Investors eyeing the energy sector have a unique chance to delve into undervalued companies among the most oversold stocks.

An essential tool for traders, the Relative Strength Index (RSI) indicates a stock’s momentum concerning price movements. A stock is labeled oversold when its RSI dips below 30, signaling a potential turning point for astute investors.

Exploring Undervalued Potential: Ecopetrol SA (NYSE:EC)

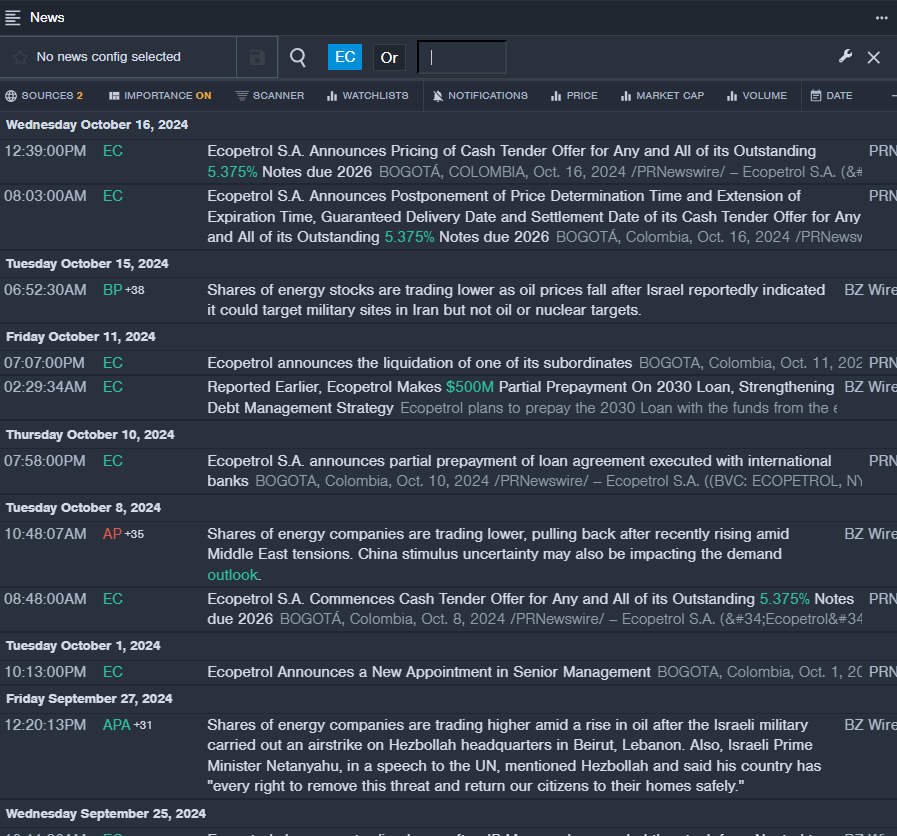

- Ecopetrol announced a cash tender offer for its 5.375% notes due 2026 on October 16, coinciding with an 11% decline in the company’s stock value over the previous five days. With a 52-week low of $8.13, the current RSI stands at 26.20.

- RSI Value: 26.20

- EC Price Action: Despite recent declines, Ecopetrol shares closed at $8.15 on Thursday.

- Keeping a keen eye on real-time developments, Benzinga Pro provides essential updates on leading stocks like EC.

Analyzing Growth Prospects: Torm PLC (NASDAQ:TRMD)

- Evercore ISI Group analyst Jonathan Chappell continued to back TORM with an “Outperform” rating on July 23, enhancing the price target to $48. Despite a recent 17% dip in stock value, Torm maintains a 52-week low of $26.10, with an RSI of 27.08.

- RSI Value: 27.08

- TRMD Price Action: Closing at $29.90 on Thursday, Torm shares exhibit potential for recovery.

- Benzinga Pro’s analytical tools offer valuable insights, aiding investors in identifying trends within TRMD stock.

Risk-takers and strategists alike find solace in the turbulent waters of the energy market, hopeful for a windfall amidst the tumultuous seas of opportunity.