Cerebras Systems, a rising star in the AI chipmaking arena, has taken a bold step by filing for an initial public offering (IPO) on the prestigious Nasdaq exchange. Stepping up to square off against industry giant Nvidia, Cerebras stated its plans to trade under the ticker symbol “CBRS,” with the IPO’s timing and size still under wraps. Notably, the company commanded a $4 billion valuation during its last funding round in 2021.

Founded in 2016, Cerebras Systems, with its chips and processors made by Taiwan Semiconductor Manufacturing Co., is gearing up to challenge Nvidia’s dominance in AI applications. The company has lined up its competition, including Advanced Micro Devices, Microsoft, and Alphabet, indicating its intent to make a mark in the fiercely competitive tech landscape.

Financial Performance and Growth Trajectory

Despite its innovative offerings, Cerebras Systems remains in the red, as revealed in its IPO prospectus. In the first six months of the current year, the company recorded a net loss of $66.6 million against $136.4 million in revenues. Fast forward to 2023, the company saw a net loss of $77.8 million and $8.7 million in revenue during the same period. Despite the financial challenges, Cerebras Systems is experiencing exponential growth, with a staggering 1,500% increase in sales year-over-year.

The imminent IPO of Cerebras Systems is expected to make waves in the tech realm. Not too long ago, Reddit and Astera Labs successfully debuted in New York, with Reddit’s stock soaring by 48% on the first trading day, and Astera Labs witnessing an impressive 77% jump in market debut.

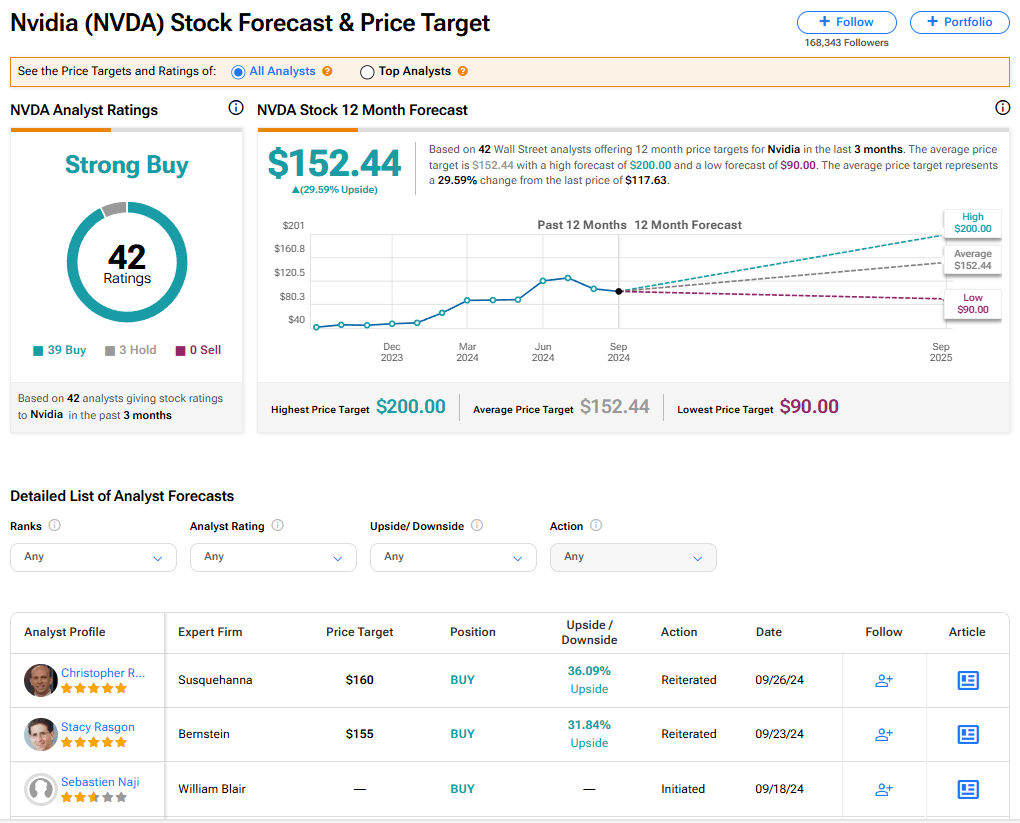

Evaluating NVDA Stock

Turning the lens on Nvidia, the stock enjoys a resounding consensus Strong Buy rating among 42 Wall Street analysts. This rating stems from 39 Buy and three Hold ratings issued in the past three months, with no Sell ratings currently in play. The average price target for NVDA stands at $152.44, pointing toward a potential upside of 29.59% from current levels.

For more insights on NVDA stock and analyst predictions, click here.