Investors, akin to savvy sailors spotting distant storms on the horizon, must pay heed to the currents and eddies of the stock market. And in the tempestuous sea of technology equities, the most oversold stocks beckon like sirens, offering a chance to seize undervalued treasures.

An indispensable tool for investors navigating these turbulent waters is the Relative Strength Index (RSI), which gauges a stock’s vigor on up days against its fortitude on down days. When the RSI dips beneath 30, the market whispers of an oversold gem awaiting discovery.

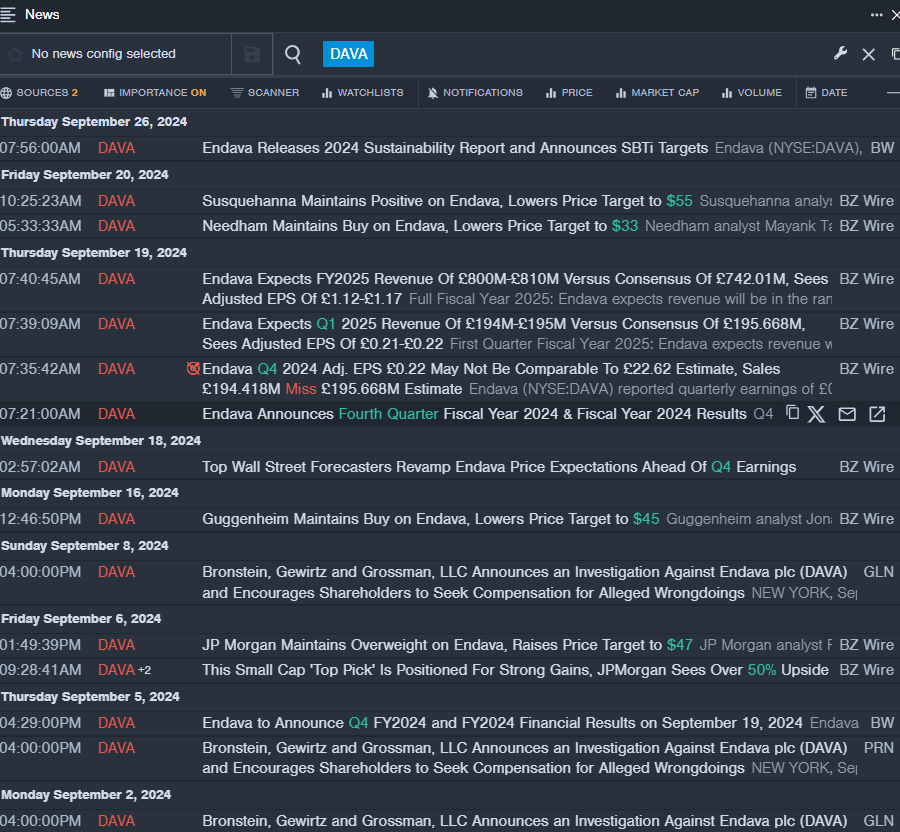

Exploring Endava PLC – ADR (DAVA)

- Endava’s recent stumble, marked by lower-than-anticipated quarterly sales, echoes across the waves of the stock market. Despite this setback, the company sets its sails for calmer waters, with CEO John Cotterell espousing hope for a return to profitable shores. The stock, battered by a 23% decline over the recent past, eyes the horizon from a 52-week low of $23.50.

- RSI Value: 25.95

- DAVA Price Action: A 3.8% downturn nudged Endava’s shares to a close at $23.59 on the latest trading day.

- The sextant of Benzinga Pro’s real-time newsfeed keeps watch over the shifting winds in the realm of DAVA.

- Verint Systems, weathering a storm of its own with a 9% downturn in recent weeks, finds solace in Wedbush analyst Daniel Ives’ endorsement of its course. The company, gazing at a 52-week low of $18.41, seeks to chart a steady path ahead.

- RSI Value: 25.50

- VRNT Price Action: Verint’s shares dipped by 1.6%, lowering its anchor at $23.60 in the latest market session.

- A sentinel in the form of Benzinga Pro’s charting tool scrutinizes VRNT’s movements, guiding investors through the market’s fickle tides.

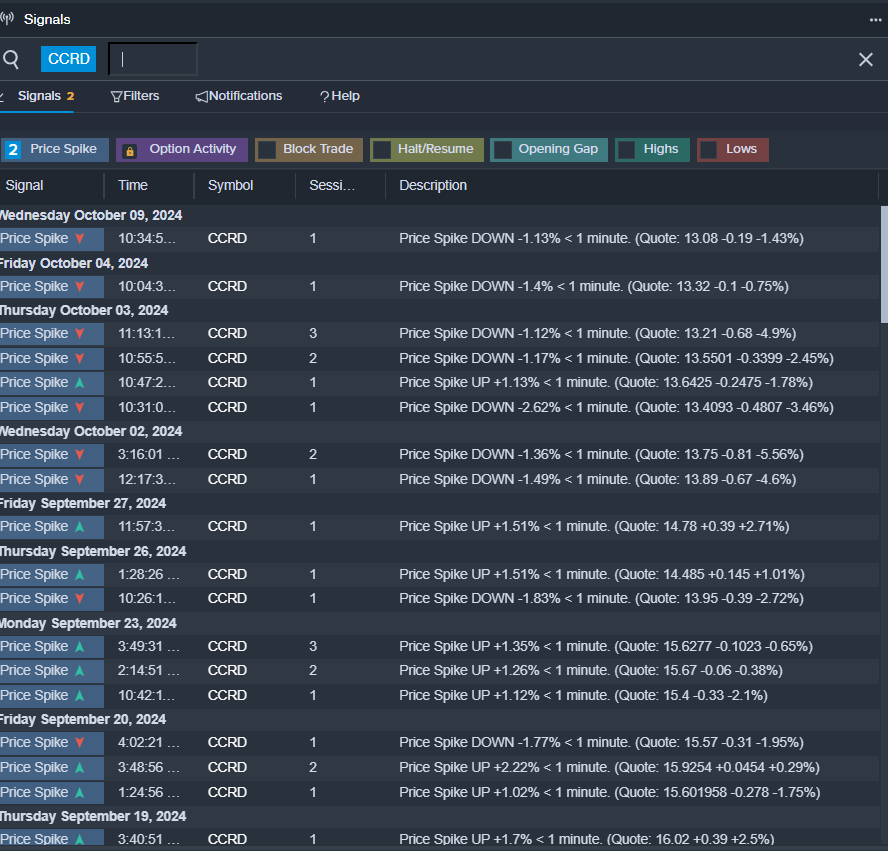

CoreCard Corp (CCRD) – Setting Sail for Opportunity

- CoreCard, hoisting its colors high after surpassing quarterly earnings expectations, paints a picture of promise in the minds of investors. CEO Leland Strange’s confident stride speaks of ongoing investments bearing fruit, even as turbulent waters saw the company’s shares dip by 11% over the last leg of the journey. With a 52-week low of $10.02, CCRD’s crew remains undaunted.

- RSI Value: 28.61

- CCRD Price Action: A 2.5% drop nudged CoreCard’s shares to a close at $12.94 on the latest trading day.

- Benzinga Pro’s signals feature acts as a trusty lookout, signaling potential shifts in the winds for CCRD’s shares.

Read Next:

Market News and Data brought to you by Benzinga APIs