Cathie Wood, the renowned investor behind the Ark Innovation ETF, recently made a significant move by purchasing nearly $14 million worth of Amazon shares. As investors observe this bold move, many are left wondering – should they follow Wood’s lead into Amazon stock?

The Amazon Empire in E-Commerce and Cloud Computing

In the realm of technological juggernauts, Amazon stands tall as a behemoth in both e-commerce and cloud computing. While some of Wood’s other fund holdings may elicit strong opinions from investors, Amazon’s dominance in these sectors is widely acknowledged and respected.

Amazon’s e-commerce division captures a staggering 38% market share in the U.S., surpassing its closest competitor, Walmart, by a significant margin. Facilitating its own product sales and serving as a third-party marketplace, the company also provides logistics and warehouse services to ensure swift deliveries to customers.

Furthermore, Amazon continues to invest in enhancing its e-commerce operations through advanced technologies like artificial intelligence (AI) to optimize delivery routes, forecast demand accurately, and streamline inventory management for third-party sellers.

Looking beyond e-commerce, Amazon’s foray into the pharmacy business affirms its commitment to innovation and expanding its market reach. By promising same-day prescription delivery in nearly half of the country, Amazon seizes opportunities in sectors undergoing transformation.

Image source: Getty Images.

On the cloud computing front, Amazon’s Amazon Web Services (AWS) reigns supreme with a 32% market share. With a focus on AI applications, AWS’s SageMaker and Bedrock platforms provide robust solutions for customers seeking to leverage AI technologies for their operations. This strategic positioning enabled AWS to achieve a 19% revenue growth in Q2, underscoring its dominance in the cloud computing arena.

Timing and Considerations for Amazon Stock Investment

While Amazon is allocating substantial resources to bolster its AI capabilities, the company boasts impressive operating cash flow and maintains a robust cash reserve on its balance sheet. Amazon’s history of prudent long-term investments, notably in its warehouse network and AWS infrastructure, reaffirms its commitment to sustainable growth.

Amid Amazon’s ongoing capital expenditures (capex) to support its expansion initiatives, investors should not overlook the company’s track record of emerging stronger from investment phases. AWS’s accelerated growth trajectory serves as a testament to Amazon’s operational efficiency and market dominance, offering favorable prospects for investors.

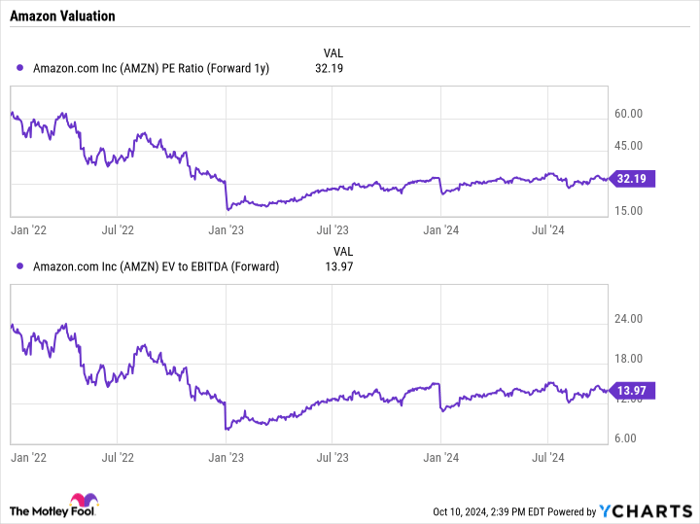

At a forward P/E ratio of approximately 32 based on analysts’ estimates for the next year and an enterprise value (EV) trading at 14 times EBITDA, Amazon’s stock appears attractively priced. Coupled with its history of trading at higher multiples and a promising growth trajectory, Amazon presents an enticing investment opportunity for discerning investors.

AMZN PE Ratio (Forward 1y) data by YCharts

An enlightening metric to consider is Amazon’s EV-to-EBITDA ratio, reflecting its net cash position and providing additional insights into the company’s valuation and financial health.