Nvidia Corp NVDA maintained its upward momentum on Monday as it prepares to replace Intel Corp INTC in the Dow Jones Industrial Average. Struggling chipmaker and key U.S. Chips Act contender Intel stock is trading lower on Monday.

S&P Dow Jones Indices announced Friday that Nvidia and Sherwin-Williams Co SHW will join the index next week.

After 25 years on the Dow, Intel will be replaced by Nvidia, while Sherwin-Williams will take over from Dow Inc DOW.

Also Read: Intel Strengthens Ties with China, Invests $300 Million to Expand Chip Operations

This move reflects market shifts in chipmaking and further setbacks for Intel.

The Dow’s 30 components are weighted by share price, not market cap.

Nvidia positioned itself for inclusion by announcing a 10-for-1 stock split in May, reducing its share price without impacting market cap, allowing it to join without significantly affecting the index’s balance, CNBC reports.

Nvidia’s revenue has surged, doubling in the past five quarters and tripling in three, as demand for its next-generation Blackwell AI GPU remains exceptionally high.

Tech giants like Microsoft Corp MSFT, Meta Platforms Inc META, Alphabet Inc GOOG GOOGL Google, and Amazon.Com Inc AMZN are splurging on Nvidia’s GPUs, including the H100, to accomplish their AI ambitions.

Beth Kindig of I/O Fund expects Blackwell chips to help Nvidia reach a $10 trillion valuation by next year.

Meanwhile, Intel faces significant challenges. Once dominant in PC chip manufacturing, Intel has lost ground to Advanced Micro Devices Inc AMD and has yet to progress in AI.

This week, Intel’s board approved cost-saving measures, including reducing its workforce by 16,500 employees and downsizing its real estate holdings—a plan first disclosed in August.

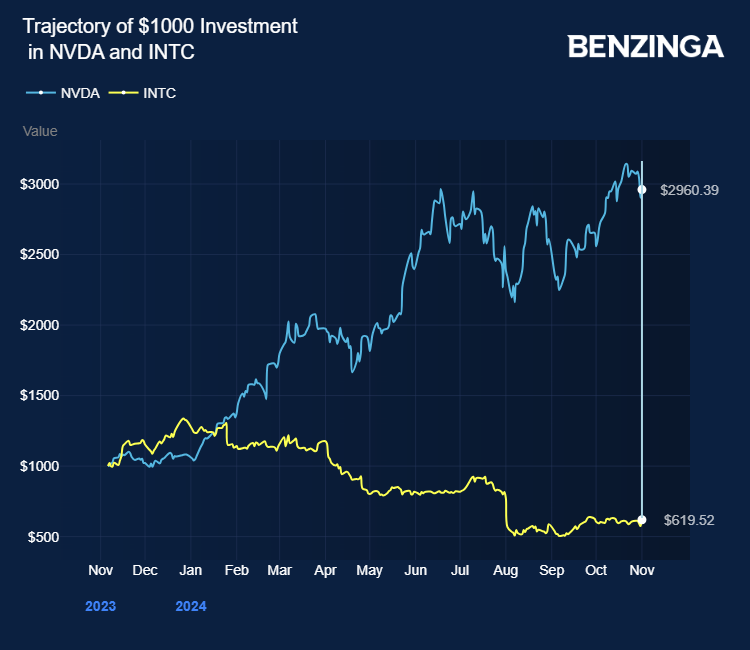

Intel stock plunged to 52% year-to-date, while Nvidia surged over 181%.

Price Actions: At last check on Monday, NVDA stock was up 1.92% at $138.01 premarket, while INTC was down 1.38%.

Also Read:

Image via Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs