Insurance giant Progressive Corporation PGR and banking leader PNC Financial Services Group PNC are two top-rated finance stocks to consider after exceeding their Q3 top and bottom line expectations on Tuesday.

Here’s a brief review of their Q3 reports and a look at why now is still a good time to buy Progressive shares which have soared nearly +60% year to date and PNC’s stock which has risen over +20% in 2024.

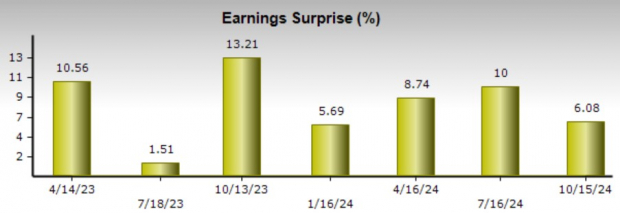

Image Source: Zacks Investment Research

Progressive’s Q3 Results

An Impressive Performance

Progressive’s Q3 sales of $19.43 billion exceeded estimates by 2%, marking a 24% increase from the comparative quarter. The surge in net premiums written led to a sharp spike in earnings, with Q3 EPS of $3.58, soaring 71% from a year ago. This surpassed estimates by 5% and underscored the company’s consistent outperformance.

Image Source: Zacks Investment Research

PNC’s Q3 Results

Steady Growth Amid Challenges

PNC reported Q3 sales of $5.43 billion, showcasing a 3% increase year over year. Despite facing a decline in bottom line figures due to lower interest payments and increased loan reserves, the bank managed to surpass EPS estimates, reflecting resilience in a challenging environment.

Image Source: Zacks Investment Research

PGR & PNC’s Attractive Valuation (P/E)

Progressive and PNC present compelling investment opportunities, with their fiscal 2024 and FY25 EPS estimates on an upward trajectory. Both companies boast reasonable forward P/E multiples of 19.6X and 14.4X, respectively, making them attractive picks for discerning investors.

Image Source: Zacks Investment Research

The Path Ahead

Following their stellar Q3 performances, Progressive and PNC are poised for continued growth. With earnings estimates likely to see upward revisions in the coming weeks, investors can expect further appreciation in these standout finance stocks, making them sound long-term investment choices at their current valuation levels.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report