Investors often rely on Wall Street analysts’ recommendations before deciding to Buy, Sell, or Hold a stock. While these analysts’ rating changes can sway a stock’s price, their merit is up for debate.

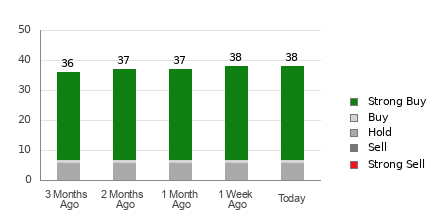

Currently, Advanced Micro Devices (AMD) boasts an average brokerage recommendation (ABR) of 1.34, straddling between Strong Buy and Buy. This calculation stems from 38 brokerage firms’ actual recommendations.

Of these recommendations, a staggering 81.6% are Strong Buy, with only 2.6% as Buy. While the prevailing sentiment leans towards buying AMD, relying solely on this intel may not be prudent.

Evaluating Analyst Trends for AMD

Despite the ABR signaling a buy, caution is advised. Studies show that brokerage recommendations may not effectively predict stocks with the most lucrative price potential. Analyst biases, tied to their firms’ interests, often skew ratings positively.

Our proprietary Zacks Rank tool, with a proven track record, categorizes stocks into five groups for a clearer picture of near-term price performance. Validating the ABR with the Zacks Rank enhances decision-making prowess.

Discerning Zacks Rank from ABR

Although both on a scale from 1 to 5, ABR and Zacks Rank differ significantly. ABR relies wholly on brokerage recommendations and usually features decimals like 1.28. Conversely, Zacks Rank utilizes earnings estimate revisions for a more data-driven perspective.

Brokerage analysts’ historically optimistic bias in their recommendations often misguides investors. In contrast, Zacks Rank’s earnings-driven methodology correlates strongly with stock movement trends.

Zacks Rank grades are uniformly applied across all stocks with current-year earnings estimates, ensuring an unbiased evaluation. Unlike ABR, Zacks Rank’s timeliness in predicting stock prices lies in analysts’ swift reflection of changing business trends.

Is AMD a Sound Investment?

Observing Advanced Micro’s earnings estimate revisions, the consensus estimate for the current year has stagnated at $3.36 over the past month.

An increasing pessimism among analysts, evident in unanimous EPS estimate downgrades, has landed Advanced Micro a Zacks Rank #4 (Sell). Considering recent estimate fluctuations, a cautious approach to AMD’s Buy-equivalent ABR is warranted.

The Infrastructure Stock Uproar

A massive US infrastructure revamp looms on the horizon, promising enormous investments and unparalleled opportunities. Embracing the right stocks early on could spell substantial gains amidst this imminent transformation.

Zacks offers a comprehensive Special Report to navigate the infrastructure boom effectively, highlighting five key companies poised to capitalize on the infrastructure overhaul. This report, essential for savvy investors, is now readily available for exploration.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Access the Free Stock Analysis Report by Zacks for Advanced Micro Devices, Inc. (AMD) here.