Semiconductor specialist Nvidia (NASDAQ: NVDA) has emerged as the face of the artificial intelligence (AI) revolution. Over the last two years, the company has gained trillions in market cap and now sits behind just Apple and Microsoft as the world’s third-most valuable company.

Despite this remarkable ascent, some of the world’s largest hedge funds have been selling Nvidia stock recently. Notable examples include Ken Griffin’s Citadel reducing its stake by 79% last quarter and D. E. Shaw trimming its position by about half.

Is it not peculiar that prominent investors are offloading Nvidia shares amid the AI boom?

Delving into this, let’s explore three critical areas that may have led billionaires to pare their positions in Nvidia while seeking growth opportunities elsewhere.

1. Assessing Competition’s Impact on Nvidia

At the core of generative AI development are advanced chipsets known as graphics processing units (GPUs). While Nvidia currently dominates the GPU space, the landscape is evolving. Major players like Microsoft, Amazon, Alphabet, Meta Platforms, and even Tesla are forging their AI infrastructures.

Many of these tech giants are venturing into crafting their custom chips, challenging Nvidia’s supremacy. This diversification may erode Nvidia’s pricing power as the GPU market saturates. Consequently, a slowdown in revenue growth and margin compression could impede Nvidia’s earnings potential.

Sophisticated investors are recognizing these shifts, anticipating a dwindling ability for Nvidia to sustain its exceptional revenue and profit trajectory.

2. Potential Regulatory Scrutiny

Nvidia currently enjoys a lead over rivals like Advanced Micro Devices and Intel in GPUs, bolstered by seamless hardware-software integration through CUDA software. This tight coupling makes it arduous for developers to blend Nvidia’s CUDA with other chips, driving many to rely solely on Nvidia’s product suite for AI training.

While this integration has fueled Nvidia’s market dominance, it also raises concerns. The Department of Justice (DOJ) might intervene to investigate Nvidia’s business practices, potentially disrupting its ecosystem and growth trajectory.

3. Forecasting Nvidia’s Trajectory

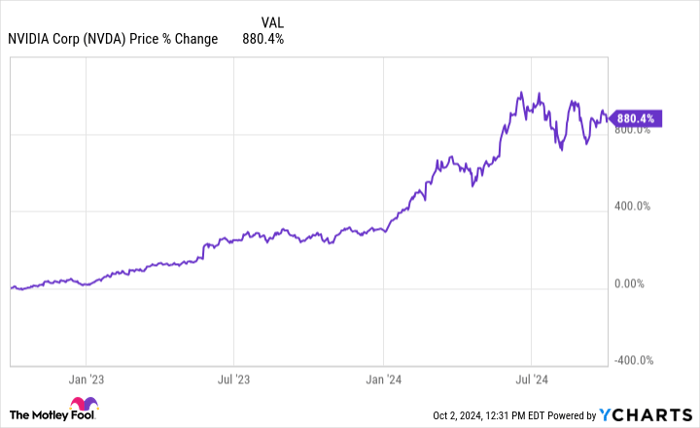

A historical look at Nvidia’s stock performance reveals a meteoric rise in the past two years. However, with heightened competition and regulatory uncertainties looming, expecting another 900% surge in the next two years seems implausible. The company’s growth catalysts may not be robust enough to support such a steep ascent in the foreseeable future.

Conclusion

The uncertainty surrounding Nvidia’s future trajectory raises valid concerns.

Will new entrants in the GPU market pose a threat to Nvidia? Could regulatory actions from the DOJ impact the company’s growth trajectory?