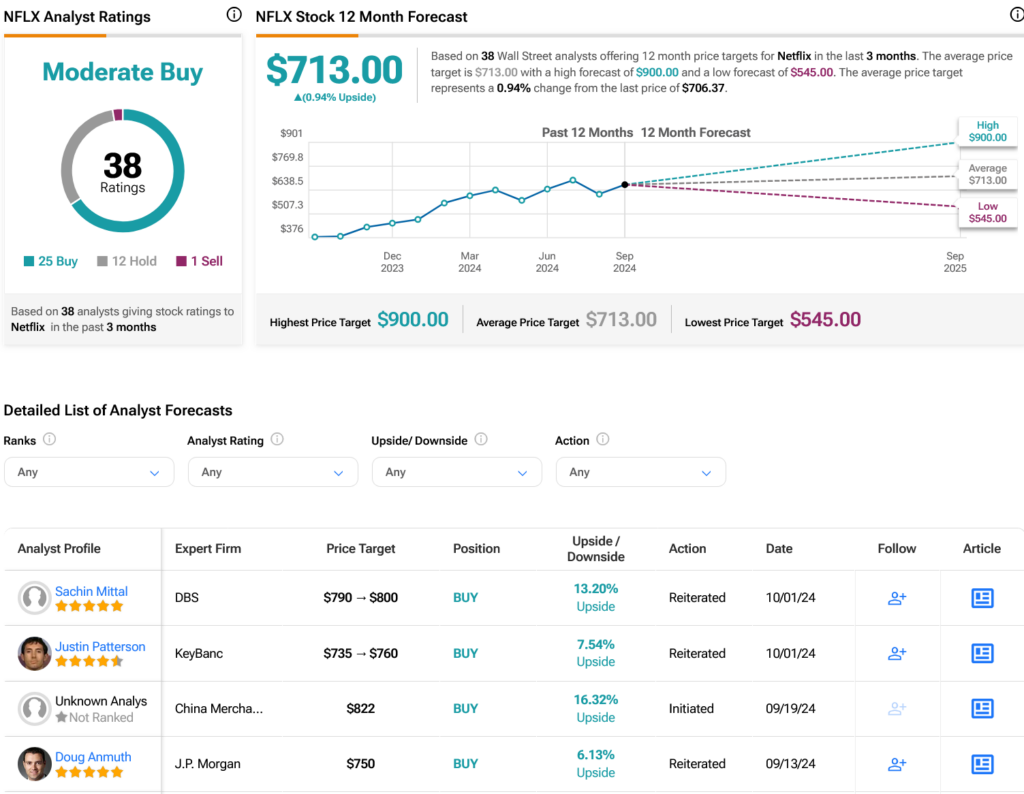

Shifting gears to Wall Street, analysts have bestowed a Moderate Buy consensus rating on NFLX stock. Recent data revealed a mix of 25 Buy, 12 Hold, and one Sell recommendations over the past three months. Despite a remarkable 85.81% surge in its share price over the last year, the average NFLX price target stands at $713 per share, signaling a modest 0.94% upside potential.