The Ebb and Flow of Consumer Stock Momentum: McDonald’s (NYSE:MCD) and More

A snapshot of the market on Oct. 21, 2024, reveals a cautionary tale unfolding in the consumer discretionary sector. For investors keeping a close eye on momentum as a critical factor in their trading strategy, four stocks stand out as potential candidates headed for a dip.

The Relative Strength Index (RSI) acts as a vital momentum indicator, shedding light on a stock’s strength during upward versus downward price movements. By analyzing RSI alongside a stock’s price performance, traders glean insights into its short-term trajectory. Typically, a stock is deemed overbought when its RSI surpasses 70, signaling a cautionary flag to investors, as per market intelligence from Benzinga Pro.

Here’s an updated roster of major players in the consumer sector exhibiting signs of being overextended.

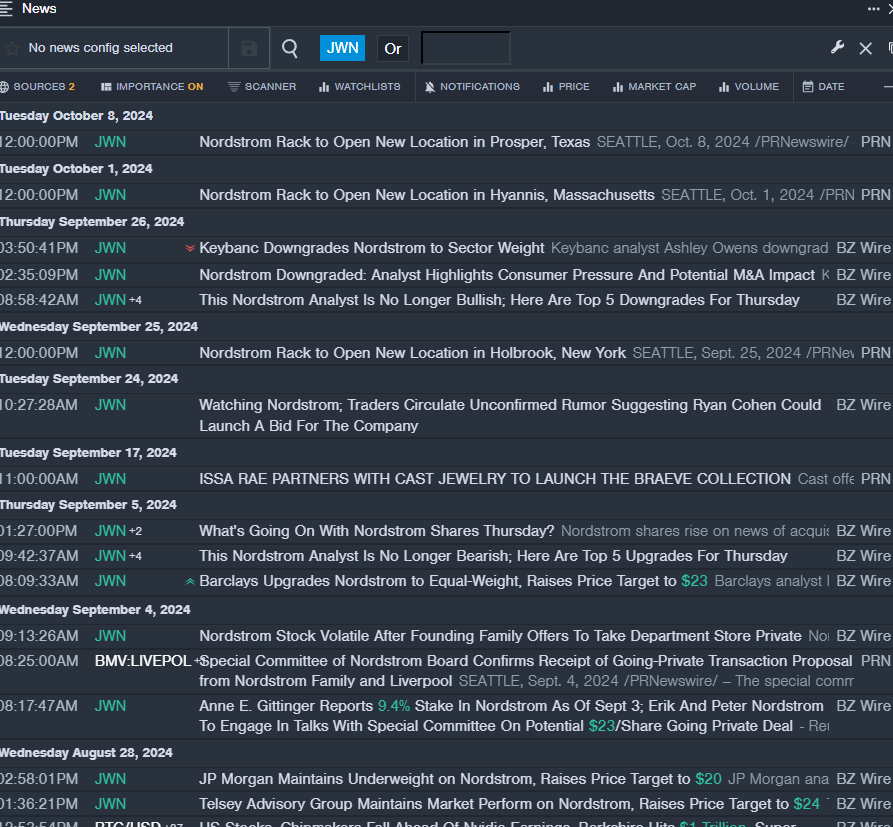

Nordstrom Inc JWN

- Leading off the list is Nordstrom Inc., which witnessed a recent downgrade on Sept. 26 by Keybanc analyst Ashley Owens from Overweight to Sector Weight. Notwithstanding, the company’s stock surged by approximately 10% over the past five days, hitting a 52-week high of $24.93.

- RSI Value: 76.29

- JWN Price Action: Nordstrom’s shares edged up by 0.9%, concluding at $24.67 on the most recent trading day.

- Benzinga Pro’s timely news alerts provide a pulse on the latest developments impacting JWN.

Toll Brothers Inc TOL

- Another contender drawing attention is Toll Brothers Inc., where Oppenheimer analyst Tyler Batory opted to reiterate an Outperform rating on Oct. 2 and adjusted the price target upward from $168 to $189. Proving resilient, the company’s stock climbed by about 6% in the past five trading days, reaching a 52-week high of $160.12.

- RSI Value: 72.41

- TOL Price Action: Toll Brothers’ shares marked a 1.9% increase, settling at $159.58 by the closing bell.

- Utilizing Benzinga Pro’s analytical tools can uncover underlying trends in TOL stock performance.

