Seizing Undervalued Gems Amidst Market Turbulence

Investors often relish the hunt for bargains, seeking out the hidden gems that emerge amidst tumultuous market conditions.

One key indicator that savvy traders utilize is the Relative Strength Index (RSI), a tool that discerns the strength of a stock on upward versus downward price days. When the RSI dips below 30, stocks are perceived as oversold, heralding a potential buying opportunity for astute market players.

Let’s delve into the realm of consumer stocks that have recently caught the attention of discerning investors with their RSI hovering near or below this critical threshold.

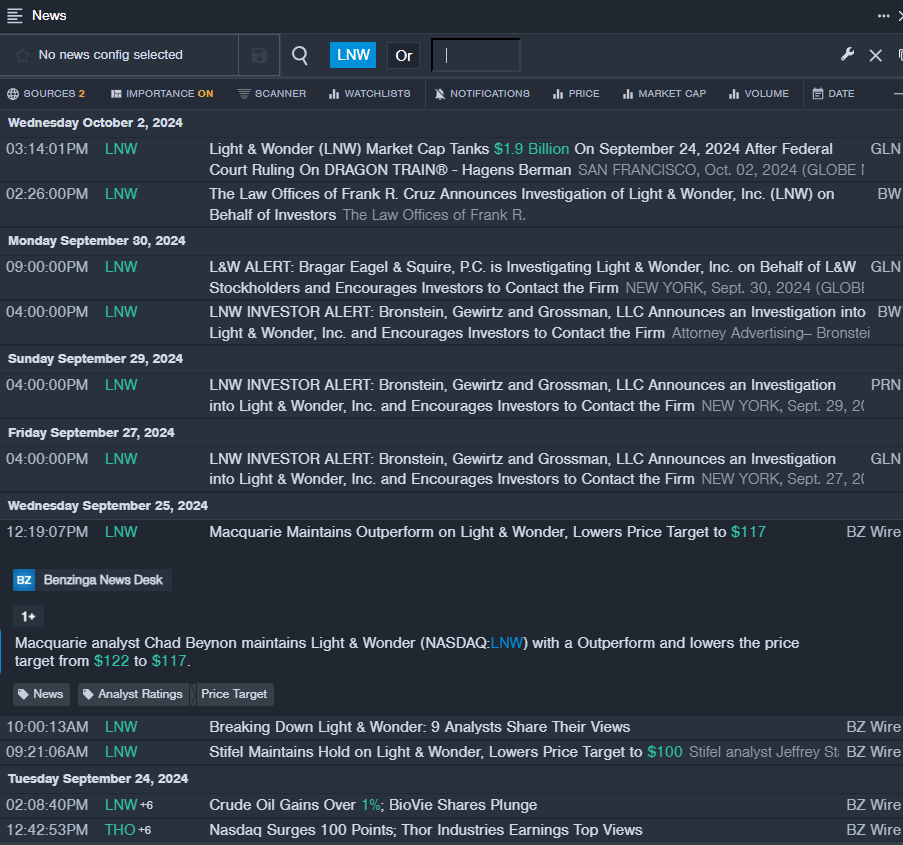

Light & Wonder Inc (LNW)

- Light & Wonder recently faced a downturn, prompting Macquarie analyst Chad Beynon to affirm an Outperform rating while adjusting the price target from $122 to $117. With the stock plummeting approximately 19% in the last month and hitting a 52-week low of $67.71, it presents an intriguing prospect for bargain hunters.

- RSI Value: 26.57

- LNW Price Action: Despite a modest 0.2% decline, Light & Wonder closed at $87.74 on Wednesday, drawing attention from traders keen on spotting potential recovery.

- Real-time insights from Benzinga Pro have been instrumental in keeping investors abreast of the latest developments surrounding LNW.

Makemytrip Ltd (MMYT)

- A recent analysis by B of A Securities saw Sachin Salgaonkar maintaining MakeMyTrip with a Buy rating, upping the price target from $100 to $112. The stock’s sharp 18% decline over the past five days emphasizes the potential for a rebound, especially considering its 52-week low of $36.81.

- RSI Value: 29.31

- MMYT Price Action: Makemytrip endured a 5.2% dip to settle at $86.91 on Wednesday, enticing traders looking to capitalize on imminent price shifts.

- Benzinga Pro’s sophisticated charting tools have proven invaluable in isolating trends within MMYT stock.

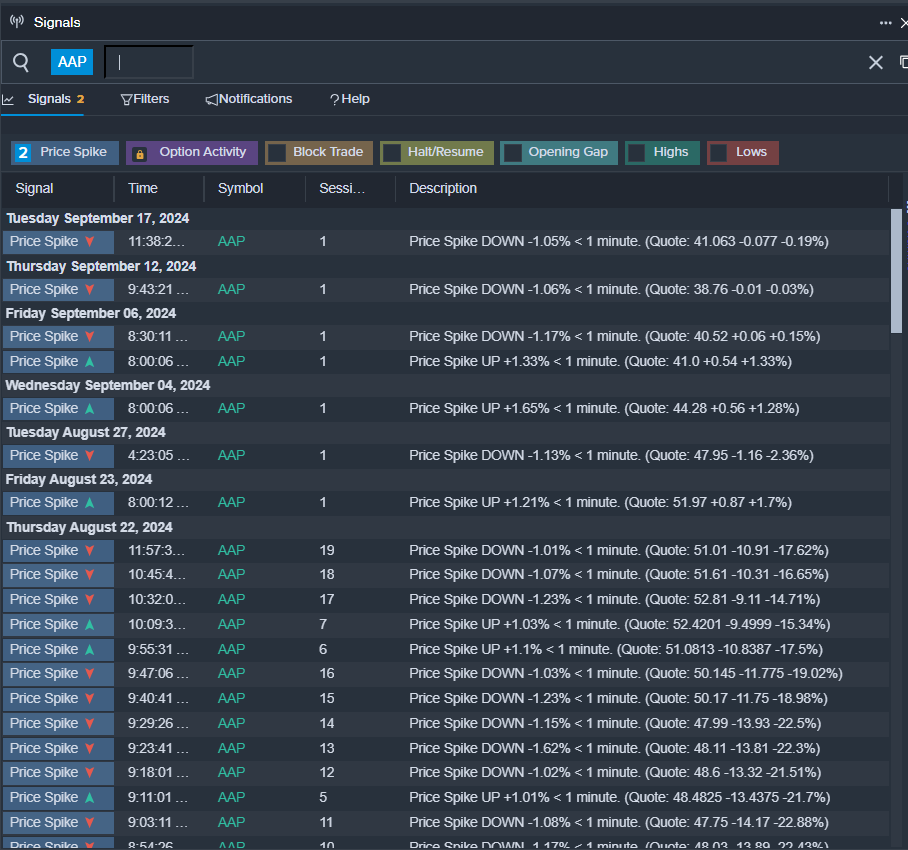

Advance Auto Parts, Inc. (AAP)

- Amidst market fluctuations, Mizuho analyst David Bellinger opted to retain a Neutral stance on Advance Auto Parts, readjusting the price target from $45 to $38. With shares witnessing a 15% decline in the past month and touching a 52-week low of $37.08, strategic investors are eyeing a potential turnaround.

- RSI Value: 27.47

- AAP Price Action: Despite a 1.6% retreat, Advance Auto Parts closed at $37.17 on Wednesday, signaling a phase where calculated moves could yield significant returns.

- The alert feature from Benzinga Pro has played a pivotal role in identifying possible breakout scenarios for AAP shares.

Read Next:

Market News and Data brought to you by Benzinga APIs