When contemplating stock moves, investors often turn to analyst recommendations for guidance. These opinions, predominantly influenced by Wall Street analysts, have the power to sway stock prices. But do these endorsements truly hold water?

Before delving into the reliability of brokerage advice, let’s peek into the musings of Wall Street giants regarding Energy Fuels (UUUU).

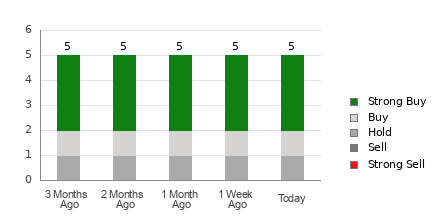

Currently, Energy Fuels boasts an Average Brokerage Recommendation (ABR) of 1.60 on a scale of 1 to 5 (Strong Buy to Strong Sell) based on inputs from five brokerage firms. This numerical indicator positions the stock between Strong Buy and Buy.

Within the pool of recommendations contributing to the ABR, three stand tall as Strong Buys and one stands as a Buy, making up 60% and 20% of all recommendations, respectively.

Analyzing Trends in Brokerage Recommendations for UUUU

We may be inclined to follow the ABR and snag shares of Energy Fuels; after all, it boasts a promising figure. But history tells us that brokerage recommendations often sing sweet melodies of positivity, heavily influenced by the interests of the firms they represent. It’s a played-out tune – for every “Strong Sell,” there are five “Strong Buys” in the choir.

So, is the brokerage chorus really composed for the common investor’s ear, or is it a deceptive tune? It’s wise to use it as a mere note in your investment symphony, alongside a more reliable tool.

Zacks Rank, a stock rating tool with a solid track record, breaks stocks into five tiers, where Zacks Rank #1 implies a Strong Buy and Zacks Rank #5 denotes a Strong Sell. Consider pairing the ABR with Zacks Rank for a clearer investment crescendo.

Deciphering the Nuances of Zacks Rank vs. ABR

While both Zacks Rank and ABR flutter on a 1-5 scale, they are birds of a different feather entirely.

ABR leans on brokerage pundits, displayed in decimals, while Zacks Rank twirls around earnings estimate revisions, flaunting whole numbers 1 to 5. Analysts in brokerage land mold recommendations under biased skies, leading investors astray.

Conversely, firmament of Zacks Rank revolves around earnings estimates, painting a clearer picture of future price dance moves. Freshness is also key; while ABR may gather dust, Zacks Rank pirouettes with the winds of new earnings estimates.

Moreover, Zacks Rank flags fly on all poles evenly, adding harmony to the stock cosmos. It’s like having a fine-tuned instrument among the cacophony of analysts’ choir.

Is UUUU Worth Your Investment?

Peering into the swirling mists of earnings revisions for Energy Fuels, the Zacks Consensus Estimate for the current year remains stationary at -$0.11 over the last month.

The analysts’ steadfast viewpoint on the company’s earnings horizon earns Energy Fuels a Zacks Rank #3 (Hold), signaling alignment with market jives in the near future. So, should you be swaying to the Buy tunes surrounding Energy Fuels?

It might be prudent to step on the investment dance floor cautiously with the Buy-riddled ABR for Energy Fuels.

Ready for a Investment Encore?

While intriguing, dwelling solely on ABR melodies for your investment playlist might not be the wisest tune. Take a spin with Zacks Rank and let the music lead you towards a more harmonious investment rhythm.