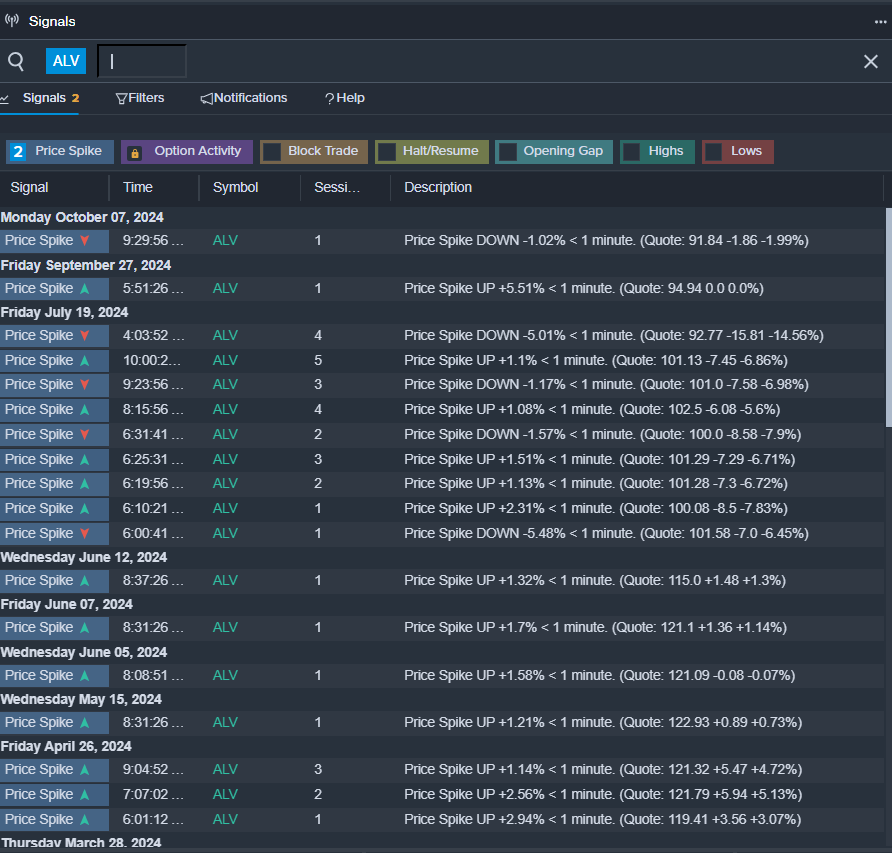

Autoliv Inc ALV

- Autoliv Inc. took center stage on Oct. 18 with a favorable third-quarter sales report, surpassing market expectations. Despite headwinds in the form of a nearly 5% global decline in light vehicle production, the company stayed afloat, outperforming the market by 4 percentage points. This resilience resulted in a commendable performance with almost level sales and operating income, even amidst a $14 million expense tied to a supplier settlement. Reflecting this, ALV stock surged by 6% over the last five trading days, reaching a 52-week high of $129.38.

- RSI Value: 70.49

- ALV Price Action: Autoliv’s shares climbed 6%, closing at $99.52 on the most recent trading day.

- Monitoring signals from Benzinga Pro can unveil potential breakout opportunities in ALV shares.

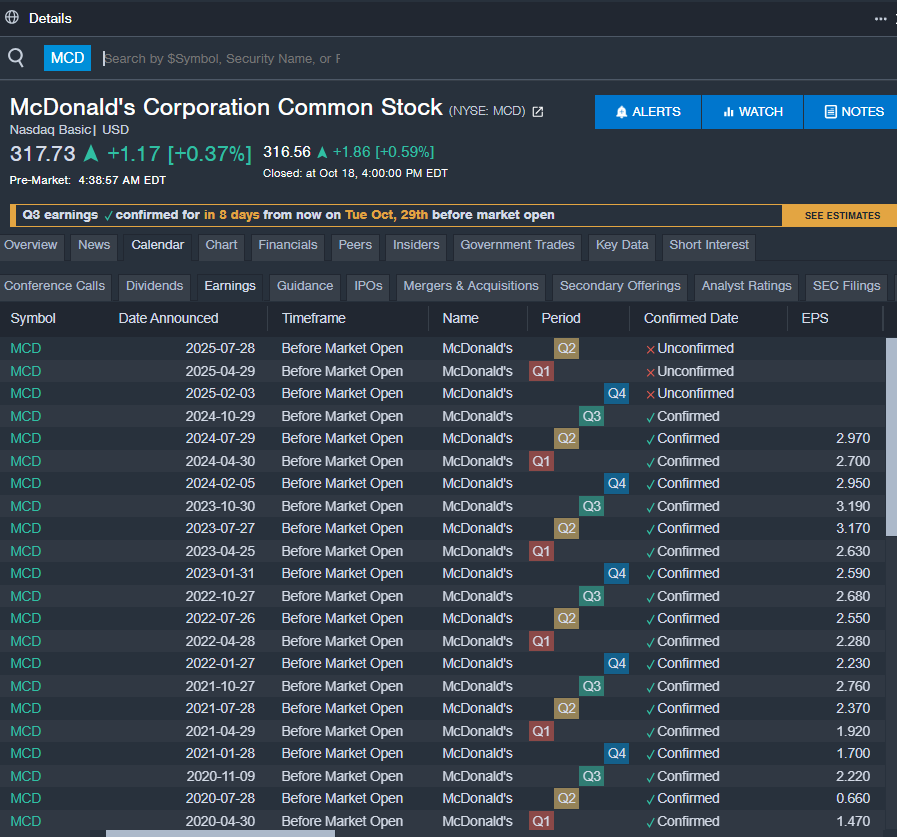

McDonald’s Corp MCD

- Lastly, McDonald’s Corporation found itself in the spotlight on Oct. 16, with TD Cowen analyst Andrew Charles opting to stick with a Hold recommendation while raising the price target from $280 to $300. The fast-food giant saw a notable 6% uptick in its stock price over the past month, reaching a 52-week high of $317.18.

- RSI Value: 82.85

- MCD Price Action: McDonald’s shares posted a 0.6% gain, closing at $316.56 on the most recent trading day.

- Stay informed with Benzinga Pro’s earnings calendar to keep abreast of upcoming reports from MCD.

Read More:

Market News and Data brought to you by Benzinga APIs