Every investor dreams of taking a sip of the same success elixir as the mystical billionaires of Wall Street. Their knack for turning millions into billions, dancing through the market’s highs and lows like seasoned tango dancers, leaves us in awe. Tracking their every move becomes a ritual, a divination of sorts, for the ordinary investor looking to peek into the crystal ball of wealth. Through the mandated transparency of quarterly 13F filings, these wizards of Wall Street reveal their latest stock conquests, offering mere mortals a glimpse into the treasure trove of investment opportunities.

We must remember to tread cautiously and make investing decisions guided by our personal financial compass. Yet, when the billionaire class collectively nudges us towards a stock, it piques our interest. The recent 13F filings unveil a top-performing stock that billionaires were feverishly accumulating while it was still prowling in the same price zone. A stock that has already winked at investors, painting their monetary dreams in vivid colors.

Let’s dive into the realm of this millionaire-maker stock and unravel why it remains a lighthouse of opportunity today, beckoning both the affluent and the frugal investor alike.

Amazon Attracts Billionaire Attention

Among the seasoned elites of Wall Street, the revered tech behemoth Amazon (NASDAQ: AMZN) stands as a beacon of reliability rather than a glistening jewel for show. Despite lacking the thrilling allure of the next big thing, billionaires surreptitiously stashed away shares in their treasure chest. Data from 13F filings unearths the names of some heavyweight investors who quietly amassed Amazon shares during the quarter ending June 30, 2024:

| Name | Fund Managed | Net Worth | Amazon Shares Added |

|---|---|---|---|

| Ken Fisher | Fisher Asset Management | $11 billion | 1.21 million |

| Ray Dalio | Bridgewater Associates | $14 billion | 1.6 million |

| Paul Tudor Jones | Tudor Investment | $8 billion | 72,609 |

| Ken Griffin | Citadel Advisors | $43 billion | 1.11 million |

| John Overdeck | Two Sigma Advisers | $7 billion | 216,400 |

Source: 13F filings on Hedge Follow and net worth data from Forbes.

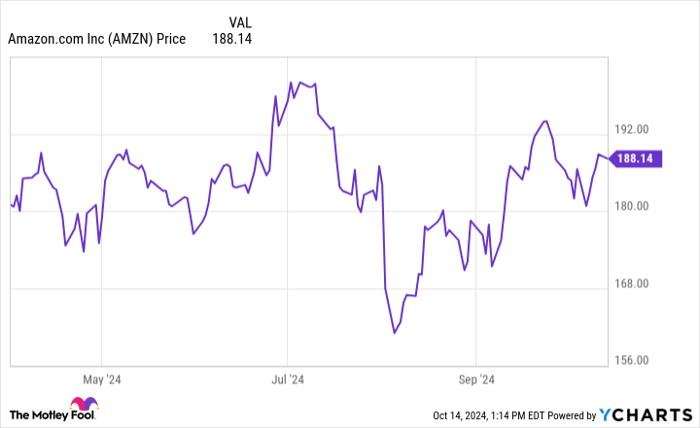

While wallowing in the retrospective glances of 13F filings can be akin to peering through a dusty window of the past, the nectar lies in understanding the essence. Amazon’s stock journey, meandering through peaks and valleys in recent months, hints at myriad possibilities. The musings of billionaires, be it selling for profits, holding steadfast, or diversifying further, only add to the enigma.

The crux lies not in the static valuation of Amazon but in the allure that captivated the billionaires initially, steering them towards this juggernaut of a company.

A Promising Trajectory for Amazon’s Growth

Amazon, a household name in the corporate universe, exudes a familiar glow rather than the dazzle of novelty. However, its history narrates tales of wealth creation, transforming meager sums into generational riches. From e-commerce dominance to cloud computing supremacy, Amazon’s stock trajectory has painted a success mural over the past few decades.

Today, Amazon stands tall as a titan in its core business domains, commanding a 40% cut of the U.S. e-commerce pie and a 31% slice of the global cloud services market. In a realm where it dances with Microsoft’s Azure and Alphabet’s Google Cloud, Amazon’s throne remains secure.

The beauty of Amazon, whose roots delve deep into ever-blooming trends, lies in the expansive landscape for growth that sprawls ahead. While e-commerce swathes merely 16% of total U.S. retail spending, the cloud computing arena sets the stage for a potential monumental growth saga. With artificial intelligence’s mystique adding to the narrative, estimates from Goldman Sachs paint a $2 trillion canvas for the cloud computing market by 2030. And this canvas skips the brushstrokes on emerging horizons like Amazon’s advertising realm, projected to rake in $50 billion this year, savoring a 20% growth.

Amazon: A Thriving Buy Opportunity

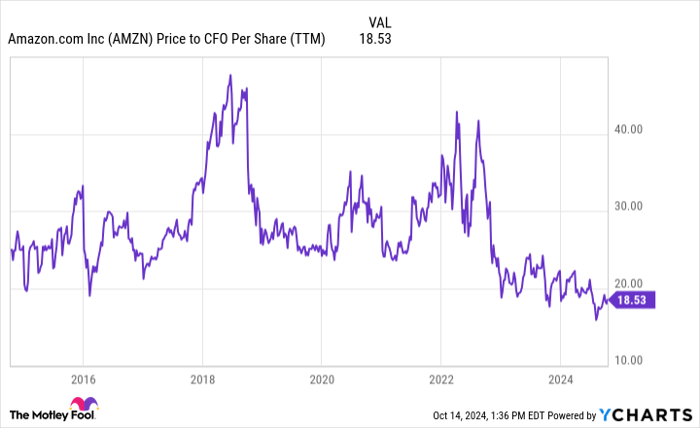

Valuing a stock finds solace in various avenues, but Amazon’s penchant for reinvesting profits in internal growth paints a unique picture. Venturing into the realm of cash flow, the yardstick for Amazon’s valuation dances around its operating cash flow:

AMZN Price to CFO Per Share (TTM) data by YCharts

Nearing a ratio of 18.5, Amazon’s current valuation resonates close to its decade-long ebb. This juncture hints at a ripe season to dive into Amazon stock’s embrace. Assuming Amazon steers its cash flows wisely, a glance at its record reveals a laudable average return on invested capital soaring at 10.9% over the past decade.

In essence, Amazon whispers tales of a dazzling business marrying a captivating price – a savory blend enticing to billionaires and everyday investors alike.

An Evolving Opportunity: Grab Your Second Chance

Missed opportunities often taunt investors, a specter of ‘what could have been’ lingering on the horizon. But, fret not!

Occasionally, our team of seasoned analysts uncovers a hidden gem, christening it a “Double Down” stock poised for a radiant emergence. If your heart flutters at the thought of missed chances, now’s the hour to grasp the coattails of these companies before they soar.

- Amazon: A $1,000 investment during our Double Down call in 2010 would have bloomed into $21,139!*

- Apple: Treading the Double Down path in 2008 would have transformed $1,000 into a bountiful $44,239!*

- Netflix: And for the bold souls venturing into our Double Down recommendation in 2004, the $1,000 seed would have blossomed into a whopping $380,729!*!

Our radar now tunes into three groundbreaking companies, casting a spotlight on a golden opportunity that beckons, a siren’s call for the discerning investor.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024