Amidst the whirlwind of market volatility, a glimmer of hope sparkles for savvy investors. The consumer staples sector unveils a compelling opportunity to dive into undervalued gems, poised for resurgence.

Behold the Relative Strength Index (RSI) – a beacon in the storm, illuminating oversold stocks ready to bloom. When the RSI dips below the coveted 30 marks, seasoned traders know it’s time to pounce on potential winners.

Riding the Waves of Opportunity

Embark on a journey through the latest roster of oversold champions in the consumer staples sector, brimming with promise and possibility.

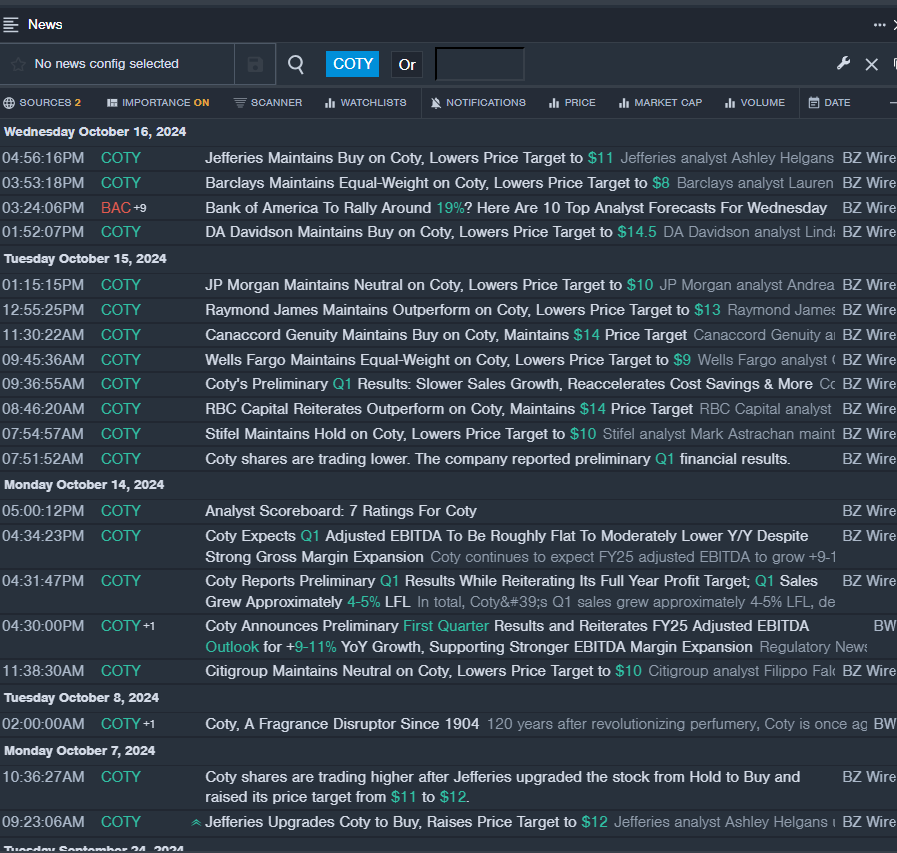

Coty Inc (COTY)

- A turbulent symphony unfolded on October 14 as Coty Inc. unveiled its preliminary first-quarter results. Reaffirming its fiscal year 2025 adjusted EBITDA outlook with a growth projection of 9-11%, Coty’s stocks plunged by 11% over the past five days, hovering near its 52-week nadir at $7.95.

- RSI Value: 29.19

- COTY Price Action: Witnessing a 2.3% descent, Coty’s shares concluded at $7.99, painting a vivid picture of market turbulence.

22nd Century Group Inc (XXII)

- A tale of valor and resilience unfolded on September 13, as 22nd Century Group’s Luminary Lawrence Firestone acquired 39,000 shares at a steadfast price of 27 cents per share. Weathering a 43% storm over the past five days, XXII stands firm at its 52-week low of $0.10, a testament to its enduring spirit.

- RSI Value: 22.29

- XXII Price Action: Battling a 17.4% dip, 22nd Century Group’s shares wrapped up at $0.11, a valiant display of fortitude in the face of adversity.

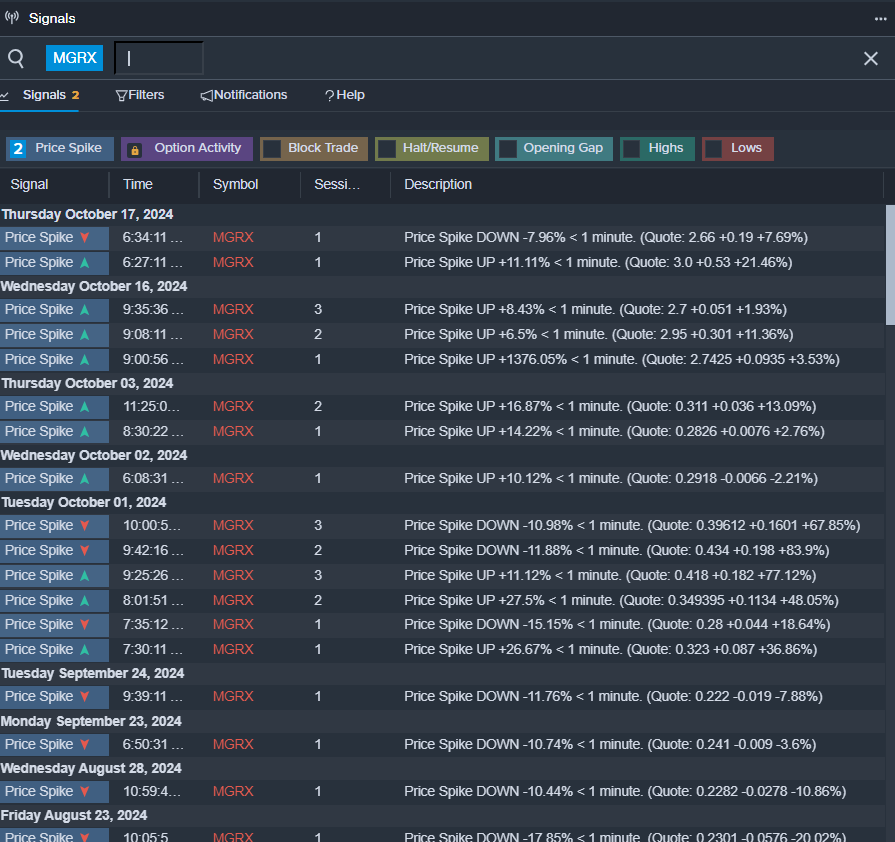

Mangoceuticals (MGRX)

- On the day of reckoning, October 14, Mangoceuticals unveiled a strategic 1-for-15 reverse stock split. Gazing into the abyss of a 21% downturn over the past five days, MGRX clings to its 52-week low of $2.14, a beacon of hope for discerning traders.

- RSI Value: 29.63

- MGRX Price Action: The echoes of a 6.8% descent resonated as Mangoceuticals’ shares settled at $2.47, painting a vivid portrait of resilience amid market tumult.

Read More:

Market News and Data brought to you by Benzinga APIs